Europe chart of the week – French unemployment

|

|

Author: Frederik Ducrozet

Categories: Europe and Euro Crisis

|

|

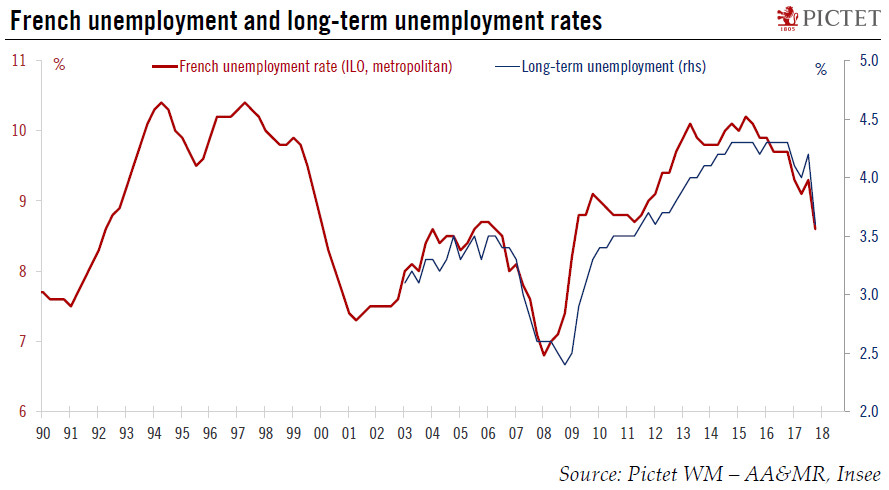

French unemployment fell surprisingly fast in Q4 2017, to a new cyclical low.France registered the largest drop in unemployment in about ten years in Q4 2017. In metropolitan France, the number of unemployed fell by 205,000 to 2.5 million people, pushing the ILO unemployment rate down to 8.6% of the labour force (-0.7pp), its lowest level since Q1 2009.

|

|

|

|

|

|

Swiss public accounts better than expected in 2017

|

|

Author: Swissinfo

Categories: Swiss Markets and News

|

|

Swiss government accounts closed with a surplus of CHF2.8 billion ($3 billion) for 2017, compared with a forecast deficit of CHF250 million, Finance Minister Ueli Maurer said at a press conference in Bern on Wednesday. This was due mainly to higher-than-estimated tax revenues.

|

|

|

|

|

|

Sovereign Wealth Funds Investing In Gold For “Long Term Returns” – PwC

|

|

Author: Mark O'Byrne

Categories: GoldCore

|

|

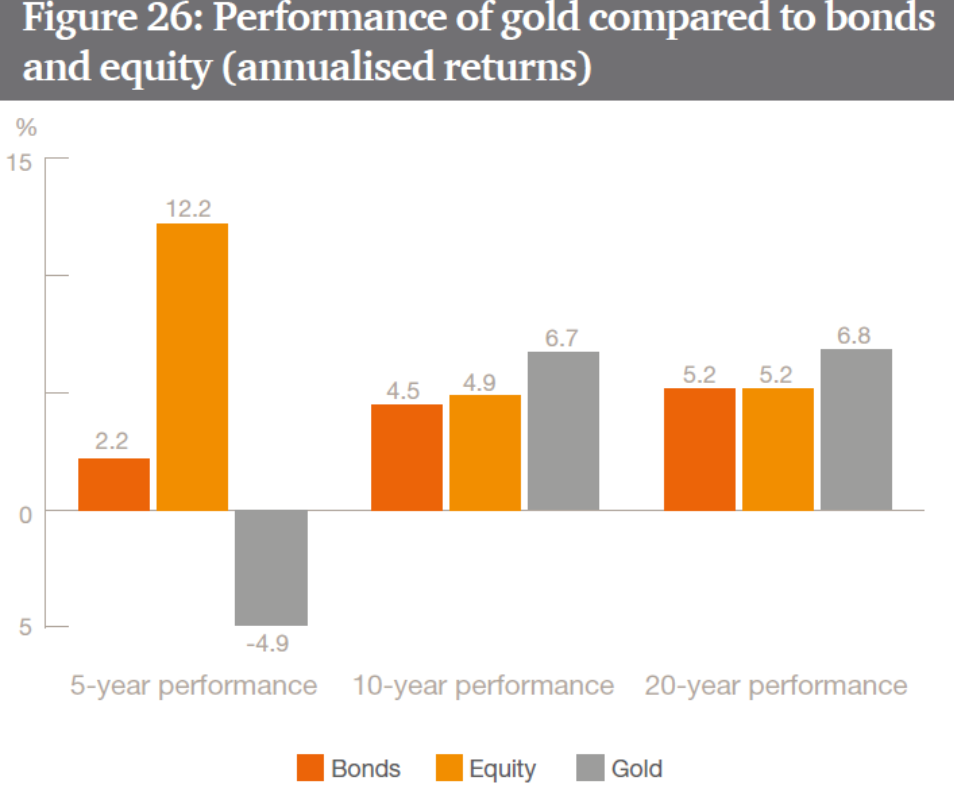

Sovereign wealth funds investing in gold for long term returns – PwC. Gold has outperformed equities and bonds over the long term – PwC Research. Gold is up 6.7% and 6.8% per annum over 10 and 20 year periods; Stocks and bonds returned less than 5.2% respectively over same period (see PwC table). From 1971 to 2016 (45 years), “gold real returns were approximately 10% while inflation increased 4%”.

|

|

|

|

|

|

Emerging Markets: What Changed

|

|

Author: Win Thin

Categories: Emerging Markets

|

|

The National Stock Exchange of India will end all licensing agreements and stop offering live prices overseas. Philippine central bank cut reserve requirements for commercial banks. Egypt cut rates for the first time since 2015. Israeli police recommended that Prime Minister Netanyahu be charged. South Africa President Zuma resigned before a no confidence vote was held.

|

|

|

|

|

|

What Kind of Stock Market Purge Is This?

|

|

Author: MN Gordon

Categories: Debt and the Fallacies of Paper Money

|

|

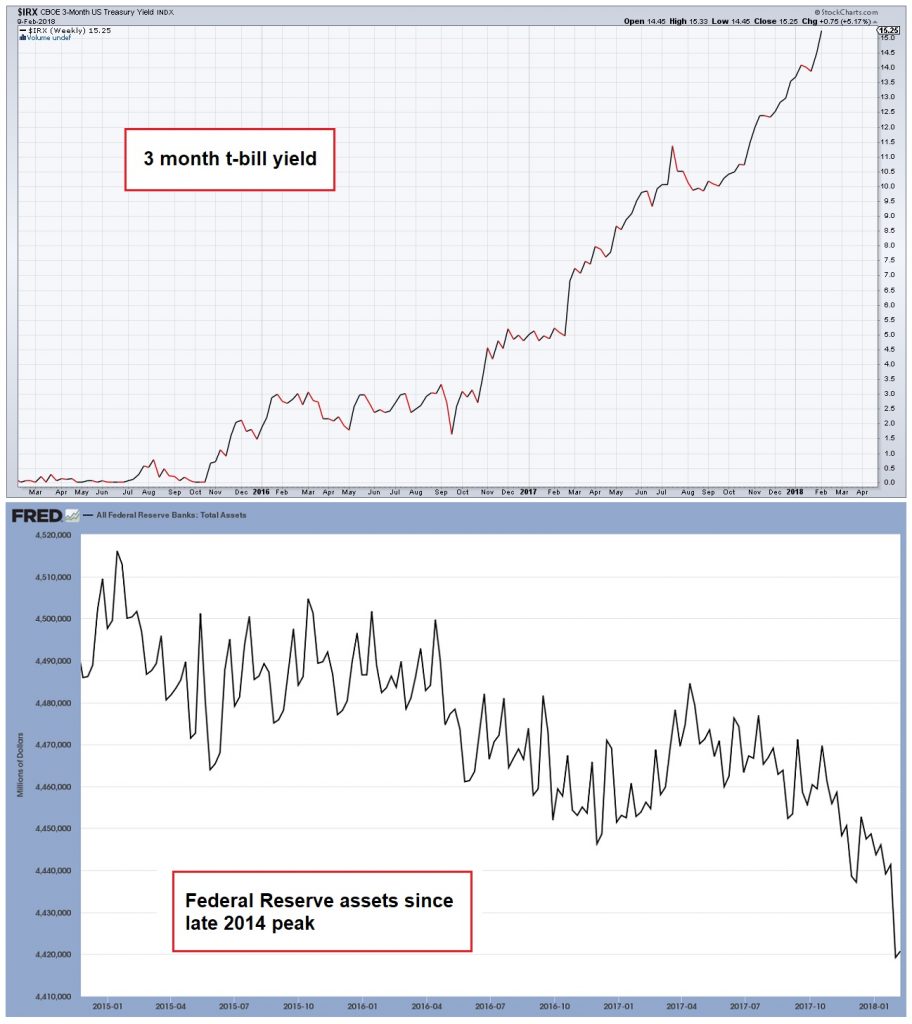

Down markets, like up markets, are both dazzling and delightful. The shock and awe of near back-to-back 1,000 point Dow Jones Industrial Average (DJIA) free-falls is indeed spectacular. There are many reasons to revel in it. Today we shall share a few. To begin, losing money in a multi-day stock market dump is no fun at all. We’d rather get our teeth drilled by a dentist. Still, a rapid selloff has many positive qualities.

|

|

|

|

|

|

|

|