FX Daily, February 07: Guns and Butter May Resolve US Legislative Logjam

|

|

Author: Marc Chandler

Categories: FX Trends

|

|

After a volatile session in North America, the major equity indices closed higher. In fact, the 1.75% rise in the S&P 500 was the best since November 2016. Asian equities stabilized, and the MSCI Asia Pacific Index was able to eke out a small gain. The European markets are moving higher is also posting early gains and the Dow Jones Stoxx 600 is about 0.45%, which threatens to snap the seven-day slide. However, the main challenge now is that the S&P 500 are trading nearly 1% lower.

|

|

|

|

|

|

Cool Video: Bloomberg Double Feature--BOE Meeting and the Yield Curve

|

|

Author: Marc Chandler

Categories: FX Trends

|

|

The Bank of England meets tomorrow. Although no one expects a move, it has little to do with the recent market volatility. The FTSE 100 is poised to snap a six-day 7%+ slide. The FTSE 250 fell for seven consecutive sessions through yesterday, shedding 5.75% in the process. The UK's 2-year yield slipped about seven basis points from last week's close to58 bp before recovering to 63 bp today, around the middle of this week's range.

|

|

|

|

|

|

US Trade Balance is Deteriorating, Despite Record Exports

|

|

Author: Marc Chandler

Categories: FX Trends

|

|

The US trade deficit swelled in December, and the $53.1 bln shortfall was a bit larger than expected. It was the largest deficit since October 2008. For the 2017, the US recorded a trade deficit of goods and services of $566 bln, the largest since 2008. The deterioration of the trade balance may be worse than it appears. There has been significant improvement in the oil trade balance. In 2017, the real petroleum balance was just shy of $96 bln, the smallest in 14 years.

|

|

|

|

|

|

Weekly Technical Analysis: 05/02/2018 - USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CHF

|

|

Author: Raffi Boyadjian

Categories: FX Trends

|

|

The USDCHF pair traded with clear negativity yesterday to approach our waited target at 0.9418, to keep the bullish trend scenario active until now, being away that it is important to monitor the price behavior when touching the mentioned level, as breaching it will push the price to extend its gains and head towards 0.9530 as a next station, while its stability will push the price to decline again.

|

|

|

|

|

|

Swiss tech universities boost economy by CHF13 billion, report says

|

|

Author: Swissinfo

Categories: Swiss Markets and News

|

|

Switzerland’s federal technology institutes account for 100,000 jobs and CHF13 billion in added value to the economy, a new report calculates. This represents a fivefold return on investment, it claims. The institutes – notably the universities of EPFL in Lausanne and ETH in Zurich – have long been acknowledged as vital components of the Swiss image and economy; the reportexternal link by British consulting firm BiGGAR now tries to put a value on it.

|

|

|

|

Crypto Currency Backlash Sees Flight From Cryptos and Bitcoin

|

|

Author: Jan Skoyles

Categories: GoldCore

|

|

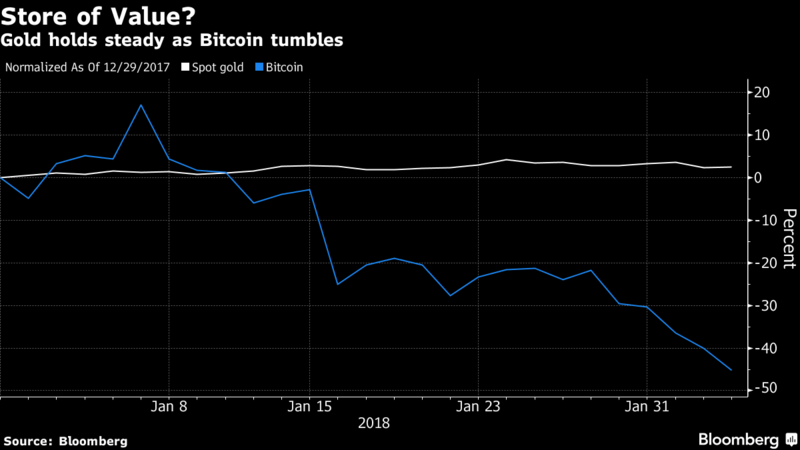

Crypto Currency Backlash Sees Flight From Cryptos and Bitcoin. Bitcoin falls from $20,000 to below $6,000 and bounces back to $8000. Top 50 crypto currencies lost over 50% of value in 24 hours. Over $60 billion wiped off entire crypto currency market in 24 hours. Markets concerned about increased regulation, manipulation & country-wide bans. ‘Growing global unease about risks virtual currencies pose to investors and financial system’.

|

|

|

|

|

|

|

|