Emerging Markets: What has Changed

|

|

Author: Win Thin

Categories: Emerging Markets

|

|

Reuters reported that China may loosen controls on outbound capital flows (QDLP). Samsung chief Lee was set free in an unexpected court reversal. Romania central bank hiked rates by 25 bp and raised its inflation forecasts for the next two years. South Africa President Zuma appears to be on the way out. Ecuador voters approved a referendum that reinstates term limits for the president. Venezuela central bank restarted FX auctions for the first time since August and devalued the bolivar by more than 80%.

|

|

|

|

|

|

South Korea and Switzerland set a currency swap

|

|

Author: Swissinfo

Categories: Swiss Markets and News

|

|

South Korea and Switzerland are entering into a bilateral currency swap agreement, it was announced on Friday. The move is aimed at strengthening buffers against external financial shocks for both countries. “The swap agreement enables Korean won and Swiss francs to be purchased and repurchased between the two central banks, up to a limit of KRW11.2 trillion, or CHF10 billion ,” a Swiss National Bank statement saidexternal link.

|

|

|

|

|

|

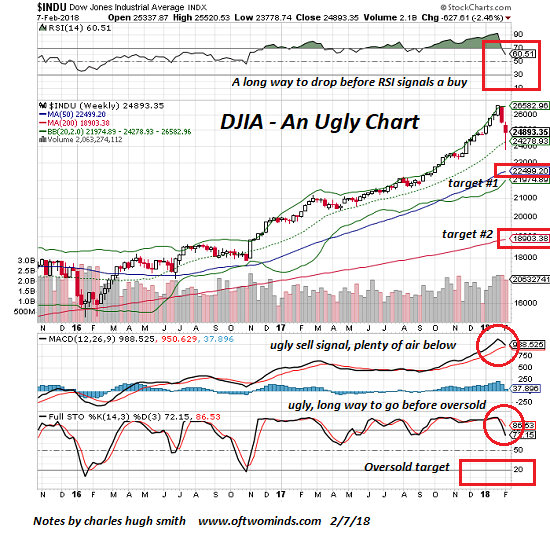

Before You "Buy the Dip," Look at This One Chart

|

|

Author: Charles Hugh Smith

Categories: The United States

|

|

There's a place for fancy technical interpretations, but sometimes a basic chart tells us quite a lot. Here is a basic chart of the Dow Jones Industrial Average, the DJIA. It displays basic information: price candlesticks, volume, the 50-week and 200-week moving averages, RSI (relative strength), MACD (moving average convergence-divergence), stochastics and the MACD histogram. These kinds of charts are free (in this case, from StockCharts.com).

|

|

|

|

|

|

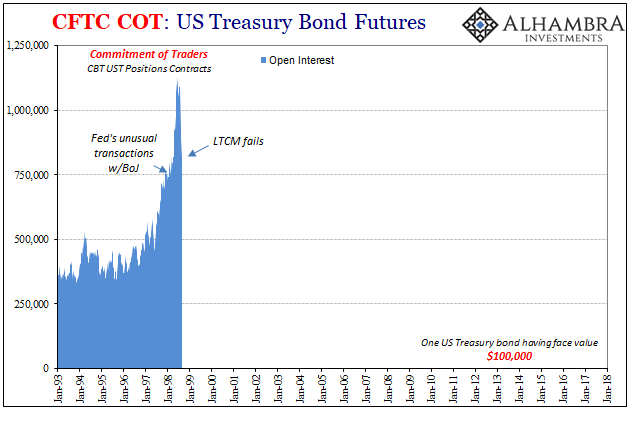

COT Blue: Interest In Open Interest

|

|

Author: Jeffrey P. Snider

Categories: The United States

|

|

For me, the defining characteristic of the late nineties wasn’t the dot-coms. Most people were exposed to the NASDAQ because, frankly, at the time there was no getting away from it. It had seeped into everything, transforming from a financial niche bleeding eventually into the entire worldwide culture. We all remember the grocery clerks who became day traders.

|

|

|

|

|

|

“Strong Dollar”, “Weak Dollar” – What About a Gold-Backed Dollar?

|

|

Author: Antonius Aquinas

Categories: Debt and the Fallacies of Paper Money

|

|

The recent hullabaloo among President Trump’s top monetary officials about the Administration’s “dollar policy” is just the start of what will likely be the first of many contradictory pronouncements and reversals which will take place in the coming months and years as the world’s reserve currency continues to be compromised. So far, the Greenback has had its worst start since 1987, the year of a major stock market reset.

|

|

|

|

|

|

|

|