When will the SNB start the process of policy normalisation?

|

|

Author: Nadia Gharbi

Categories: Pictet Macro Analysis, SNB

|

|

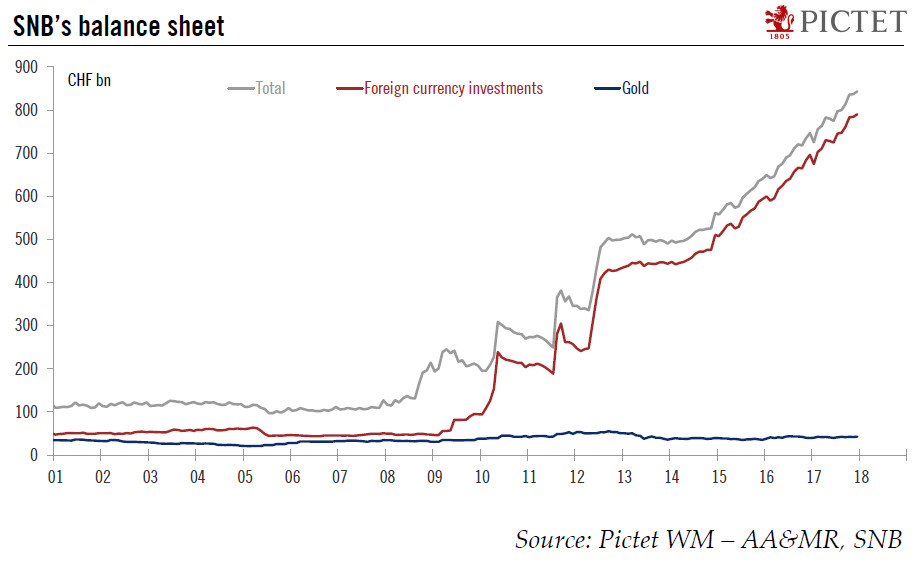

When the Swiss National Bank (SNB) scrapped its currency floor three years ago, its monetary policy strategy was clear: to fight Swiss franc appreciation. It did so verbally, by calling the currency “significantly overvalued”, and physically, by implementing a negative interest rate and intervening in the foreign exchange market as necessary. Three years on, the interest rate on sight deposits at the SNB remains unchanged at a record low of - 0.75%.

|

|

|

|

|

|

China: PMIs suggest moderation in momentum in Q1

|

|

Author: Dong Chen

Categories: China, Pictet Macro Analysis

|

|

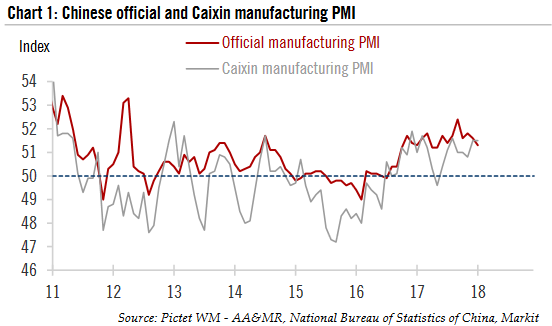

China’s official manufacturing purchasing manager index (PMI) came in at 51.3 in January, down slightly from December (51.6). The Markit PMI (also known as the Caixin PMI) stayed at 51.5, the same as in the previous month (Chart 1). The official non - manufacturing PMI rose slightly to 55.0 in January from 44.8 the previous month.

|

|

|

|

|

|

FX Daily, February 02: A Note Ahead of US Jobs Report

|

|

Author: Marc Chandler

Categories: FX Trends

|

|

The US dollar is sporting a firmer profile against all the major currencies after weakening yesterday. Frequently, it seems the Australian dollar leads the other currencies, and we note that it is making a new low for the week today. Briefly, in Europe, it slipped below its 20-day moving (~$0.7985) average for the first time since December 13.

|

|

|

|

|

|

Monetary Metals Brief 2018

|

|

Author: Keith Weiner

Categories: Debt and the Fallacies of Paper Money

|

|

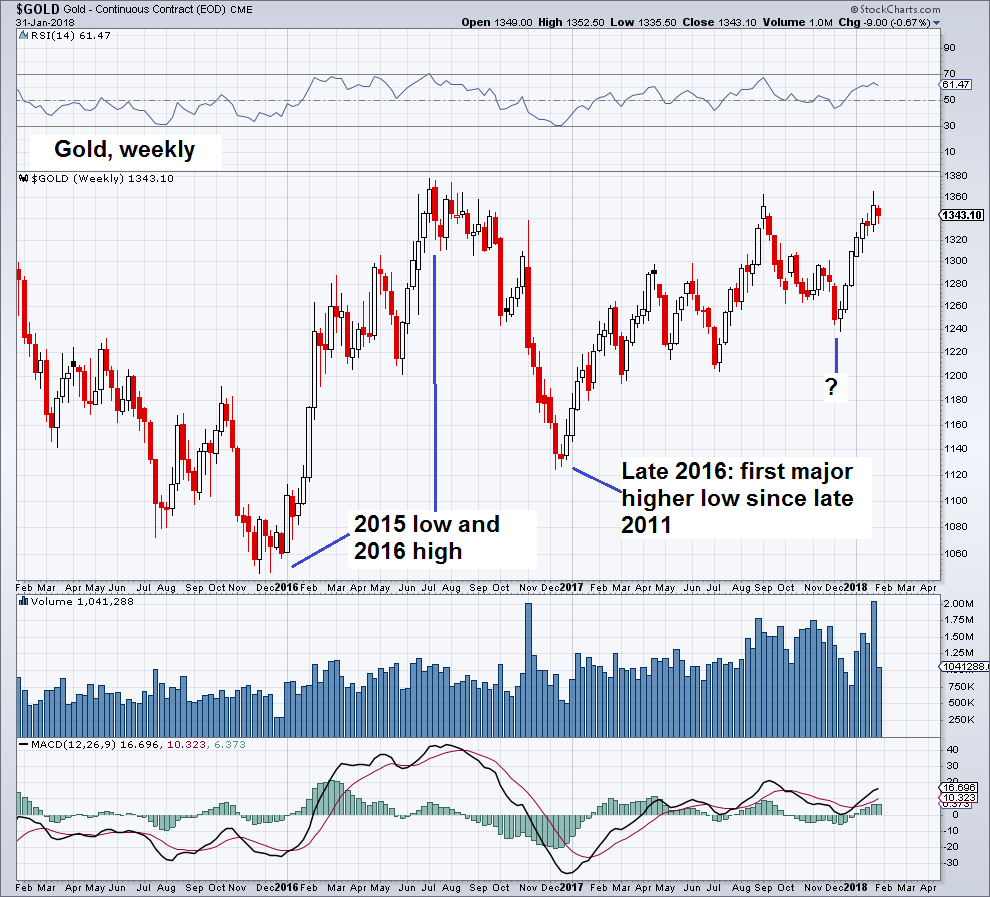

Predicting the likely path of the prices of the metals in the near term is easy. Just look at the fundamentals. We have invested many man-years in developing the theory, model, and software to calculate it. Every week we publish charts and our calculated fundamental prices.

|

|

|

|

|

|

Switzerland ranked ‘global capital of bank secrecy’

|

|

Author: Swissinfo

Categories: Swiss Markets and News

|

|

Switzerland is the most secretive financial centre in the world, followed by the United States, according to the Tax Justice Network, a non-governmental organization that campaigns for greater transparency. The Cayman Islands, Hong Kong, Singapore, Luxembourg, Germany, Taiwan, the United Arab Emirates and Guernsey (in descending order) were ranked in the top ten of the NGOs Financial Secrecy Indexexternal link, published on Tuesday.

|

|

|

|

Too Much Bubble-Love, Likely to Bring Regret

|

|

Author: Pater Tenebrarum

Categories: Debt and the Fallacies of Paper Money

|

|

Readers may recall our recent articles on the blow-off move in the stock market, entitled Punch-Drunk Investors and Extinct Bears (see Part 1 & Part 2 for the details). Bears remained firmly extinct as of last week – in fact, some of the sentiment indicators we are keeping tabs on have become even more stretched, as incredible as that may sound. For instance, assets in bullish Rydex funds exceeded bear assets by a factor of more than 37 at one point last week.

|

|

|

|

|

|

|

|