Dividendes de la BNS: le compte n’y est pas

|

|

Author: Liliane Held-Khawam

Categories: SNB

|

|

La Banque nationale suisse s’attend à un bénéfice de 54 milliards de francs pour l’exercice 2017. Celui-ci résulte de: Un gain de 49 milliards de francs sur ses positions en monnaies étrangères. D’une plus-value de 3 milliards de francs sur l’or. D’un bénéfice de 2 milliards de francs sur ses positions en franc.

|

|

|

|

|

|

FX Daily, January 11: Capital Markets Calmer, Greenback Consolidates

|

|

Author: Marc Chandler

Categories: FX Trends

|

|

As market participants were just getting their sea legs back after the start of the year, it was hit by a one-two punch of ideas that BOJ policy was turning less accommodative and that Chinese officials were wary of adding to their Treasury holdings. Then late yesterday, a news wire reported that Canada suspected the US was going to withdraw from NAFTA.

|

|

|

|

|

|

Cool Video: Bloomberg TV Clip on Central Banks

|

|

Author: Marc Chandler

Categories: FX Trends

|

|

I joined Alix Steel and David Westin on the Bloomberg set earlier today. Click here for the link. In the roughly 2.5 minute clip, we talk about the US and and the monetary cycle in Europe. In the US, Q4 was another quarter of above trend growth. The Atlanta Fed says the economy is tracking 2.7%, while the NY Fed puts it at 4.0%.

|

|

|

|

|

|

Number of unemployed in Switzerland drops by 4 percents

|

|

Author: Swissinfo

Categories: Swiss Markets and News

|

|

The Swiss unemployment rate fell from 3.3% in 2016 to 3.2% in 2017, according to figures released by the State Secretariat for Economic Affairs (SECO) on Tuesday. In terms of actual numbers, 143,142 people were registered as unemployed, a decrease of 6,175 compared with the year before.

|

|

|

|

|

|

Gold Prices Rise To $1,326/oz as China U.S. Treasury Buying Report Creates Volatility

|

|

Author: Mark O'Byrne

Categories: GoldCore

|

|

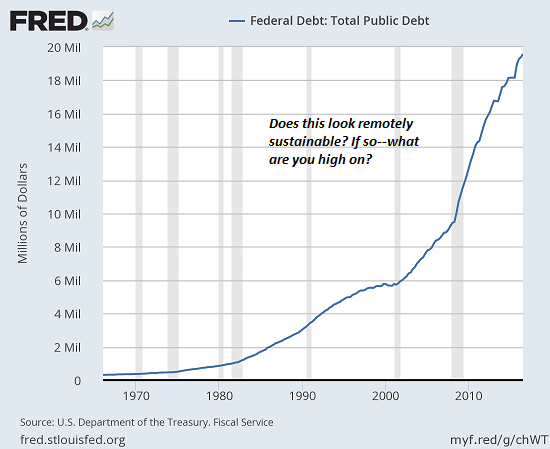

Gold prices rise to $1,326/oz on concerns China may slow U.S. Treasury buying. Equities fell sharply on the report as did Treasurys and the U.S. dollar. Chinese officials think U.S. debt is becoming less attractive compared to other assets. Trade tensions could provide a reason to slow down or halt U.S. debt purchases. U.S. dollar vulnerable as China remains biggest buyer of U.S. sovereign debt. Currency wars to return as China rejects U.S. hegemony in Asia

|

|

|

|

Yes, But at What Cost?

|

|

Author: Charles Hugh Smith

Categories: The United States

|

|

This is how our entire status quo maintains the illusion of normalcy: by avoiding a full accounting of the costs. The economy's going great--but at what cost? "Normalcy" has been restored, but at what cost? Profits are soaring, but at what cost? Our pain is being reduced--but at what cost? The status quo delights in celebrating gains, but the costs required to generate those gains are ignored for one simple reason: the costs exceed the gains by a wide margin.

|

|

|

|

|

|

|

|