Slow wage growth to keep Fed on prudent normalisation track

|

|

Author: Thomas Costerg

Categories: Pictet Macro Analysis, Swiss and European Macro

|

|

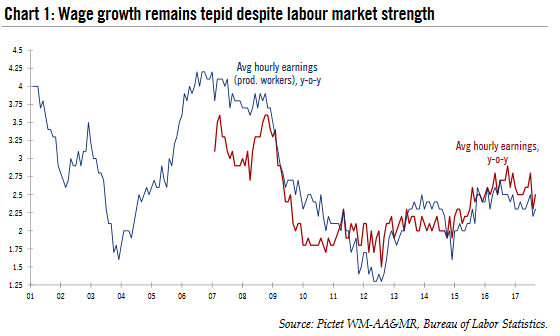

The November employment report showed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest -rate hikes (although it is still very likely to hike 25bps on 13 December).

|

|

|

|

|

|

ECB preview: close to target…by 2020

|

|

Author: Frederik Ducrozet

Categories: Pictet Macro Analysis, Swiss and European Macro

|

|

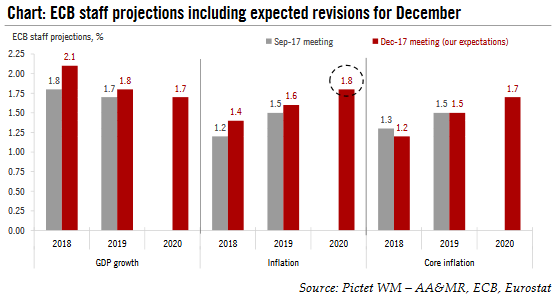

The ECB’s meeting on 14 December would be a non-event if it were not for two specific points to make clear before the Christmas break – the staff forecasts for inflation, and the not-so-constructive ambiguity on QE horizon. We expect no major surprise from the new staff projections, reflecting the ECB’s cautiously upbeat tone.

|

|

|

|

|

|

Poverty risk high for Swiss pensioners despite high spending

|

|

Author: Le News

Categories: Personal Finance, Swiss Markets and News

|

|

A recent OECD study, which looks at retirement, shows the relatively large amount spent on pensioners in Switzerland. Switzerland consumes 11% of its GDP on retirees, compared to 9% across OECD nations. Despite this high spending, the risk of poverty is higher in Switzerland than across the OECD. According to the organisation, 19% of those over 64 in Switzerland are at risk of poverty, compared to an OECD average of 13%.

|

|

|

|

|

|

Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

|

|

Author: GoldCore

Categories: Gold and Bitcoin

|

|

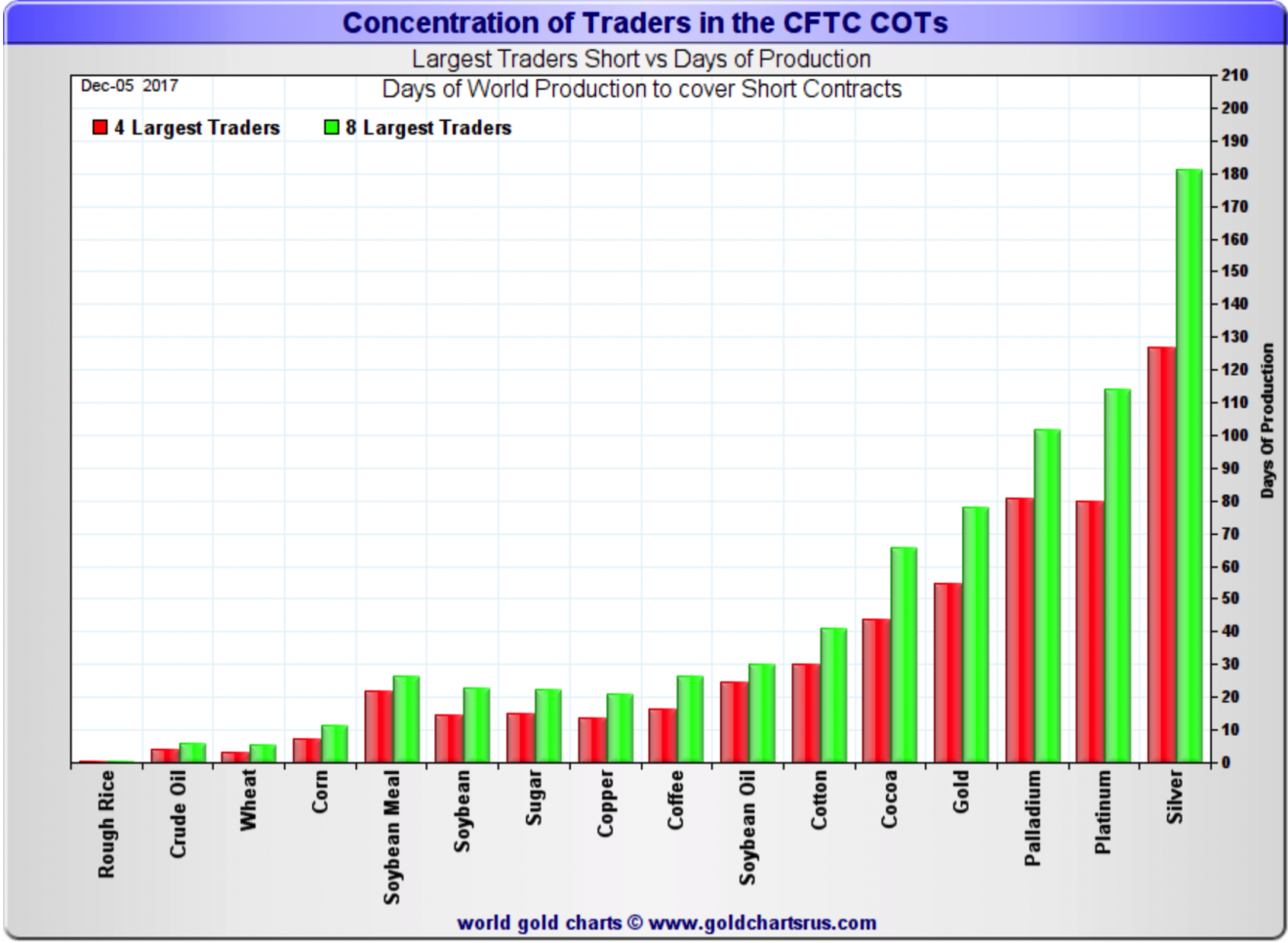

Gold and silver COT suggests bottoming and price rally coming. Speculators cut way back on long positions and added to short bets. Commercials/banks significantly reduced short positions. Commercial net short position saw biggest one-week decline in COMEX history. ‘Big 4’ commercial traders decreased their short positions by 28,800 contracts. Seasonally, January is generally a good month to own gold (see table). "If history is still reliable, January will be a great month to own precious metals"

|

|

|

|

|

|

Could Central Banks Dump Gold in Favor of Bitcoin?

|

|

Author: Charles Hugh Smith

Categories: The United States

|

|

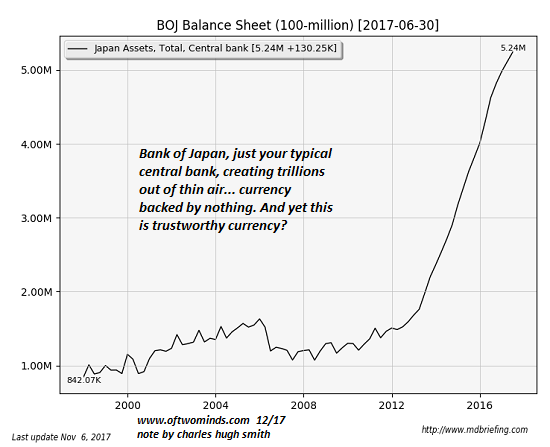

All of which brings us to the "crazy" idea of backing fiat currencies with cryptocurrencies, an idea I first floated back in 2013, long before the current crypto-craze emerged. Exhibit One: here's your typical central bank, creating trillions of units of currency every year, backed by nothing but trust in the authority of the government, created at the whim of a handful of people in a room and distributed to their cronies, or at the behest of their cronies. And this is a "trustworthy" currency?

|

|

|

|

The Rug Yank Phase of Fed Policy

|

|

Author: MN Gordon

Categories: Debt and the Fallacies of Paper Money

|

|

The political differences of today’s two leading parties are not over ultimate questions of principle. Rather, they are over opposing answers to the question of how a goal can be achieved with the least sacrifice. For lawmakers, the goal is to promise the populace something for nothing, while pretending to make good on it.

|

|

|

|

|

|

|

|