Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

|

|

Author: Graham Summers

Categories: SNB, Zerohedge on SNB

|

|

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well.

|

|

|

|

|

|

Euro area: The sky is the limit

|

|

Author: Nadia Gharbi

Categories: Pictet Macro Analysis, Swiss and European Macro

|

|

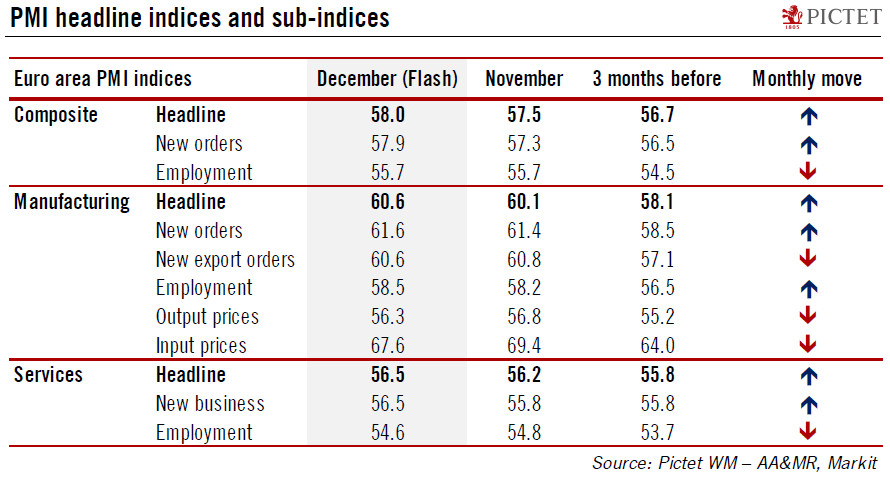

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors.

|

|

|

|

|

|

China tops export destination ranking for Swiss SMEs

|

|

Author: Swissinfo

Categories: Swiss Markets and News

|

|

A study commissioned by Switzerland Global Enterprise (SGE) indicates that China is the most attractive export destination for Swiss small and medium enterprises (SMEs). A total of 107 countries were evaluated using a set of 15 criteria that included market size, market potential, export volume and average market growth in recent years.

|

|

|

|

|

|

A Gold Guy's View Of Crypto, Bitcoin, And Blockchain

|

|

Author: Alex Stanczyk

Categories: Gold and Bitcoin

|

|

Bitcoin was on my radar far back as 2011, but for years, I didn’t think much of it. It was a curiosity. Nothing more. Sort of like the virtual money you use in World of Warcraft or something. In 2015, looking deeper, I slowly (not the sharpest tool in the shed) arrived at that “aha” inflection point that most advocates of honest money arrive at. I realized that a distributed public ledger has the power to change, well, everything.

|

|

|

|

|

|

Bi-Weekly Economic Review: Animal Spirits Haunt The Market

|

|

Author: Joseph Y. Calhoun

Categories: The United States

|

|

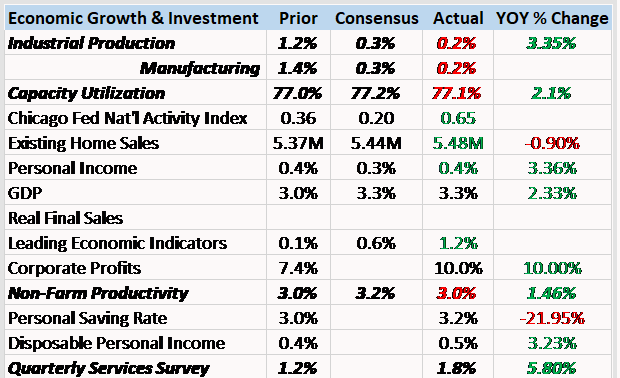

The economic data over the last two weeks continued the better than expected trend. Some of the data was quite good and makes one wonder if maybe, just maybe, we are finally ready to break out of the economic doldrums. Is it possible that all that new normal, secular stagnation stuff was just a lack of animal spirits?

|

|

|

|

Fed’s enthusiasm on tax cut plans remains limited

|

|

Author: Thomas Costerg

Categories: The United States

|

|

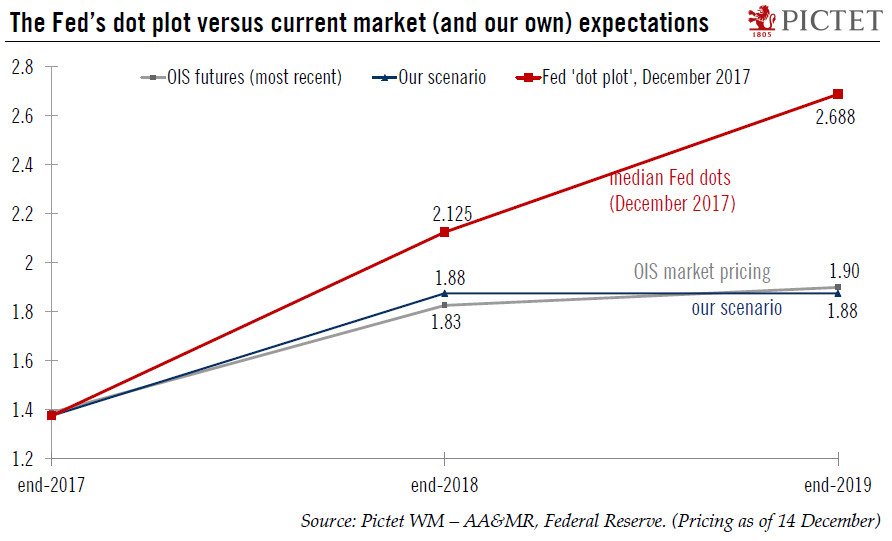

The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’.

|

|

|

|

|

|

|

|