The pandemic is still with us as the year winds down and has not yet become endemic, like the seasonal flu. Even before the new Omicron variant was sequenced, Europe was being particularly hard hit, and social restrictions, especially among the unvaccinated, were spurring social strife. US cases, notably in the Midwest, were rising, and there is fear that it is 4-6 weeks behind Europe in experiencing the surge. Whatever herd immunity is, it has not been achieved. Moreover, despite plenty of vaccines in high-income countries, inoculation efforts in many low-income countries won't begin in earnest until next year.

That said, the new variant has injected a new element into the mix, and it is with a heightened degree of uncertainty that we share our December outlook. Given the unknowns, policymakers can choose the kind of error they are willing to make. They are trying to minimize their maximum regret. The utmost regret is that the mutation is dangerous and renders the existing vaccines and treatment significantly less effective. This will leave them vulnerable to accusations of over-reacting if the Omicron turns out to be a contagious but less deadly variation.

Meanwhile, there has been some relief to the supply chain disruptions. Covid-related factory closures in Asia, the energy shortage, and port congestion are easing. Large US retailers have stocked up for the holiday shopping season, some of which chartered their own ships to ensure delivery. There are also preliminary signs that the semiconductor chip shortage may be past its worst. Indeed, the recovery of the auto sector and rebuilding of inventories will help extend the economic expansion well into next year, even though fiscal and monetary policy are less supportive for most high-income countries. The flash November US manufacturing PMI saw supplier delivery delays fall to six-month lows.

We assume that the US macabre debt ceiling ritual will not lead to a default, and even though it distorted some bill auctions, some resolution is highly probable. The debate over the Build Back Better initiative, approved by the House of Representatives, will likely be scaled back by moderate Democratic Senators and Republicans.

Besides assessing the risks posed by the new variant, the focus in December is back on monetary policy. Four large central banks stand out. The Chinese economy has slowed the People's Bank of China quarterly monetary report modified language that signals more monetary support may be forthcoming. Many observers see another reduction in reserve requirements as a reasonable step. Unlike in the US and Europe, which saw bank lending dry-up in the housing market crisis (2008-2009), Beijing is pressing state-owned banks to maintain lending, including the property sector.

The Federal Reserve meets on December 15. There are two key issues. First, we expect the FOMC to accelerate the pace of tapering to allow it to have the option to raise rates in Q2 22. The Fed's commitment to the sequence (tapering, hikes, letting balance sheet run-off) and the current pace of tapering deny the central bank the needed flexibility. The November CPI will be reported on December 10. The headline will likely rise to around 6.7%, while the core rate may approach 5%. Second, the new "Summary of Economic Projections" will probably show more Fed officials seeing the need to hike rates in 2022. In September, only half did. The rhetoric of the Fed's leadership has changed. It will not refer to inflation as transitory and is signaling its intention to act.

The European Central Bank and the Bank of England meet the day after the FOMC. The ECB staff will update its forecasts, and the key here is where it sees inflation at the end of the forecasting period. In September, it anticipated that CPI would be at 1.5% at the end of 2023. Some ECB members argued it was too low. It may be revised higher, but the key for the policy outlook is whether it is above the 2% target. We doubt that this will be the case.

While the ECB will likely announce that it intends on respecting the current end of the Pandemic Emergency Purchase Program next March, its QE will persist. The pre-crisis Asset Purchase Program is expected to continue and perhaps even expand in Q2 22. The "modalities" of the post-emergency bond-buying program, size, duration, and flexibility (self-imposed limits) will be debated between the hawks and doves. With eurozone inflation approaching 5% and Germany CPI at 6%, the hard-money camp will have a new ally at the German Finance Ministry as the FDP leader Linder takes the post. On the other hand, the Social Democrats will name a Weidmann's replacement at the head of the Bundesbank, and nearly anyone will be less hawkish.

While we correctly anticipated that the Bank of England would defy market expectations and stand pat in November, the December meeting is trickier. The decision could ultimately turn on the next employment and CPI reports due 1-2 days before the BOE meeting. The risk is that inflation will continue to accelerate into early next year and that the labor market is healing after the furlough program ended in September. On balance, we suspect it will wait until next year to hike rates and finish its bonds purchases next month as planned.

Having been caught wrong-footed in November, many market participants are reluctant to be bitten by the same dog twice. As a result, the swaps market appears to be rising in about a 35% chance of a 15 bp move that would bring the base rate up to 25 bp. Sterling dropped almost 1.4% (or nearly two cents) on November 4, the most since September 2020 when the BOE failed to deliver the hike that the market thought the BOE had signaled.

The combination of a strong dollar and the Fed tapering weighed emerging market currencies as a whole. The JP Morgan Emerging Market Currency Index fell by about 4.5% in November, its third consecutive monthly decline, bringing the year-to-date loss to almost 10%. It fell roughly 5.7% in 2020. Turkey took the cake, though, with the lira falling nearly 30% on the month. It had depreciated by 15% in the first ten months of the year. This follows a 20% depreciation last year. Ten years ago, a dollar would buy about 1.9 lira. Now it can buy more than 13 lira.

The euro's weakness was a drag, and the geopolitical developments (e.g., Ukraine, Belarus) weighed on central European currencies. The central bank of Hungary turned more aggressive by hiking the one-week deposit rate by 110 bp (in two steps) after the 30 bp hike in the base rate failed to have much impact. The forint's 3.1% loss was the most among EU members. Colombian peso was the weakest currency in Latam, depreciating by almost 5%. It was not rewarded for delivering a larger than expected 50 bp rate hike in late October.

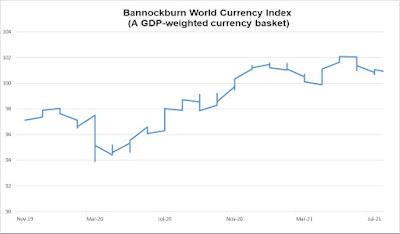

Bannockburn's GDP-weighted global currency index (BWCI) fell by nearly 1% in November, the largest monthly decline since June. It reflected the decline of the world's largest currencies against the dollar. Three currencies in the index proved resilient On the GDP-weighted basis, China has immense gravity, with a 21.8% weighting (the six largest EM economies, including China, account for a 32.5% of the BWCI). It appreciated by about two-thirds of a percent. The Brazilian real managed to rise (~0.25%) too.

Since the day before the Omicron variant was sequenced, the Japanese yen gained a little more than 2%, reversing the earlier decline that had brought it to four-year lows. It rose by 0.7% in November, making it the strongest currency in the index. Among the major currencies, the Australian dollar fell the most, declining about 5.2%. The Canadian dollar was next, with around a 3% loss.

As it turns out, the dollar (Dollar Index) recorded its low for the year as shocking events were unfolding in Washington on January 6. The bottomed against the yen and euro the same day. The greenback did not bottom against the Australian dollar until February, but it took it until early June to put in a low against sterling and the Canadian dollar. The BWCI peaked in early June and, by the end of last month, had retreated by about 2.7%. We suspect it may decline by another 2%, which would return it the levels of late 2019. That, in turn, implies the risk of a stronger dollar into the first part of next year.

Dollar: The jump in US CPI to above 6%, and a strong sense that it is not the peak, spurred speculation that the Federal Reserve would likely accelerate the pace of tapering at the December meeting. Several Fed officials seemed sympathetic, including San Francisco President Daly, who is perceived to be a dove. The minutes of the November meeting underscored the central bank's flexibility over the pace of tapering. At the same time, most of the high-frequency data for October came in stronger than expected, lending credence to ideas that after a disappointing Q3, the world's largest economy is accelerating again in Q4. The divergence of monetary policy and the subsequent widening interest rate differentials is the primary driver of expectations for dollar appreciation against the euro and yen. The market had been leaning toward three rates hikes in 2022 before news of the new Covid mutation emerged and trimmed the odds. Powell was renominated for a second term at the helm of the Federal Reserve, Brainard was nominated to be Vice-Chairman. There is still the Vice-Chair for supervision and an empty governor seat for President to Biden to fill. In addition to the changes in leadership, the rotation of the voting members of the FOMC brings in a somewhat more hawkish bias next year.

Euro: In contrast with the US, eurozone growth is set to slow in Q4. After two quarters that growth exceeded 2% quarter-over-quarter, growth is likely to moderate to below 1% in Q4 21 and Q1 22. Food and energy are driving inflation higher. The EC continues to negotiate with the UK over changes to the Northern Ireland Protocol. The dispute over fishing licenses and migrant crossing of the channel are also unresolved sources of tension with the UK. Tensions between the EC and Poland/Hungary over the rule of law, judicial independence, and civil liberties have also not been settled. As was the case in the spring, Russia's troop and artillery movement threatened Ukraine, though the tension on the Poland/Belarus border has eased. The ECB's leadership continues to maintain the price pressures are related to the unusual set of circumstances but are ultimately temporary. Its December 16 meeting, the last one before Bundesbank President Weidmann steps down, is critical. In addition to confirming the end of the Pandemic Emergency Purchase Program in March 2022, and the expansion of the Asset Purchase Program, the ECB staff will update its inflation forecasts. The focus here is on the 2023 CPI projection of 1.5%. There was a push back against it in September, and a slight upward revision is likely. Nevertheless, it will probably remain below the 2% target. The swaps market is pricing in a 25 bp hike in 2023.

(November indicative closing prices, previous in parentheses)

Spot: $1.1335 ($1.1560)

Median Bloomberg One-month Forecast $1.1375 ($1.1579)

One-month forward $1.1350 ($1.1568) One-month implied vol 7.1% (5.1%)

Japanese Yen: Japan has a new prime minister who has put together a large fiscal stimulus package that will help fuel the economic recovery that had begun getting traction since the formal state of emergency was lifted at the end of September. After a frustratingly slow start, the inoculation efforts have started bearing fruit, with vaccination rates surpassing the US and many European countries. Unlike most other high-income countries, Japan continues to experience deflationary pressures. Food and energy prices may be concealing it in the CPI measure, but the GDP deflator in Q2 and Q3 was -1.1%. However, the BOJ does not seem inclined to take additional measures and has reduced its equity and bond-buying efforts. The exchange rate remains sensitive to the movement of the US 10-year note yield, which has chopped mostly between 1.50% and 1.70%. With a couple of exceptions in both directions, the greenback has traded in a JPY113-JPY115 range. The emergence of the new Covid mutation turned the dollar back after threatening to break higher. A convincing move above the JPY115.50 area would likely coincide with higher US rates and initially target the JPY118 area.

Spot: JPY113.10 (JPY113.95)

Median Bloomberg One-month Forecast JPY113.30 (JPY112.98)

One-month forward JPY113.00 (JPY113.90) One-month implied vol 8.2% (6.4%)

British Pound: Sterling never fully recovered from disappointment that the Bank of England did not hike rates in early November. Market participants had understood the hawkish rhetoric, including by Governor Bailey, to signal a hike. The implied yield of the December 2021 short-sterling interest rate futures plummeted by 30 bp by the end of the month, and sterling has not seen $1.36, let alone $1.37, since then. Indeed, sterling chopped lower and recorded new lows for the year in late November near $1.3200. Growth in the UK peaked in Q2 at 5.5% as it recovered from the Q1 contraction. It slowed to a 1.3% pace in Q3 and looks to be slowing a bit more here in Q4. The petty corruption scandals and ill-conceived speeches by Prime Minister Johnson have seen Labour move ahead in some recent polls. An election does not need to be called until May 2024, but the flagging support may spur a cabinet reshuffle. The next important chart point is not until around $1.3165 and then the $1.30 area, which holds primarily psychological significance.

Spot: $1.3300 ($1.3682)

Median Bloomberg One-month Forecast $1.3375 ($1.3691)

One-month forward $1.3315 ($1.3680) One-month implied vol 7.5% (6.8%)

Canadian Dollar: The Canadian dollar appreciated by almost 2.4% in October and gave it all back, plus some in November. Indeed, the loss was sufficient to push it fractionally lower for the year (-0.4%), though it remains the best performing major currency against the US dollar. The three major drivers of the exchange rate moved against the Canadian dollar last month. First, its two-year premium over the US narrowed by 17 bp, the most in four years. Second, the price of January WTI tumbled by around 18.2%. Commodity prices fell more broadly, and the CRB Index snapped a seven-month rally with a 7.8% decline. Third, the risk appetites faltered is reflected in the equity markets. The Delta Wave coupled with the new variant may disrupt growth. Still, the swaps market has a little more than two hikes discounted over the next six months. The government is winding down its emergency fiscal measures, but the spring budget and election promises mean that the fiscal consolidation next year will be soft.

Spot: CAD1.2775 (CAD 1.2388)

Median Bloomberg One-month Forecast CAD1.2685 (CAD1.2395)

One-month forward CAD1.2770 (CAD1.2389) One-month implied vol 7.2% (6.2%)

Australian Dollar: The Australian dollar fell by more than 5% last month, slightly less than it did in March 2020. It did not have an advancing week in November after rallying every week in October. Australia's two-year premium over the US was chopped to less than 10 bp in November from nearly 28 bp at the end of October. The Reserve Bank of Australia pushed back against aggressive rate hike speculation. The unexpected loss of jobs in October for the third consecutive month took a toll on the Australian dollar, which proceeded to trend lower and recorded the low for the year on November 30, slightly below $0.7065. A break of $0.7050 would initially target $0.7000, but convincing penetration could spur another 2-2.5-cent drop. The 60-day rolling correlation between- changes in the Australian dollar and the CRB commodity index weakened from over 0.6% in October to below 0.4% in November. The correlation had begun recovering as the month drew to a close.

Spot: $0.7125 ($0.7518)

Median Bloomberg One-Month Forecast $0.7195 ($0.7409)

One-month forward $0.7135 ($0.7525) One-month implied vol 9.7% (9.1%)

Mexican Peso: The broadly stronger US dollar and the prospects of more accelerated tapering weighed on emerging market currencies in November, but domestic considerations also weighed on the peso.

The Mexican peso fell by around 4.1%, the most since March 2020. The economy unexpectedly contracted by 0.4% in Q3. There is little fiscal support to speak of, while monetary policy is becoming less accommodative too slowly compared with some other emerging markets, such as Brazil. Price pressures are still accelerating, and the bi-weekly CPI rose above 7% in mid-November. The swaps market discounts nearly a 25 bp hike a month for the next six months. The government's policies, especially in the energy and service sectors, are not attractive to investors. President AMLO dealt another blow to investor confidence by retracting the appointment of former Finance Minister Herrera for his deputy to head up the central bank starting in January. This is seen potentially undermining one of the most credible institutions in Mexico. Lastly, Mexico's trade balance has deteriorated sharply in recent months and through October has recorded an average monthly trade deficit of nearly $1.2 bln this year. In the same period, in 2020, it enjoyed an average monthly surplus of almost $2.5 bln, and in the first ten months of 2019, the average monthly trade surplus was a little more than $150 mln.

Spot: MXN21.46 (MXN20.56)

Median Bloomberg One-Month Forecast MXN21.23 (MXN20.42)

One-month forward MXN21.60 (MXN20.65) One-month implied vol 14.9% (9.6%)

Chinese Yuan: The Chinese yuan has been remarkably stable against the US dollar, and given the greenback's strength, it means the yuan has appreciated sharply on a trade-weighted basis. Going into the last month of the year, the yuan's 2.6% gain this year is the best in the world. Chinese officials have signaled their displeasure with what it sees as a one-way market. At best, it has orchestrated a broadly sideways exchange rate against the dollar, mainly between CNY6.37 and CNY6.40. The lower end of the dollar's range was under pressure as November drew to a close. Even though the Chinese economy is likely to accelerate from the near-stagnation in Q3 (0.2% quarter-over-quarter GDP), it remains sufficiently weak that the PBOC is expected to consider new stimulative measures. It last reduced reserves requirements in July, and this seems to be the preferred avenue rather than rate cuts. Yet, given the interest rate premium (the 10-year yield is around 2.85%), record trade surpluses ($84.5 bln in October), portfolio inflows, and limited outflows, one would normally expect a stronger upward pressure on the exchange rate.

Spot: CNY6.3645 (CNY6.4055)

Median Bloomberg One-month Forecast CNY6.38 (CNY6.4430)

One-month forward CNY6.3860 (CNY6.4230) One-month implied vol 3.5% (3.5%)

Tags: #USD,Featured,macro,newsletter