| Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup? You can’t blame COVID at the tail end for a woeful string which actually dates back farther than the last pandemic (H1N1).

Emil Kalinowski has it absolutely right; what happened in 2013 in the Treasury market was no tantrum. On the contrary, he quite correctly identified how it was a taper celebration. As the both of us have to constantly point out, that was a period, albeit very brief, when bonds and central bankers each saw the same thing at the same time. |

|

| Maybe a slight pickup in growth therefore a modest bit less deflation-y.

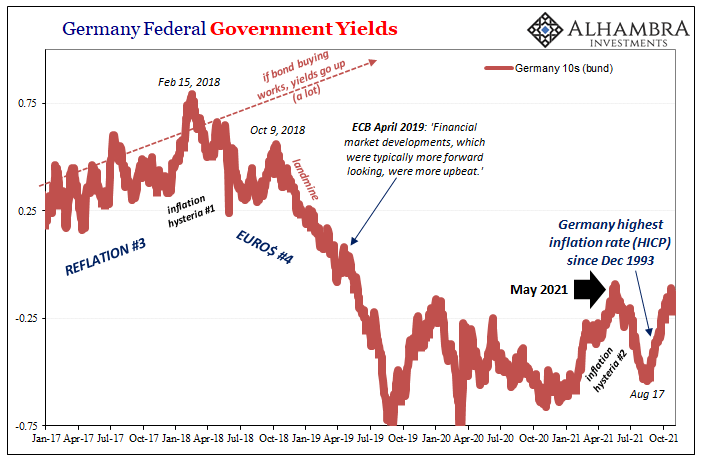

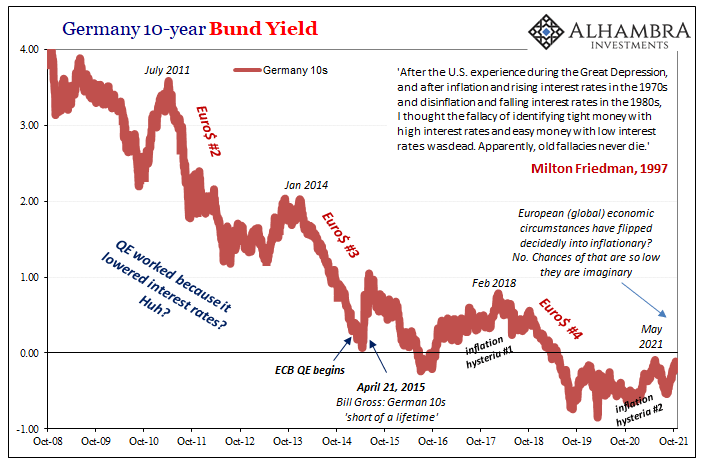

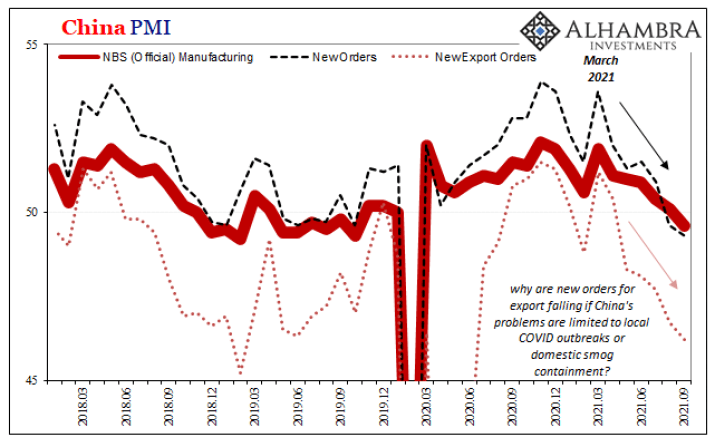

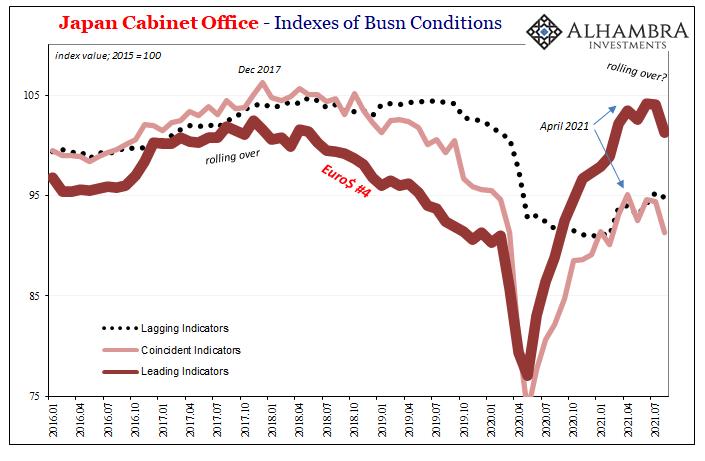

If that was 2013’s taper, what would an actual tantrum celebration look like, one in which the market is anticipating a real pickup in growth and therefore an end to nearly all the last decade and more of deflationary weight? I don’t know for certain, but I am absolutely sure it would be nothing like what we’re seeing worldwide this year. Apart from the first few months, since around March/April everything going the wrong way (at best, stopped going the right way). The Fed isn’t the only central bank on the “hawkish” warpath. Others have begun to raise rates, while over in Europe the ECB is ahead in terms of its plans to scale back QE (taper). The modest rise in European yields since August hardly fits the tantrum celebration definition. |

|

| Since we live in a silly world populated mostly by unserious people where myths and shorthand are taken at face value in the face of every last bit of unflinching evidence, this lack of more forthright bond market bloodletting is, of course, attributed to skillful central banking – as pretty much everything is.

If bond yields were to have gone way up like they were supposed to, they’d say it was because the ECB was successful with its QE in finally solving the inflation/growth puzzle. As bond yields instead refuse to move very much at all, they still say it is because of the ECB, only now it must be expert communication reassuring panicky bond investors who allegedly fret the balance sheet twitch of every LSAP parameter. We constantly hear from the lazy interpretation, how in the face of all unambiguous empirical proof (seriously, just look at a yield chart, any yield chart!) without a central bank buying them bonds would be doomed.

|

|

| That sets it up to nudge asset purchases further down in December if financial conditions remain favourable — or postpone or reverse in the opposite case — all without drama. Jay Powell and the Fed will consider themselves lucky if they can pull off the same feat.

Powell’s actually been handed the same “gift” as Christine Lagarde in Europe, both suffering the same delusion of bond yields which are actively betting against (flat plus now lower nominal yields) the economic scenarios behind each of these taper intentions. In other words, global bond markets recognizing how central bankers are about to do what they always do; extrapolating a modest bit of reflation in a straight line expecting it to continue forever upward. They do this repeatedly, having learned absolutely nothing from the last time it all fell apart in the same way. |

|

| This is why, before too much longer, someone should demand an explanation from policymakers for these egregious past errors before merely accepting the likely commission of their latest. This is really where bonds are at currently; we’ve seen this all before.

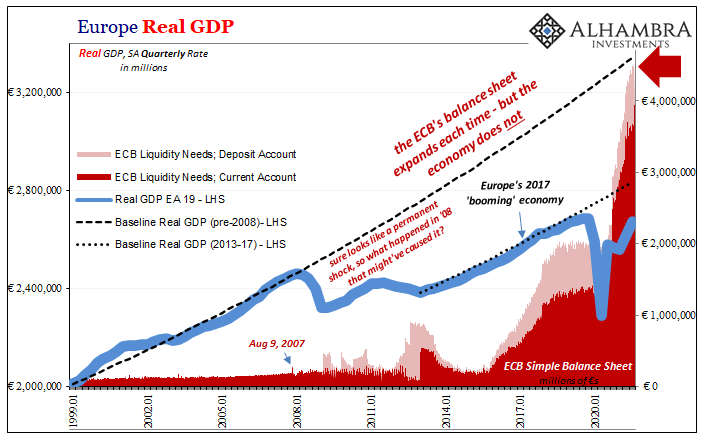

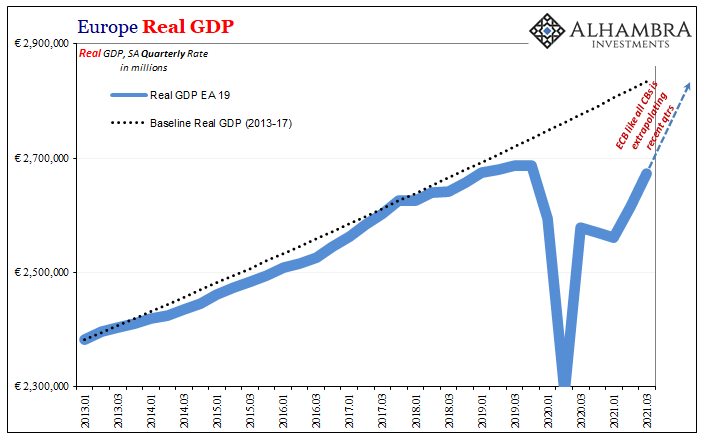

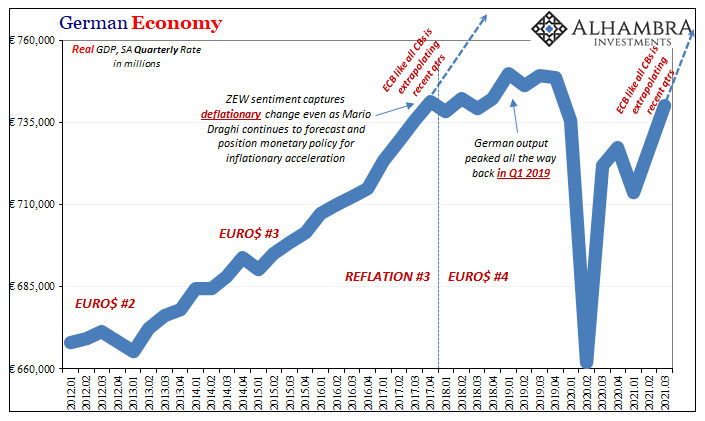

For Europe, anyway, the straight-line extrapolation at least has two quarters now of real GDP in behind. According to last week’s Eurostat estimates, Q3 ended up like Q2, both high rates of rebound which otherwise bucked the worldwide trend. Lagarde’s legion regards this as expert policy execution when the data, like bonds, indicates something else; a delayed reopening when compared to everywhere else on the planet. |

|

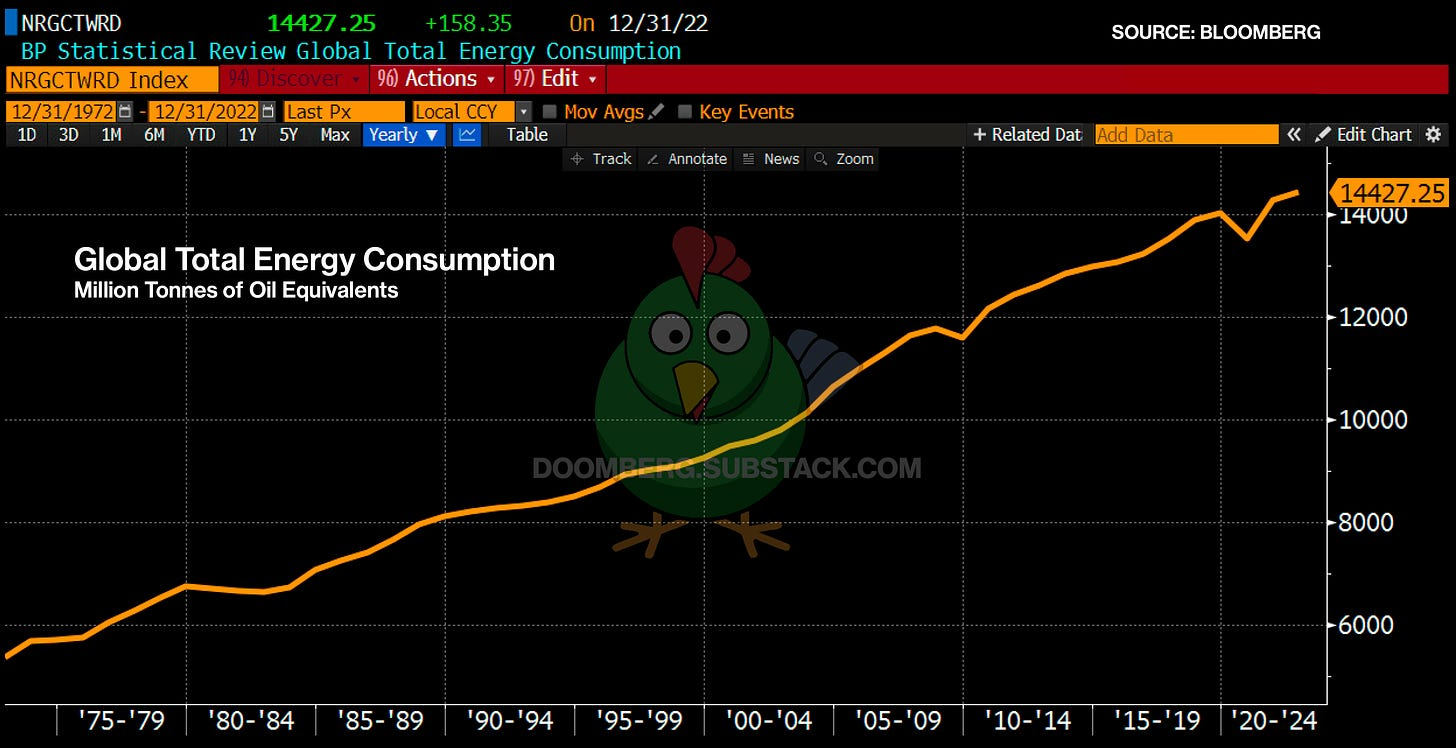

| This puts the European system on track to look upward at a time when globally synchronized increasingly means something different than growth. | |

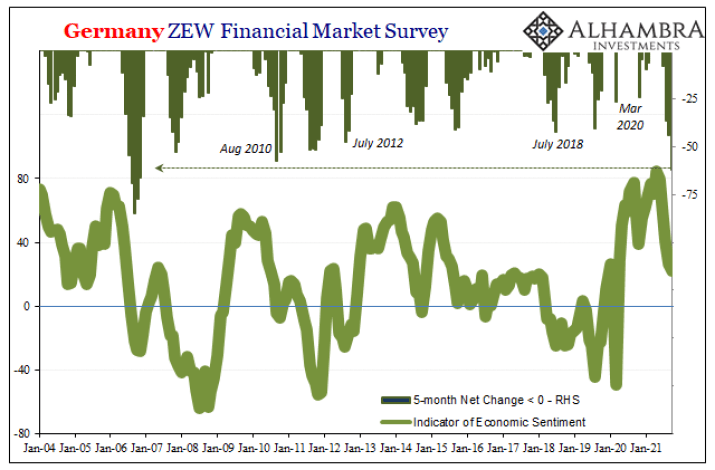

| And it has been Germany where the “growth scare” already aligns with the 2017-18 hysteria. The German ZEW (as well as that country’s IFO) isn’t projecting Q4 and beyond in the same linear trend, rather, like early 2018, commercial professionals answering this survey are saying they see more concerning than not (even if they attribute their skepticism to non-economic factors like supply chains; in 2018, “everyone” said it was trade wars when that had little to do with the global inflection).

The important point, therefore, and not just ZEW nor merely Germany, is how the potential for global inflection is once again rising at the same time central bankers in Europe and elsewhere convince themselves of only smooth sailing therefore nothing stopping the inflation trend this time (even though, again, they have no idea what did stop the last one, and the one before that, and…) Not just bonds and ZEW survey panelists, banks, too, are betting against the forever upward economy. |

|

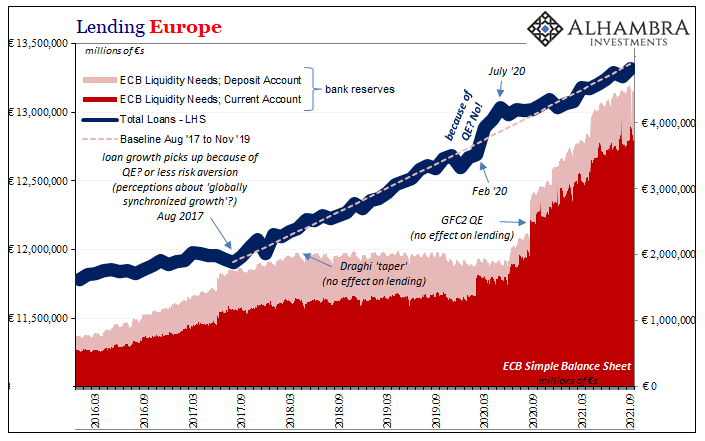

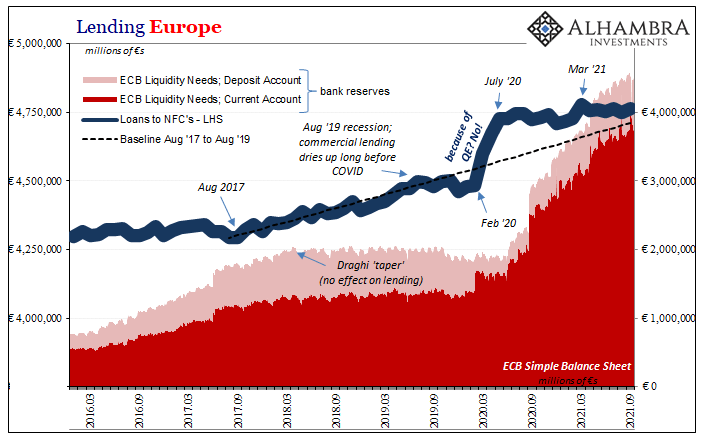

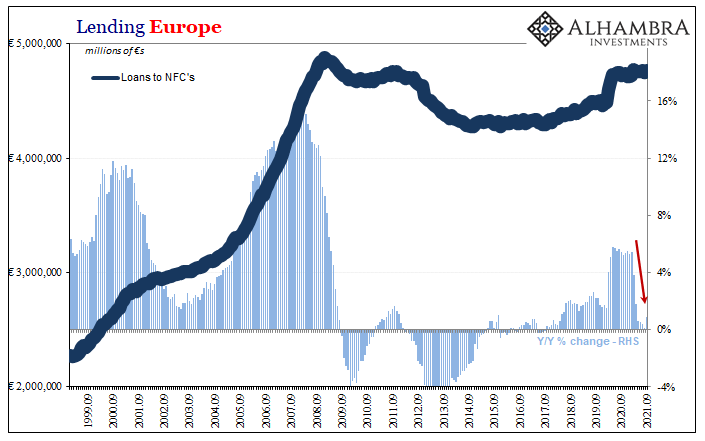

| We’ve covered bank lending several times already, and European loan data up to the end of Q3 2021 remains equally as skeptical if not downright alarming. In other words, banks are behaving – especially in commercial lending (NFC, or non-financial corporations in European loan terminology) – where the tone and the direction are far closer to recessionary than not. | |

That, too, does Europe’s financial system share in common with America’s. It is, after all, a global monetary regime centered not around central banks and their irrelevant QE’s but commercial banks who really would be lending if anything of the mainstream narrative were even semi-true.

Bonds aren’t the only way to sort out the various instances of CPI outbreaks, essentially ignoring and pricing the current burst of consumer prices as distinct from inflation. Banks are doing the same thing in their loan books, which isn’t surprising given that the same banks are loading up their overall books with the same sort of safe and most liquid bonds pricing this inflation skepticism.

Not just skepticism, increasingly betting against the ECB and Fed’s forecasts forging each taper.

There’s no tantrum anywhere because unlike 2013 there actually isn’t the smallest cause for even a brief celebration. There’s only central banks and their ridiculous straight lines.

Full story here Are you the author? Previous post See more for Next post

Tags: bond market,Bonds,Christine Lagarde,currencies,ECB,economy,Europe,Featured,Federal Reserve/Monetary Policy,german bunds,Germany,inflation,lending,Loans,Markets,newsletter,QE,real GDP,recession,taper,Yield Curve