Monthly Archive: August 2012

Eurobonds, fiscal or banking union are all pure utopia

Germany’s stance in the euro crisis: More than ESM will not be possible for many years updated on August 31, 2012 German politicians and the German Bundesbank believe that the Euro crisis can be only solved by supply side reforms as formulated in the Euro Plus Pact, reforms that were already successfully introduced during the Thatcher/Reagan era in the …

Read More »

Read More »

The End of ECB Rate Cuts or Draghi against Weidmann to be Continued..

Even in the unlikely case of a fiscal union, the conflict “Draghi against Weidmann”, between the ECB and the Bundesbank will continue for years. The ECB mandate and european inflation figures do not allow for excessive ECB rate cuts or for state financing via the printing press, but Draghi wants to help his struggling …

Read More »

Read More »

The Full English Translation of the Interview with Thomas Jordan

Here a translation of the interview with the president of the Swiss National Bank, Thomas Jordan, in the finance magazine ECO of the Swiss television SF1. Here the original German video. Question: Given that the SNB has reserves of over 200 bln. Euros, are you still able to sleep ? Jordan: We are in a … Continue reading...

Read More »

Read More »

The Swiss television interview with Thomas Jordan, or was it Leonid Brezhnev ?

Today Thomas Jordan gave a quick interview in the Swiss television. Everything was so well prepared and as sterilized. Thomas Jordan learned all answers by heart and was answered the questions about one second after the question was asked. It reminded me of an interview in Soviet television with former Soviet leader Leonid Brezhnev. Each …

Read More »

Read More »

SNB only major central bank missing at Jackson Hole, are important SNB decisions looming ?

The Jackson Hole Symposium is traditionally a meeting of global central bankers, here the 2010 attendance list. This year it takes place between August 30 and September 1. Central bankers assemble The annual economic symposium for central bankers staged by the Federal Reserve Bank of Kansas City begins in Jackson Hole, Colorado (until September 1). …

Read More »

Read More »

FX Technical Outlook, Net Speculative Positions, Global Markets, week August 27

Submitted by Mark Chandler, from marctomarkets.com There are two main drivers behind the price action in the foreign exchange market and they will likely persist in the days ahead. First, there continues to be position adjustment ahead of the what promises to be eventful few weeks. Second, the release of the minutes from the August 1 …

Read More »

Read More »

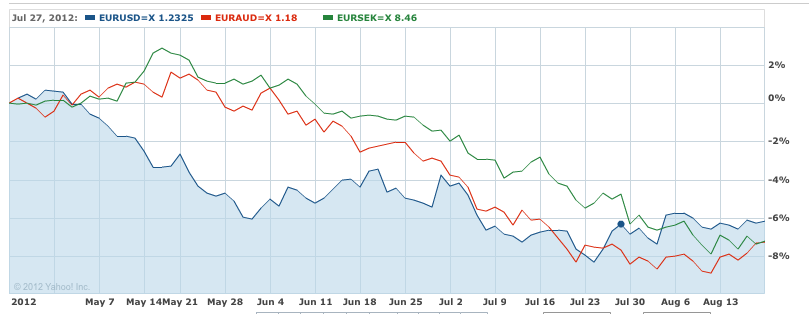

Why the euro has recovered? or are Markit PMI really reliable?

Here a follow-up of our contribution on Seeking Alpha written on August 15th, with the title “Are Markit PMIs really reliable?“. We recommended to go long the euro and the Swiss franc against the US dollar and sterling, because the Markit PMIs were not in line with trade balance data. Previously we suggested in … Continue...

Read More »

Read More »

Brad DeLong on Jackson Hole and Quantitative Easing

Berkeley Professor Brad DeLong has delivered a nice allegorical entry in his type pad on a quick Quantitative Easing. Letting speak old greek mythological figures he hides his personal opinion. A half now completely written platonic dialogue on what the Federal Reserve is Doing — or not Doing — Right Now DeLong explains the …

Read More »

Read More »

Net Speculative Positions , Global Markets and Outlook, week from August 20

Currency Positioning and Outlook, week from August 20 Submitted by Mark Chandler, from marctomarkets.com The market is like expectant parents who don’t know the gender of the fetus. They know something big is around the corner, but they don’t have enough information to make some important decisions. They can contemplate the future, but there …

Read More »

Read More »

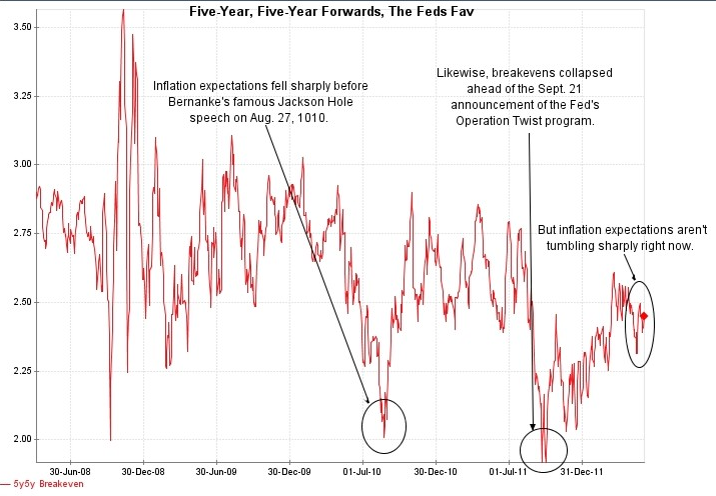

Fed Violates its Own Inflation Targets. Should QE3 Be Postponed?

At this year’s Jackson Hole symposium, Ben Bernanke promised to help the economy via further easing if needed. We doubt his promises because because the Fed might contradict their inflation targets. Current levels of around 2 % for the consumer price inflation excluding food and energy (“core CPI“) and the deflator of the GDP …

Read More »

Read More »

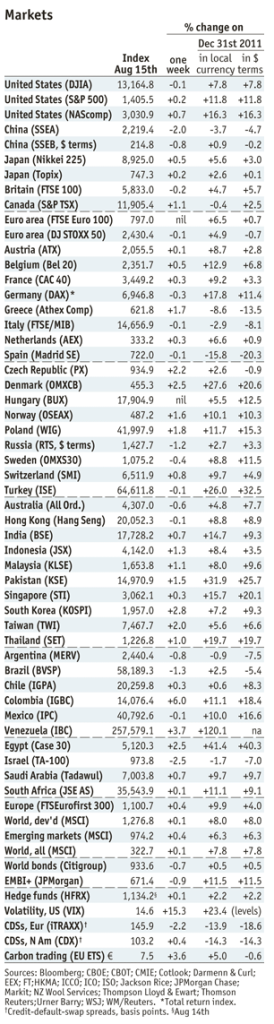

Net Speculative Positions and Outlook, week of August 13

Currency Positioning and Outlook, week of August 13 Submitted by Marc Chandler from MarctoMarkets.com Market positioning in the week ending August 10 suggests that speculators in the futures market generally agree with our assessment that ECB President Draghi’s recent proposal was not a game changer. The recent pattern continued. Essentially what this entails is buying …

Read More »

Read More »

All roads lead to a euro zone break-up

For us all roads lead to a euro zone break-up and multiple sovereign defaults. Our reasoning can be summarized as follows: Equities are worthless when associated debt becomes encumbered (risk capital takes the first loss). Equity is not an asset; it is merely the remainder that is left over once debt is subtracted from …

Read More »

Read More »

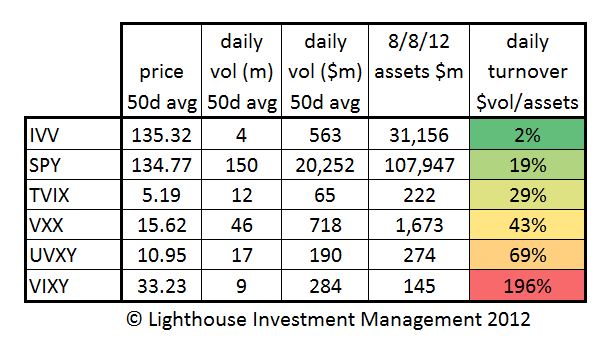

Volatility ETFs’ crazy churn

Two volatility ETFs (VXX and UVXY) are having almost half of the trading volume in the world’s largest ETF (SPY). How come? First, the facts: SPY is heavily traded (19% of assets daily turnover) compared to IVV (also referring to the S&P 500). But then come the volatility ETFs. Tiny VIXY (assets $145m) … Continue reading...

Read More »

Read More »

Otmar Issing’s new book on the euro crisis

We well remember when the über-bailouter of the Financial Times Wolfgang Münchau claimed that except some old economy professors like Otmar Issing nobody in Germany would like to abolish the euro. According to Münchau the euro can be saved only via a fiscal and a banking union. The response to Münchau’s post could be … Continue reading...

Read More »

Read More »

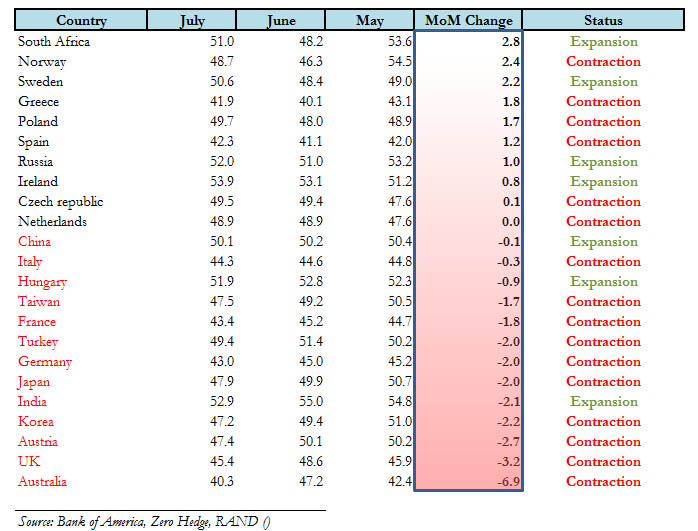

Globale Einkaufsmanager-Indizes per 5.August 2012. Sind die Aktienmärkte überbewertet ?

Dank der seit dem Winter immer noch positiven amerikanischen Konsumentenstimmung, steigen die Aktienmärkte weiter, während die Einkaufsmanager-Indizes der Fertigungswirtschaft sich schon seit 3 Monaten abwärts bewegen. Wie kommt dass die Aktienmärkte heute wesentlich höher als im September 2011 stehen, obwohl die Konjunkturdaten, insbesondere in der Fertigungswirtschaft wesentlich schlechtere Zahlen als damals liefern ? Dies obwohl …...

Read More »

Read More »

Global PMIs Contracting More – Are Stocks Overvalued?

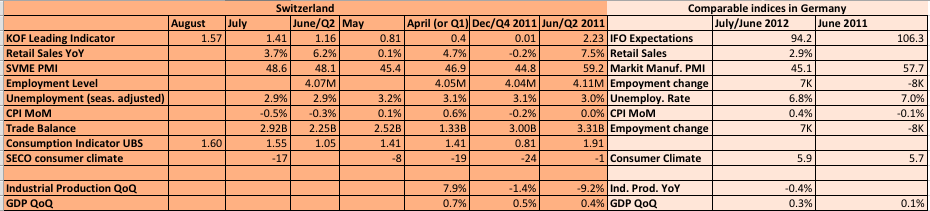

updated August 05,2012 We publish a detailed analysis of global PMIs and compare them with the main risk indicators S&P500, Copper, Brent and AUD/USD some days after most PMIs came out. Abstract: Thanks to positive US consumer confidence, stock markets are highly valued, whereas the Purchasing Manager Indices (PMIs) for the manufacturing industry are contracting …

Read More »

Read More »

Net Speculative Positions and Technical Analysis,week from August 6

Currency Positioning and Technical Analysis, week from August6 Submitted by Marc Chandler from MarctoMarkets.com The overall technical tone of the US dollar is suspect. During the last few months, it has been trending lower against the dollar-bloc currencies, Canadian and Australian dollars and the Mexican peso. The greenback has trended higher against the euro and Swiss …

Read More »

Read More »