National accounts in Switzerland in 2014

Press Release by Swiss Statistics (FSO)

Foreign trade the main source of growth

Neuchâtel, 27.08.2015 (FSO) – In 2014 the Swiss economy registered a growth in gross

domestic product (GDP) of 1.9% at the previous year’s prices (+1.8% in 2013).

Taking a slight decrease in the general price level into account, GDP at current prices grew by 1.2% (2013:

+1.7%).Foreign trade strongly contributed to the rise in GDP in 2014 due to sustained growth

in exports of goods. Exceptionally the gross national income (GNI) is lower than the GDP due

to a negative foreign income balance. These results are taken from initial estimates of the

Federal Statistical Office (FSO).

Details:

(translated, from the original German version)

Real GDP:

The Swiss economy recorded in 2014 a rise in gross domestic product (GDP) from prices of the previous year by 1.9 per cent (2013: + 1.8%).

Nominal GDP:

Given the weakening of the general price level (negative GDP Deflator), the GDP at current prices rose by 1.2 per cent (2013: + 1.7%).

Foreign Trade makes up more than 50% of the 2014 GDP rise

In 2014, foreign trade and rising exports contributed most to the rise in GDP.

Excluding the non-monetary gold, the Swiss surplus on trade of goods and services increased by 10.4 percent.

Total Exports: + 4.8%, Total Imports +1.3%, Contribution to GDP: +0.6%

Thanks to this increase, nominal GDP rose by 1.1 percent. Foreign trade is thus responsible for more than half of GDP growth. One explanation for the positive results of the goods account (excluding non-monetary gold), as exports rose more quickly than imports (+ 4.8% and + 1.3%). Heavyweights such as the pharmaceutical and the watch and jewelry industries recorded strong growth in exports.

Trade Surplus in Services declined, as Swiss continue to travel abroad

The balance of the services account declined, however, as imports rose more than exports (+ 5.1% versus + 2.4%). Switzerland increased in 2014, the tourism expenditure abroad and imports of business services and royalties clearly.

Slowdown in private consumption: Only +1.3%

The SECO says:

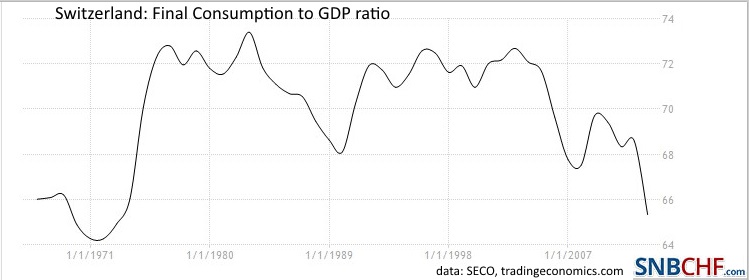

“Final domestic demand, one of the main engines of growth until 2013, fatigued. This slowdown is due to a moderate increase in the consumption expenditure of households, which accounts for around 65 percent of GDP (see graph).

Consumption increased by 1.3 percent only (2013: + 2.2%). The deterioration of consumer sentiment in the second quarter of 2014 was caused by the pessimism of households with regard to the development of the economy. A rising unemployment rate has certainly contributed to this result.”

See more forIncrease in investments: +2.1%

Investments, however, experienced a marked increase (+ 2.1%). This is due to construction, that has seen growth rates of over 3 percent for several years. Capital equipment returned back to growth (+ 1.3%) after difficulties in earlier years.

Manufacturing with 2.4% growth

After two difficult years, the manufacturing sector registered again significant growth (+ 2.4%), which helped to raise the trade surplus. The ongoing construction investment had an impact on the production of the relevant economic sector, whose value added increased by 2.1 percent. Energy and water supply and related remediation activities, however, recorded a sharp decline in value.

Services with 1.9% growth

Apart from a few industries with a negative development, the service sector recorded a value increase. The health sector (+ 4.3%) and – to a lesser extent – the telecommunications grew significantly.

The growth in the financial sector (banking and insurance), slowed, after a very strong increase in 2013.

Gross National Income Turns Negative for the first time since 2008

The gross national income (GNI) was exceptionally lower than GDP. The reason for this was the negative income balance for Swiss investments abroad. The GNI saw the first contraction since 2008, the year of the financial crisis. The decline can be explained by the strong rise of payments made to foreign investors (+ 25.2%) and by salary payments to cross-border commuters (+ 4.7%).

The increase in the investment income from abroad (+ 4.9%) was not sufficient to compensate for these movements. The increase in payments made to foreign investors is driven by both higher income on foreign direct investments and by portfolio investments (stocks, bonds, money market).

The total balance between income received abroad and income paid to foreigners decreased by CHF 16 billion. This led to a 2014 deficit in the income balance of CHF 4 billion.