(article originally written in 2013, arguments still valid today)

In 2012, Joseph Gagnon from the very influential Peterson Institute criticized the Swiss National Bank (SNB) saying that they manipulate currency exchange rates and implicitly harm the recovery of the United States (link to his paper).

In August 2013, SNB chairman Thomas Jordan has finally come to Washington to respond to this critique in one of the most important speeches in his career: “Making Monetary Policy for Switzerland in a Global Economy”, Peterson Institute Washington D.C.

The transcript of the speech is available at the SNB website.

Jordan’s main arguments are that:

The Swiss current account surplus is due to very specific factors. The goods trade account, for instance, makes only a modest contribution. The three most important elements with regard to the current account surplus are investment income from Switzerland’s substantial net international investment position; financial sector earnings from business with customers abroad, which is traditionally a significant source of revenue for Switzerland; and earnings from merchanting, which have risen sharply over the past decade….

SNB monetary policy is focused on ensuring price stability, while taking due account of economic developments. To fulfil this mandate, the SNB must secure appropriate monetary conditions. The current account surplus does not play a role in monetary policy. source SNB

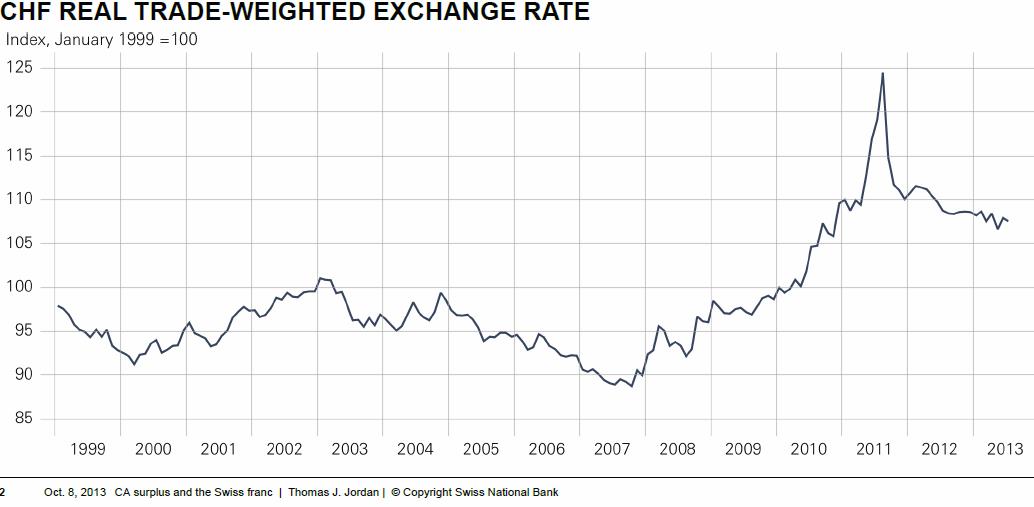

According to the transcript, the real trade-weighted exchange rate shows an overvaluation against 1999 of only 7%, after reaching 24% in August 2011. For insiders: 1999 was 3 years after the bust of the Swiss real estate bubble, a quite difficult time for Switzerland.

Jordan’s arguments and the Q&A are here, we recommend the audio that has a better quality than the video above and is always available.

Joe Gagnon asked an interesting question in the Q&A , listen to the Q&A audio at around 10 minutes.

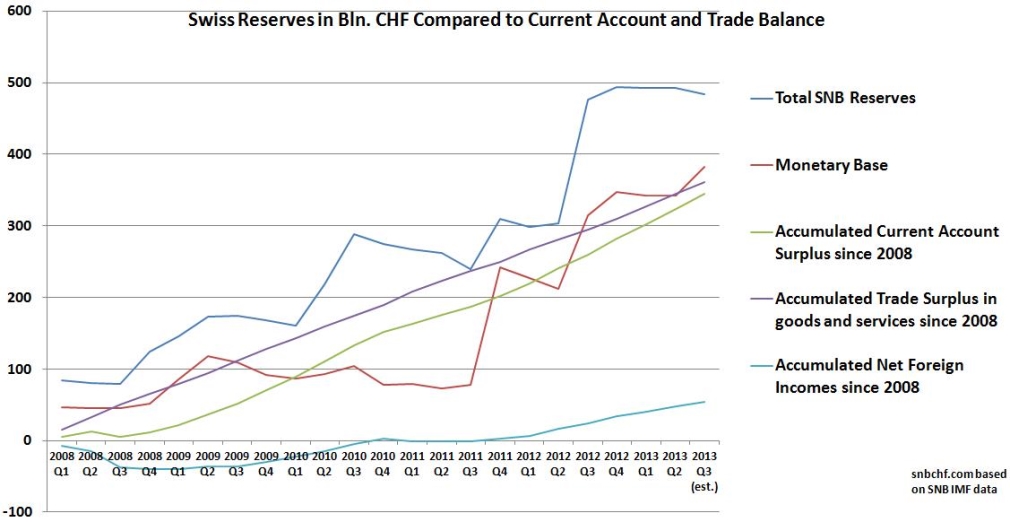

To give the readers some more possibilities to draw their own conclusions, here are the comparisons among SNB reserves, trade surplus in goods and services and the incomes on foreign investments.

SNB's Jordan Responds to the Critique from the Peterson Institute: What They Forgot to Ask... - Click to enlarge

What Adam Posen, Joe Gagnon and the Peterson Institute Forgot to Ask…

- Mr Jordan, you are saying that Switzerland could have entered, and might still enter, a deflationary trap if you gave up the CHF cap. Are there really deflationary risks given that nominal wages appreciated by 0.8% per year1, that rents are risings by 0.9% 2, wealth increased by 4.5%3 and consumer spending by 2.5% annualized4?

- According to today’s Swiss CPI figures, prices of private services increased by 0.7% y/y, prices of public services by 1.1% and the ones of goods produced in Switzerland by 0.7% y/y. Only imported goods like clothes, household equipment and energy still exercise deflationary pressure, but could be washed out after some time.

Is the minimum exchange rate still justified under the “deflationary trap criterion”? - The difference between inflation in the euro zone and in Switzerland has narrowed to less than 1%, when measured in HICP terms. The low euro zone inflation rate is driven by very weak demand, especially from Southern Europe, somewhat intensified by the wish of European leaders to lower labor costs there. With falling wages and demand Greece seems far closer to a deflationary trap than Switzerland.

Italy has an inflation rate of 1%, just slightly higher than the price increases of Swiss services. Couldn’t a stronger franc help boost Swiss purchasing power and Swiss consumer demand for products from (or travel to) Southern Europe? - You mentioned the strong Swiss net international investment position (NIIP) that is mostly made up of Swiss international companies. Are you aware that SNB reserves are the equivalent of 56% of the NIIP and that the SNB effectively owns far more than these companies?

This is a similar situation as for the People’s Bank of China, implying (for both countries) that further currency appreciation means losses for the central bank, while companies take profit on the weaker currency? - You said that Swiss exports are mostly unrelated to the exchange rate. But sudden exchange rate fluctuations would harm the export industry. The EUR/CHF has barely changed since the end of December 2010, when it was around 1.24.

Why don’t you move the EUR/CHF minimum exchange rate to 1.15, this would be a relatively small change that does not harm exporters? - Switzerland has two types of exporters: for pharmaceuticals, chemicals, watches and the luxury industry the exchange rate does not matter a lot, while the machinery industry has struggled. Is the minimum exchange rate not an artificial subvention for a certain industry? Should Switzerland not concentrate on the industries where it has a comparative (Ricardian) advantage?

- source Swiss statistics [↩]

- source Swiss statistics [↩]

- source SNB [↩]

- source SECO [↩]