In 2013 the International Monetary Fund (IMF) judged “that the SNB’s net revenue is subject to large fluctuations, and sizeable losses could occur if an appreciation of the Swiss franc was to take place before foreign exchange interventions were unwound.” In its 2014 assessment, however, the balance sheet was a minor subject.

On March 18, 2013, the IMF published the “Switzerland—2013 Article for Consultation Preliminary Conclusions“. Given the current situation in Cyprus, some mainstream media focused on the word “negative interest rates”. But the report contained at lot more and is worth reading.

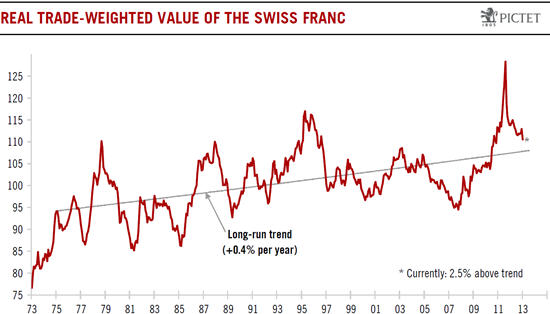

First the most important thing: the Swiss franc is according to the IMF a “still moderately overvalued currency“.

Our comment:

We warned that the “1.20 floor” was not a real minimum rate. For us the 1.20 is a fair value from a historical perspective, when calculated via purchasing power parity and producer price indices. Claims that the franc would be overvalued – e.g. OECD price comparison or SNB valuation models or what the IMF says now – forget that the franc was nearly always overvalued except during a short period between 2005 and 2009. Weaker Swiss inflation is often just a sign of stronger competitiveness and favorable tax conditions.

The detailed IMF points

- IMF: “The economy has responded better than expected to exchange rate appreciation and weak external demand.”

Our comment: The SNB knew well that during prior strong CHF appreciation periods (1930s, 1970s and after 1987) internal demand and construction reacted very positively to the stronger franc. Therefore, we do not agree with the words “better than expected”. This expectation was for us ill-founded, see also point 3a.

For comparison see also the GDP components which are similar to Australia except the 2012 downturn in construction and investment caused by the euro crisis: - IMF: “The economy is expected to improve moderately, but risks are still present.”

Our comment:

We judge that the Swiss economy will continue to outpace the euro zone in terms of GDP growth by at least one percent in 2013 and 2014. As opposed to UBS, we see a 2% rise in household consumption for 2013. Similarly to Australia, that could have problems with China’s slowing, any country can have an issue with slow global growth. - IMF: “In spite of weak external demand and the still moderately overvalued currency, export-oriented industries have shown resilience.

“Our comments:The current account surplus that fell from 15% of GDP to 8% in 2011, has recovered again to nearly 12%. Four reasons:- For Swiss exports, like pharmaceuticals and luxury goods, the exchange rate is not very important and is more a question of the state of the global economy. The Swiss surplus for the trade in goods is increasing.

- Strong new drivers are the transit trade on commodities and the high portion of FDI income. For the first, the employees of Glencore, et. al. spend the surplus in francs, the later is often reinvested by the Swiss multinationals in foreign currency. (See details in a recent speech by Thomas Jordan.)

- The stronger dollar has made Swiss products on the global market more competitive.

- As visible in the purchasing power parity: with each day the floor exists, the Swiss exporters become more competitive.

- IMF: “The exchange rate floor should remain in place for now.”

Inflation is still well below comfortable levels, growth is modest, and the risk of a resumption in safe haven capital flows remains substantial. Once an economic recovery gets firmly under way, the SNB should exit the floor and return to a free float if inflation threatens to move above comfortable levels. Until then, sustained capital outflows should be used to cautiously unwind past currency interventions, while in case of renewed appreciation pressures the SNB should defend the floor, including by introducing negative interest rates on excess bank reserves as a temporary measure to discourage capital inflows.

Our comments:

We judge that current slow global growth has postponed the exit scenario for at least two years. Sustained capital outflows, however, have not shown up yet, with the consequence that the SNB did not unwind interventions, i.e. did not sell currency reserves. Even if some like “Inside Paradeplatz” suggested it: if the SNB had sold reserves, this would have created a negative dynamic and led to the closing of carry trades based on francs. A warning with negative rates contradicts the rising Swiss inflation and recent statements by SNB officials.

- IMF: “While the exchange rate floor policy played a key role in ensuring economic stability, it has expanded the SNB balance sheet to an unprecedented size.”

This exposes the bank’s net revenue to large fluctuations, and sizable losses could occur if an appreciation of the Swiss franc was to take place before foreign exchange interventions were unwound. The SNB capital is large and growing, reflecting in part reduced profit distribution to the Confederation and Cantons. However, there is a risk that losses may exceed buffers. In such circumstances, it will be important that the independence of the central bank not be put into question. Also, if balance sheet risks continue to grow, more aggressive profit retention and capital building would be advisable.

Our comments:

SNB capital buffers could increase mostly thanks to a temporarily weaker franc, but not really thanks to strong income. We agree with the IMF about the risk that a CHF appreciation could exceed SNB capital buffers. We recently calculated a capital building of 1.26% yield on the balance sheet in 2012, which might not be sufficient to survive a strong CHF appreciation.

The CHF exchange rate is strongly driven by global events and less by the Swiss economy. A new wave of big inflows in the franc might happen in around 3 to 5 years if the Fed and the ECB continue a policy of financial repression. One scenario could be that US inflation rises to 2.5% CPI or more, but the Fed gauge of 2.5% core PCE deflator will not be reached yet. Consequently US rates will remain at zero resulting in strongly negative real rates.

Already with Swiss inflation of around 1%, the franc will free float again, which could happen in 2014 or 2015. Real US rates of minus 2% will result in inflows into the CHF. Due to positive market sentiment, the franc could depreciate in the meantime. This will lead to higher inflation and an earlier introduction of the free float.A second scenario is an end to QE3 due to inflation pressures despite continuing high structural US unemployment and low growth (see Bill Gross). In this case, markets will be under strong pressure and this will trigger inflows in the franc and the yen. We judge that over the long-term the partially Fed-financed increase of US real estate prices is not sustainable, while QE3 certainly helped to prevent a collapse of the global economy and to end the biggest fears in the euro crisis.

We judge that ECB rates will remain under one percent for at least three years. Increases in German wages and inflation will be countered by very low pay rises in France and the European periphery, and slower global growth. This could imply a far smaller inflation gap between the euro zone and Switzerland than the 2.1% of today or the 3.7% in 2011/2012. By 2014 the difference could reach 0.5%.

- IMF: “In current conditions the fiscal stance could be more supportive of the expansionary monetary stance to the extent allowed under the fiscal rule.”

Our comments:

Effectively the rise of Swiss government spending is lower than its peers (see table above). To our view, higher public spending and consequently higher Swiss GDP growth would lead to more pressure on the floor and increase the risk of losses, and should be avoided. Swiss growth will restart when the global economy gets more speed. - IMF: “The recent measures to stem risks in the mortgage market are welcome.”

With mortgage interest rates falling to new lows, mortgage debt has reached a historic peak, and housing prices are growing well above nominal GDP growth. While so far average prices are not accelerating as in typical bubble episodes, there is evidence of bubble-like dynamics in “hot spots.” In 2012, the authorities appropriately moved to cool off the market with several measures, including most recently by increasing capital requirements on mortgage portfolios, stricter repayment requirements, and, importantly, the prohibition to use Pillar II pension fund savings to finance minimum down payments. The recent activation by the Federal Council of the newly-created counter-cyclical capital buffer (CCB) is an important additional step.

Our comments:

We agree that the prohibition of using Pillar II pension fund savings to finance down payments is a very important step. - IMF: “However, more interventions may become necessary as the low interest rate environment is likely to persist.”

…. the authorities should also stand ready to implement new measures or tighten existing ones, including raising the CCB to the maximum of 2.5 percent or introducing minimum affordability ratios.

Our comments:

We suggest that the introduction of minimum affordability ratios would be the right measure, while the CCB has only a limited effect. - IMF “This would be an appropriate time to phase out existing tax incentives that artificially inflate the mortgage market.”

Because mortgage interest payments are tax-deductible, many households carry much more mortgage debt than warranted. In fact, the ratio of residential mortgages to GDP in Switzerland is one of the highest in the world. Phasing out the preferential tax treatment of mortgage interest, while at the same time phasing out taxation of imputed rents, would remove a distortion from the economy and reduce risks in the mortgage market

Our comments:

We share the IMF arguments as for the tax-deductible interest payments. We would like to warn that if home owners pay down their mortgages in Swiss francs this could trigger sales of assets in foreign currency and result in further pressure on the SNB.

With the floor introduction at the, for us, too high rate of 1.20, the SNB has removed all possibilities to counter the asset price bubble with a stronger franc or, the best way, a hike of interest rates, unless the bank accepts large losses.We have omitted points 10-12 concerning the banking system. Here again is the IMF source: “Switzerland—2013 Article for Consultation Preliminary Conclusions“.

Reference: IMF Assessment of Switzerland for 2014.

1 ping

Oh, what have you done? - Deflation Market

2015-04-01 at 15:50 (UTC 2) Link to this comment

[…] IMF sees considerable risks on SNB balance sheet […]