For George Dorgan, the leading Swiss monetary economist, Ernst Baltensperger, is wrong when he thinks that SNB losses on FX can be recovered by income on seigniorage. Hence the SNB balance sheet and the asset price bubble are more important than the danger of upcoming Swiss price inflation.

(Originally written in March 2013, updated with newest data)

here also the internet archive versions.

What Ernst Baltensperger Got Wrong: Why SNB FX Losses Might Not Be Recovered By Income on Reserves

In an article in “Die Volkswirtschaft 01-02-2013” and in a concise form on “Ökonomenstimme“, Professor Dr. Ernst Baltensperger, the leading Swiss monetary economist over some decades, explains his fear that the American and European central banks are ready to accept inflation in order to fight against rising U.S. debt and the imbalances in Europe (see also the equivalent concept “The Reverse Volcker Moment”).

For him the SNB runs two risks:

- The bank could have losses on its currency portfolio.

- The huge SNB liquidity could cause inflation in Switzerland.

According to Baltensperger, the minimum exchange rate for the euro would not imply that the Swiss have lost monetary independence; they could give up the floor whenever they wanted. History shows that living with rapidly moving exchange rates would be better than joining a currency union with an unstable monetary policy and a unreliable central bank. Rebuilding confidence in the ECB, however, would take decades; therefore, it can be excluded that Switzerland joins the euro.

Baltensperger emphasizes that the first risk, big losses on its currency portfolio, is far less important than the second one, the potentially upcoming inflation. In the longer term, losses on the portfolio could be recovered by the income on the holdings. Baltensperger thinks that inflation must finally show up given that central banks have provided so much liquidity.

Response by George Dorgan:

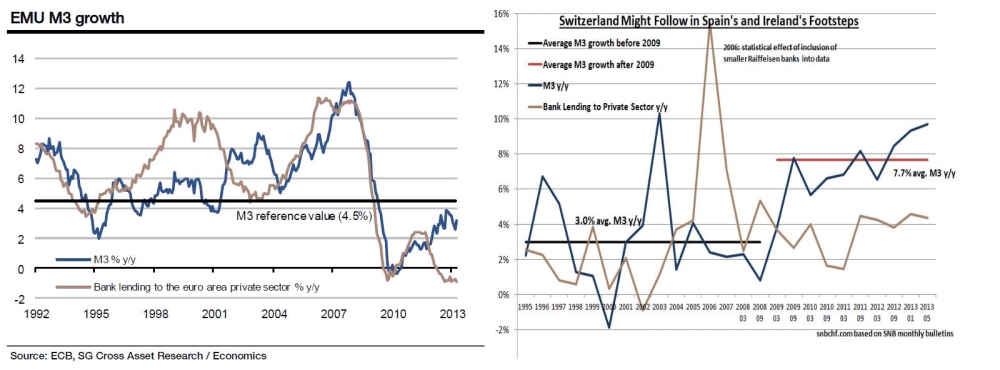

As Richard Koo impressively shows in the Japanese case, liquidity, in form of a higher monetary base, often remains unused on the balance sheet of banks while they are reluctant to lend and consumers do not spend. This problem concerns most developed economies, especially the United States and the euro zone. Switzerland, however, proves to be a notable exception. ;3 has increased by 7.3% per year since 2009, credit expands by over 4%.

The Swiss asset price boom

Instead of causing price inflation with her liquidity, the SNB has created a big asset boom which is unlikely to diminish as Swiss companies profit on global expansion and the SNB insures the appreciation of Swiss assets with the EUR/CHF floor and liquidity. Creating the asset price boom, the central bank has already violated an unfortunately subordinated criterion of its mandate.

Despite reduced risk aversion since September 2012, the central bank’s liabilities in the form of sight deposits and bank notes have risen to new record highs, while currency reserves remained stable. This implies that the SNB is still buying reserves while suffering slight losses on the existing portfolio.

In spite of the only modest increase of the EUR/CHF exchange rate from 1.20 to 1.22, the usually rather conservative SMI has outperformed the German DAX with a 10% return against 4% since in the year 2013.

The SMI price movement reflects that Swiss exporters do not have a problem any more with the so-called “strong” franc and that Swiss asset managers currently do not see a better place than Switzerland. See more why Swiss portfolio investments now concentrate on Switzerland.

The Swiss franc appreciates with profits of the Swiss multi-nationals and with global

Some foreign risk-off investors left Switzerland, but more funds came to Switzerland driven by a risk-on wave: many former risk-off investors in francs want to participate in global growth with Swiss multinationals and like to enjoy Swiss security at the same time.

Swiss real estate prices were increasing by 5% per year since 2009, a phenomenon the central bank has already tried to address with the countercyclical capital buffer.

Most recently some Swiss economists brought up again the idea of negative rates claiming that they would have stopped inflows into Switzerland.

They fail to recognize that the Swiss franc has become at least partially a risk-on investment that appreciates with global growth (especially with income on direct investments and transit trade on commodities, see Thomas Jordan’s explanation). Negative rates might even have accelerated the inflows into Swiss investments and the rise of SNB sight deposits.

Update 2014: The weakness of Emerging Markets continued and with it also the Swiss franc.

Coming back to Baltensperger. We think that some of his arguments are not justified. The reasons are:

- We judge that global growth will be limited in the coming years. Therefore we agree with the SNB’s opinion that Swiss inflation risks will be contained. The difference between Swiss monetary expansion and Southern European monetary contraction and the resulting Swiss asset price boom will move Swiss inflation closer and closer to the euro zone CPI. In particular because the quasi gold standard called “euro” requires that wages in European crisis countries must fall. The following graph shows that, while euro zone inflation is falling, the Swiss CPI is rising.

- Baltensperger does not speak about the negative effects of a longer period of weak interest rates. It might lead to massive housing boom and misallocation of resources. But it also limits SNB’s yield on investment.

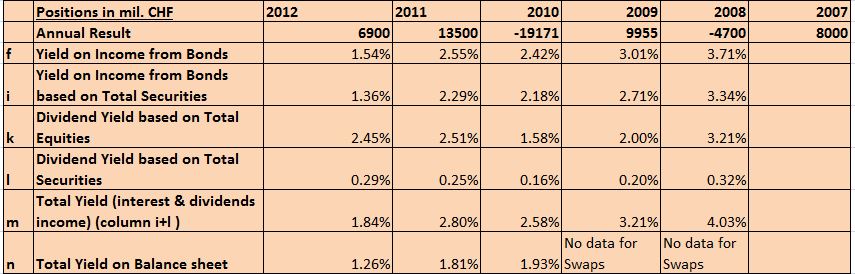

- Seigniorage versus Currency: Baltensperger might be wrong, when he thinks that the income on foreign exchange positions is able to counter the negative effect of a stronger Swiss franc for the SNB balance sheet. In a this post we examined the income on bonds and equities:

The question is if 1.26% yield per year, like in 2012, will be enough to counter a 10% or 15% appreciation of the franc in a couple of years. To counter these effects the central bank had to move into corporate bonds and equities.

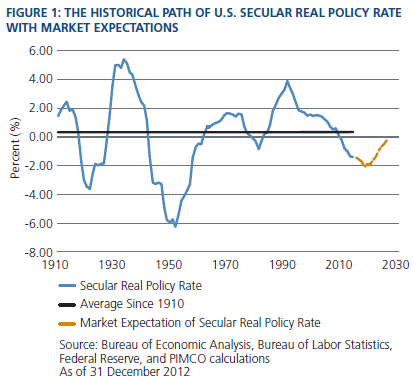

The “seigniorage effect” that Baltensperger was used to in the 1970s and that together with Volcker rescued the SNB from suffering huge losses at that time, is impossible in times of financial repression. Not only investors and insurances have issues with financial repression but also central banks. The following chart from the Fed shows that the battle against financial repression my take more than one decade.

4) Even during risk-on periods, such as Winter 2012/2013, the bank must continue to buy foreign currency to maintain the floor. Many economists like Nouriel Roubini reckon that global imbalances are not eliminated at all and that a new crisis must come again. During the euro crisis between 2010 and 2012, the SNB balance sheet increased from 40% to 83% of Swiss GDP. Another US and/or euro zone crisis might lift this percentage easily to 120 or 150% of GDP.

5) In 2011, the Swiss current account surplus fell from 15% of GDP to 8% and the third quarter GDP contracted, while the EUR/CHF rate fell almost to parity. This decoupling between Swiss fundamental data and exchange rates triggered the necessary but exaggerated intervention of the central bank – a floor of 1.10 would have been sufficient and might have been possibly abandoned by 2013. Most recent data showed that the Swiss current account surplus had risen to 12% again.

Due to the Swiss asset price boom a big part of the Swiss current account surplus will remain in Switzerland; it will not exit via the Swiss capital account as between 2003 and 2007. Even more, the boom might attract foreign capital and improve the Swiss balance of payments and SNB currency reserves further.

The combination of these four factors is what finally leads the SNB sheep to the slaughter. Still it is not a scenario which is not realistic for the coming years given the strong SNB adherence to the floor and the currently weak global growth.

We agree with Baltensperger that stronger inflation will eventually show up in Europe and the United States, and both the ECB and the Fed will not prevent it. This will imply the re-appearance of the concept of wage and “imported inflation” of the 1970s. The exact moment, however, when the Swiss asset price boom and imported inflation will drive the Swiss CPI over the price stability target of 2%, is still unknown and may happen in 10 or maybe even 20 years.

But when this happens, when inflation comes back, then global investors might similarly, as in the 1970s, run into the Swiss inflation safe-haven, because inflation in the euro zone and the U.S. will be far higher. While the SNB manages to achieve yields of 1% per year, markets will drive the EUR/CHF rate to parity and reserves will balloon possibly to 150% of GDP. If we suppose a similar movement for other currencies, then the SNB might suffer a loss of 18% on its positions – euro 1.20 to 1.00 – totaling into an increase of Swiss debt from 49% to 74% of GDP, while income on SNB positions could reduce Swiss debt only a bit.

At that moment the SNB will proudly declare that they were able to avoid price inflation thanks to a stronger franc and cheaper imports, but they will hand in a salted invoice. Due to the ageing population in developed countries, changed rational expectations and the (wage) competition by emerging markets, we disagree with Baltensperger’s point that inflation figures could match the ones of the 1970s.

A repetition of the 1970s inflation experience, however, will be possible when Chinese salaries will be nearly the same as in developed countries and the Asian savings and investment glut finally ends, a scenario from which we are 20 to 35 years away.

Summary

Baltensperger’s arguments are based on the idea that history must repeat itself. We, however, reckon that a repetition of history in the form of 1970s-style inflation will not take place for the next two decades. Therefore a violation of price stability will not be the principal danger for the SNB. The risks of an asset bubble and huge losses on the SNB currency portfolio are higher.

This implies that the principles of Swiss monetary policy, the “concept 2000” and in particular the strong focus on price stability and on inflation targeting are just a relict of a long-time passed reality and – as the asset bubbles and busts in the USA and in the European periphery have impressively shown – not suitable any more for developed nations in the 21st century – albeit they make sense for emerging markets.

The misleading argument of “deflationary risks” for Switzerland, a country with a strong immigration, rising salaries, high consumer spending, rising asset prices and firm (positive) inflation expectations makes clear that the Swiss are about to repeat exactly the same mistakes the Fed did in 2003 (see e.g. Obstfeld/Rogoff p. 16).

While the Fed was not forced by law to avoid an asset bubble, the SNB is about to violate this second ( unfortunately subordinated) principle of her legal mandate: “If interest rates remain too low for a lengthy period….” then asset price bubbles and busts are unavoidable.

Read also:

The Volcker Moment and the First Cap on CHF

See more for