Do You Know Where German Excess Reserves and TARGET2 Claims Are Lying?

Under German Mattresses!

In June 2014, the ECB decided to introduce negative rates on the excess reserves of banks. We explain that German banks had already removed most excess liquidity before the ECB meeting of June 2014, and they will continue to do so. Hence hardly any German bank will pay negative rates after the recent ECB decisions at that meeting.

Most parts of the German TARGET2 surplus and banks’ excess reserves are already lying as cash under German mattresses; and there will be lying more.

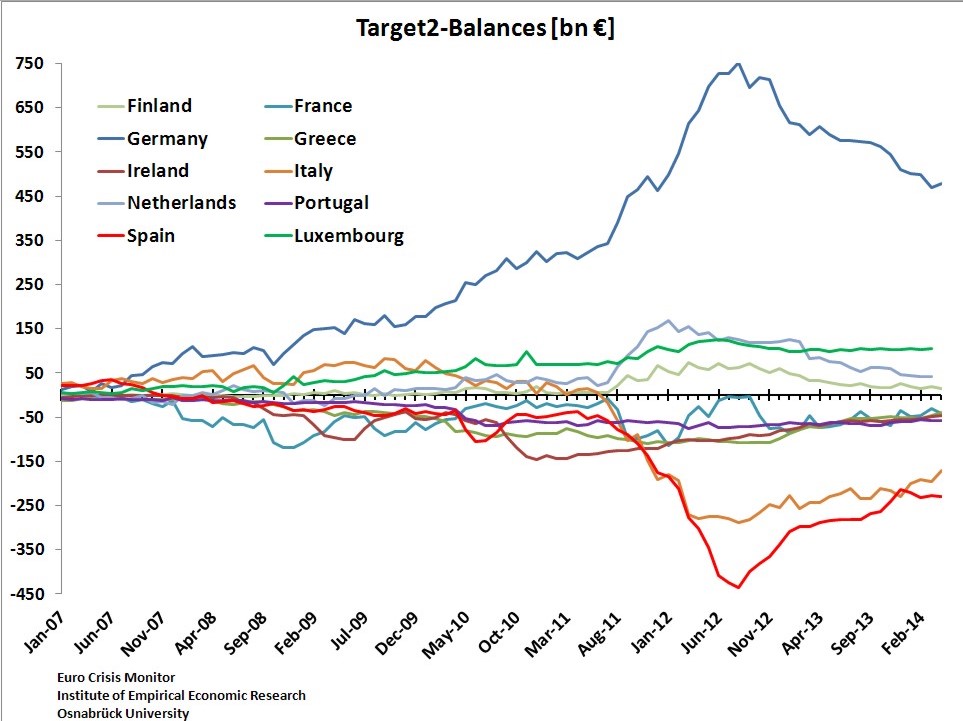

TARGET2 claims are an asset in the balance sheet of the German Bundesbank (BuBa). They have not declined at lot since the highs of 2012. What is even more interesting is that the BuBa possesses cash liabilities for nearly the same amount, either in cash issued by the Bundesbank or issued by other NCBs, namely BuBa’s liabilities inside the euro system.

TARGET2 claims are an asset in the balance sheet of the German Bundesbank (BuBa). They have not declined at lot since the highs of 2012. What is even more interesting is that the BuBa possesses cash liabilities for nearly the same amount, either in cash issued by the Bundesbank or issued by other NCBs, namely BuBa’s liabilities inside the euro system.

Based on these BuBa “TARGET liabilities” it implies that the 510 bln.€ are only Germany’s Gross TARGET2 Claims, while German private sectors already extracted 224 bil. € in cash out of the euro system as advance for the German claims. (See also Karl Whelan’s 2012 paper1 )

The German Net TARGET2 Claims are hence only 286 bln. €.

Still, given the current low yields for the European periphery, it implies that these 286 bln. € are now a 100% representation of German current account surpluses with the periphery and France, a big part of the German Net International Investment Position in the Eurozone (“€NIIP”). Like the NIIP in general, it has an assets part, namely Buba’s claims (510 bil. €) and a liabilities part, namely the Buba’s euro system debt (224 bln.€).

Hardly any German banks will pay negative rates, Most Funds Already Lie in Cash under German Matresses

The 510 bln. € Bundesbank claims in the Target2 system – Bundesbank assets – correspond to the following BuBa liabilities:

- 237 bln. are cash in circulation emitted by the Bundesbank

- and 224 bln. € German euro system liabilities because Germans hoarded bank notes and coins emitted by other European national central banks.

The small difference between the 510 – (237+224) will soon end up under German mattresses, too.

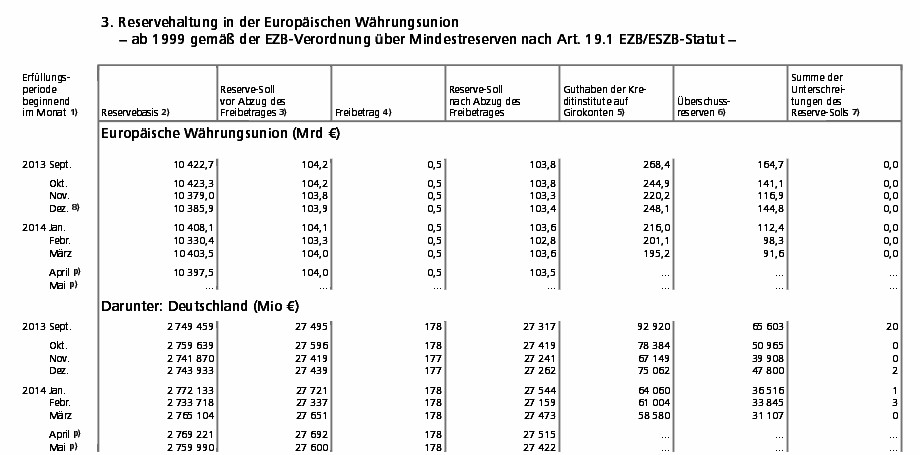

monthly Bundesbank May 2014 report (page 42* in the annex)

According to the Handelsblatt , the German Commerzbank will avoid negative rates completely. In March 2014, German banks held 27.4 bln. € minimum reserves and 31 bln. € excess reserves “at the ECB.“

This is slightly misleading: in general, commercial banks maintain their ready-to-use liquidity at the NCB (national central bank), here at the Bundesbank.

Then the Bundesbank provides liquidity to the euro system (Target2) or directly to the ECB (for example ELA).

The total liquidity of German banks in the form of excess sight deposits at the Bundesbank, point (i) in the ECB statement above, had already fallen long before; and from 47.8 bln. at the end of 2013 to 31 bln. in March 2014. The Handelsblatt did not speak of the deposit facility. However this kind of liquidity had already fallen from 41 bln. in 2012 to 10 bln € at the end of 2013.

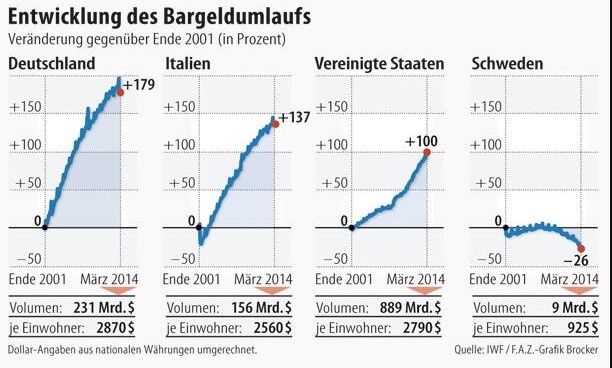

Use of cash increases in Germany and Italy, but not in Sweden, source FAZ

We reckon that most other German banks will circumvent negative rates, too: the easy way is the ever rising customer demand for cash. Cash in circulation in Germany has increased by 179% since 2001 (graph).

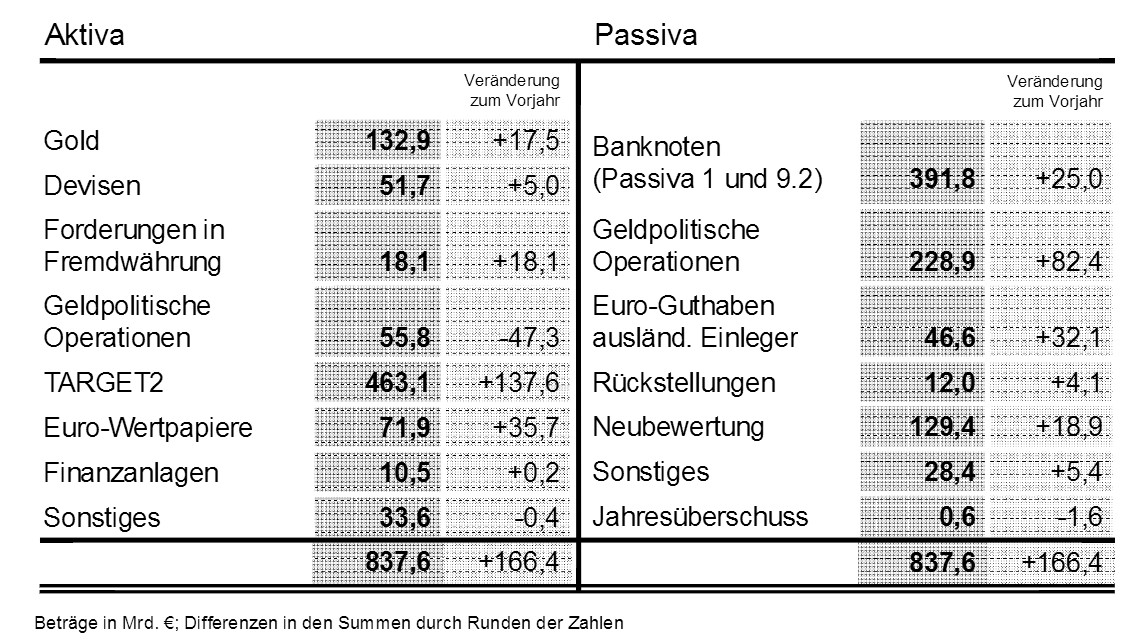

The following is an overview of the Bundesbank’s most important balance sheet items. In 2013, cash in circulation emitted by the Buba edged up by 5%, cash emitted by other NCB by 10%. But since the latter cash (number 9.2.) is owned by the German private sector, the Bundesbank is liable for it.

Bundesbank Balance Sheet 2013 versus 2012 (most important items)

Source Bundesbank Balance Sheet 2013

Assets (End 2013) in bln. € (End 2012) in bln. € Liabilities (End 2013) in bln. € (End 2012) in bln. €

1. Gold 94.9 137.5 1. Cash in circulation 237.3 227.2

2. Claims not in € 2. Liabilities in € against banks/MFI

2.1 Claims on IMF 20,8 22.3 2.1. Sight Deposits of banks/MFI 83.9 129.6

2.2 Claims on non-euro 28.1 28.8 2.2. Deposit Facility 10.7 40.5

5. Claims in € for monetary policy 4. € Liabilities vs. others in euro area 10.5 39.9

5.1. Main refinance 38.2 2.9 5. € Liabilities vs. others outside euro area 52.0 83.3

5.2. Longterm refinance 13.7 69.7 8. IMF rights 13.5 14.1

7. € denominated securities 9. Liabilities inside the euro system

7.1. Securities for monetary policy 55.8 67.5 9.2. Liabilities due to bank notes distribution 224.2 200.3

8. Claims against German State 4.4 4.4 12. Provisions 19.2 18.9

9 Claims inside the euro system (TARGET2) 13. Adjustment due to revaluations 88.1 132.6

9.1. Claims against ECB 2.0 2.0 14. Owners' equity 5 5

9.2. Claims caused by transfer of currency reserves to ECB 10.9 10.9 15. Profit 4.6 0.6

9.4. Other claims inside the eurosystem 510.5 654.9

11. Others

11.3. Financial Assets 11.8 12.1

Total Assets 801 1025 Total Liabilities 801 1025

For completeness here is the Bundesbank’s balance sheet of 2011 where cash emitted from Buba or other NCBs was up 25% against 2010 and stood at 392 bln€.

source Deutsche Bundesbank

When Fed’s Fischer now says that Draghi is the real European president, then we ask why?

Maybe because he managed to remove 400 billion € out of the European banking system and to convert it into cash?

- At the same time, the Bundesbank’s Intra-Eurosystem liabilities relating to excess banknote issuance have also been steadily increasing in recent years. Standing at €192 billion at the end of September 2012, these liabilities represent a significant offset to Bundesbank’s TARGET-related liabilities. source [↩]