It is critical for an investor to be very vigilant during the earnings season, which already began on January 11 with Alcoa (AA) reporting its results. Not only do companies report their financials, but they also make other significant announcements, such as either raising or lowering their earnings guidance for the coming months.

Given the importance of this information, it is no surprise that a company’s stock can often soar or plunge on these disclosures. Therefore, investors need to be on their guard ready to sell, hold or buy. In making their decisions, they ought to take measures to protect their capital gains or if the stock reports turn out to be very favorable in terms of forward guidance set buy points; that is when an upward trend would be confirmed.

To arm yourself for these announcements it pays ‘dividends’ to know the earnings release dates for the stocks that you either own or have in your watch list. You should also be familiar with analysts’ consensus earnings forecasts and sales targets not just for the current quarter but for the next and the full year.

You must always keep in mind that a stock might not react as you would expect after an earnings report. Frequently this has to do with the market’s overall mood. For example, in a roaring bull market, investors may forgive a company for falling short of analysts’ sales forecasts, but a stock could be badly mauled in a bearish environment, such as we have right now, even if all figures are satisfactory.

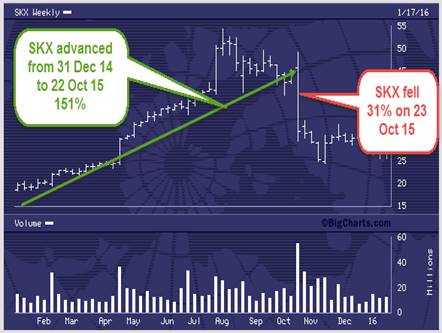

To prove just how important this advice is let us take a look at Sketchers USA Inc. (SKX), which was until October 22, 2015 a top-rated stock. As the chart below shows, the stock price grew spectacularly from December 31, 2014 to October 22, 2015 from $18.41 to $46.19, a gain of 151%! But from the next day, when management made its earnings report, the stock’s fortunes took a violent turn for the worse.

Despite delivering an adjusted earnings of $0.58 per share, which beat expectations by $0.04, Sketchers plunged on October 23 $14.55 from $46.19 to $31.64, or -31.5%, in after-market trading. The reason for the severe reaction was that its revenue had fallen short of consensus expectations, especially because the company had delivered seven straight quarters of excellent revenue growth. Management had however hinted that a soft domestic market retail environment and foreign currency headwinds had impacted Sketchers’ sales performance. And taking that hint ominously, disappointed investors read into it that the hitherto earnings growth was now threatened. It made absolutely no difference to sellers that the company had achieved record revenues, or that it had attained the highest quarterly sales in its 23-year history.

Despite delivering an adjusted earnings of $0.58 per share, which beat expectations by $0.04, Sketchers plunged on October 23 $14.55 from $46.19 to $31.64, or -31.5%, in after-market trading. The reason for the severe reaction was that its revenue had fallen short of consensus expectations, especially because the company had delivered seven straight quarters of excellent revenue growth. Management had however hinted that a soft domestic market retail environment and foreign currency headwinds had impacted Sketchers’ sales performance. And taking that hint ominously, disappointed investors read into it that the hitherto earnings growth was now threatened. It made absolutely no difference to sellers that the company had achieved record revenues, or that it had attained the highest quarterly sales in its 23-year history.

Consequently Sketchers got knifed by the mob! In fact from that day, the stock continued to bleed, falling a further 12% as of January 22!

So just as the soothsayer warned Shakespeare’s Julius Caesar I say unto you “Beware the Ides of the Earnings Season!” or ignore it at your own peril! And the simple advice is: At the very least, place stop/losses on a stock before it is too late!