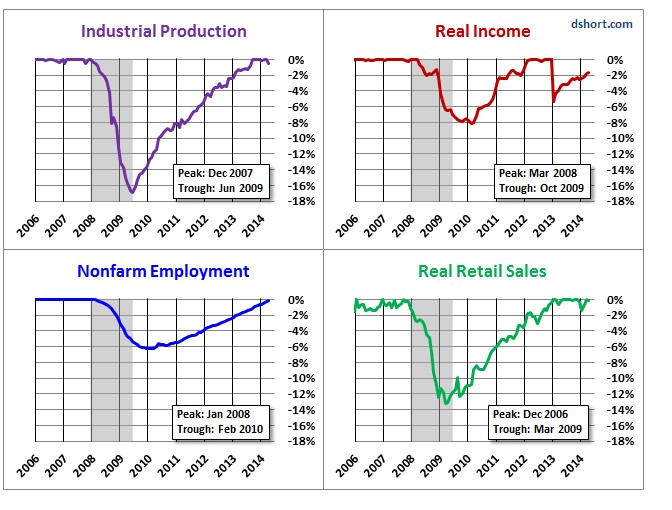

The coincident economic indicators for the American economy can be seen in full details at Doug Short/Advisor Perspectives

We will give concise view, some insights and give a three-years history.

2014 detailed data

2013 detailed data

2012 detailed data

Real income has risen far more slowly than industrial production. Companies are increasing profits, the US is becoming more productive. Productivity comes from both higher production and slowly increasing real wages, hence the US is becoming more “Chinese”. A point which is not covered in Doug’s charts is that real income per hour is not rising.

Employment cannot cope up with population growth, creates a split society

Employment remains subdued. It cannot cope up with population growth even adjusted for ageing effects.

This leads to a split American society:

- entrepreneurs, stock owners, well qualified people

- the ones with negative real increases in income,

- the ones without work (the “not in labor force has increased by 8.5 million since 2008) and/or the ones who live on foodstamps (from 31.1 in 2008 to 47.6 million)

Read more: Labor Participation Rates: Falling in the Ageing U.S., Rising in Ageing Germany

Real sales are rising more quickly than real income: Deficit spending

Real sales is rising more quickly than real income: Last but not least thanks to the Fed’s actions, Americans are deficit spending again.

See more for