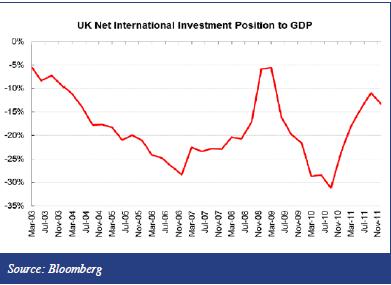

The NIIP is heavily driven by valuation effects: British foreign portfolio investment are apparently rather risk-on investments, while possessions of foreigners in the UK are rather risk-off. Consequently the NIIP swings with stock markets.

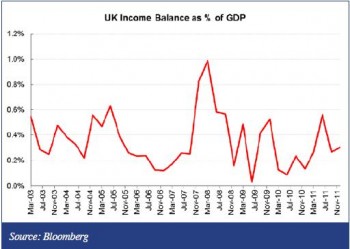

Via FT Alphaville: “While the UK NIIP is down from the lows in 2006/07 and 2010, 10% is a high number as it creates a structural drag on the current account in the form of a negative income balance. However, this is only in theory and the UK is a good example of having a strong (positive) income balance even in the face a negative NIIP.

“The size is less important that the fact that it is positive even in the face of a negative NIIP. This suggests that the return foreigners earn on capital in the UK is substantially less than what UK investors (corporate and private) earn abroad. This could be a result of UK investors being more shrewd and adept than their foreign counterparts, but this is an unlikely explanation.”

Read on the next page about the Swiss net international investment position and the one of Italy

See more for