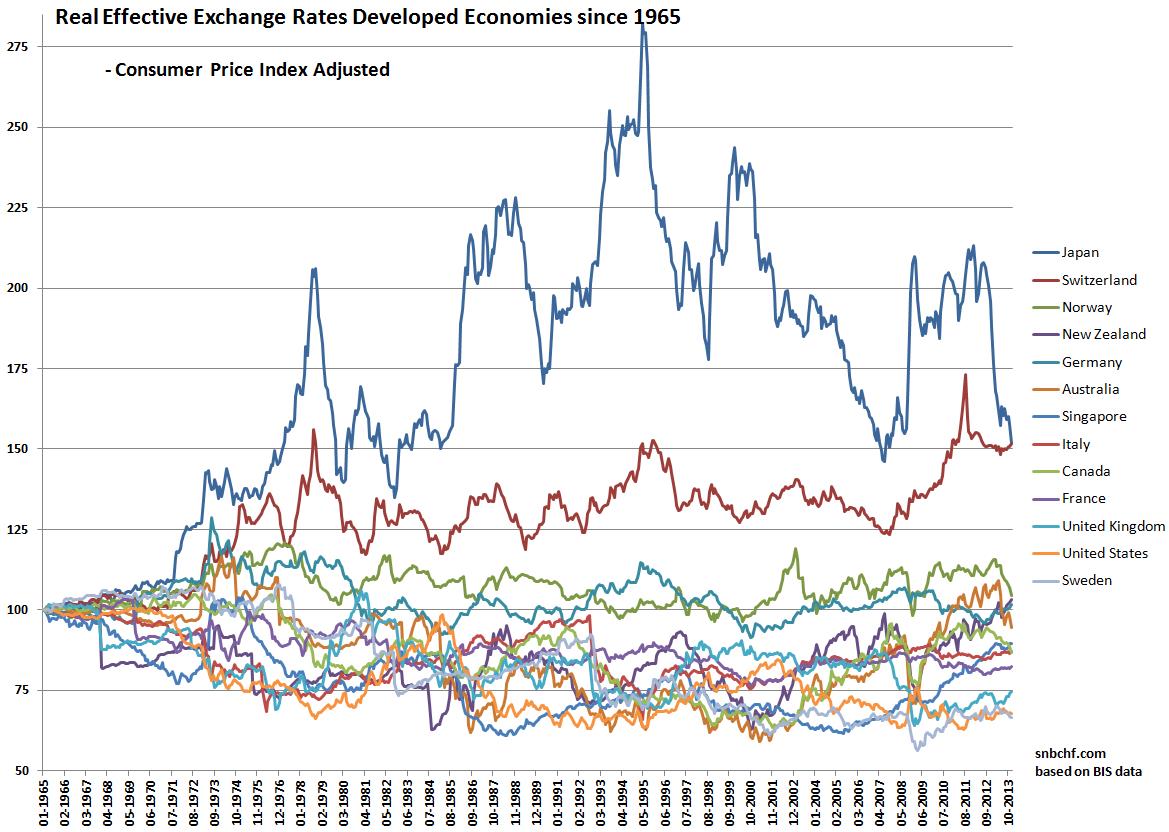

If we calculate Real Effective Exchange rates on the base year 1965, the Japanese yen remains the most overvalued currency.

CPI-based Real Effective Exchange Rate Since 1965: Yen Still Most Overvalued Currency

This analysis is based on the real effective exchange rate (REER) provided by the Bank of International Settlement (BIS) and a consumer price-index adjusted exchange rate.

The real value of the yen is around 50% higher than 1965, the same applies to the Swiss franc.

In 1995 the yen hit a 180% overvaluation against the 1965 base year. On the bottom of the list are the United States, the UK and Sweden; those currencies are undervalued against 1965 by 30-35%. Still in the year 2000, the commodity currencies AUD, CAD, NZD and NOK were undervalued; Australia was at 59% in 2001. But in 2013, the commodity currencies are in the midfield together with most European currencies.

(please click to expand, latest data from end 2013)

As opposed to the mainstream’s and our view, the Bank for International Settlement (BIS) calculates real effective exchange rates (REER) using the consumer price index (CPI) – for the “real” part. The “effective” part of the REER is taken as usual from the export shares.

We reckon that during that period exchange rates we largely driven by the fear of inflation and higher wages. Currencies with low wage rises, higher savings and investments and consequently low consumer price inflation appreciated. This helped to reduce interest rates and borrowing costs. Low wage increases and low borrowing costs helped companies to become more profitable.

Measuring international price and cost competitiveness

….

.. general issue concerns the choice of price or cost measure used. As for industrial countries, there are basically three sorts of measures in common use:

1) those based on unit labour costs in manufacturing industry;

2) those based on consumer prices (or some other broadly-based price measure);

3) and those based on export unit values.

…

A final element of recent efforts to broaden the scope of competitiveness measures is the greater attention paid to non-manufacturing: as the relative importance of manufacturing industry declines, the need for such a re-emphasis is likely to grow. Not only are non-manufacturing outputs increasingly traded, but service inputs are frequently key components of traded goods even if these inputs are themselves not directly traded. … (source BIS)

Option 1 and 3) and most common inflation adjustment, the Producer Price Index are better measurements for tradable goods and international competitiveness.

Option 2, consumer price index (CPI) used in the graph, is often slightly misleading. For rich and competitive countries, prices of tradable goods often increase more slowly than locally available consumer goods like food or housing.

Over the years this may add a massive bias, as we see above.

See more for

1 comment

1 ping

nancyjohn2010

2015-01-16 at 08:15 (UTC 2) Link to this comment

Forex trading is a zero sum game. For every long there is also a short

<a href=”http://forex-matter.blogspot.com/2011/06/costs-of-trading.html”>futures stocks Trading</a>

La crisi dell'Italia: cronaca di un suicidio annunciato - Elzeviro

2020-01-15 at 01:16 (UTC 2) Link to this comment

[…] presenta un tasso di cambio effettivo reale (REER) sopravvalutato del 50% rispetto al valore che dovrebbe avere. Cioè le merci italiane all’estero, per colpa dell’euro, costano il 50% in più (poi […]