Cheap ECB interest rates and rising home prices helped to enrich Southern Europeans between 1999 and 2007. Germany’s middle-class and poor, most of them not owning a home, were the ones that financed the expansion in a period of falling real wages and rising profits of German companies.

We think that most of this will be reversed in the transfer union from South to North since 2008.

The German West-East transfer union

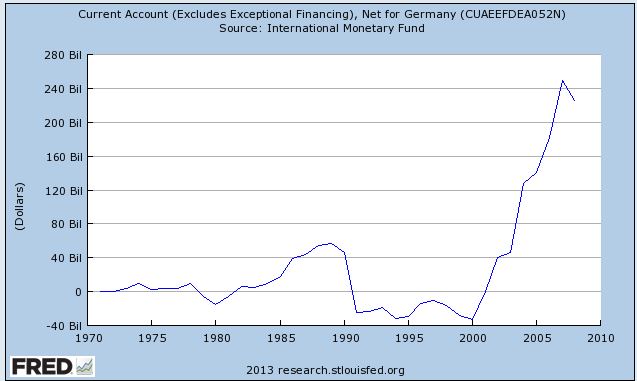

Between the year 1990 and 2005 the excessive costs of the transfer union between Western and Eastern Germany depressed the “sick man of Europe”. High public spending resulted in a German current account deficit until the year 2000. Still today the East is far poorer than the West.

In western Germany, the median value of net wealth stands at € 78,900, whereas in eastern Germany it amounts to € 21,400. (source Bundesbank wealth study)

Only the union among countries that were equally weak (resulting in EUR/USD of 0.78 US cents in 2001) made the common currency called Euro, possible.

The European transfer union North to South

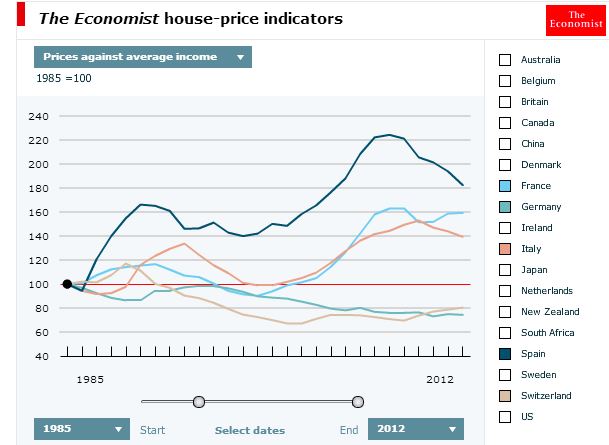

Cheap ECB interest-rates meant to heal Germany that contributes to only 35% of euro zone GDP. This caused excessive risk taking and housing bubbles in the other 65%, in the euro periphery and France but also in countries like Denmark and the Netherlands, while many Germans did not obtain any wage increase and impoverished.

It resulted in an indirect transfer union from Germany to Southern Europe and France via current account imbalances from the year 1999 to 2007 but enriched also German and Spanish entrepreneurs and e.g. Spanish home builders. Higher home prices increased wealth in the periphery till the financial crisis; and in France even until 2010.

(click to expand) Germany and Swiss with falling income since 1980s compared to Italy, Spain and France

Wealth for average Germans remained limited, because home prices and salaries did not take off due to supply-side reforms, low-costs jobs (“one-euro jobs”) and bargaining power of employers thanks to increase labor supply with the integration of 17 million Eastern Germans.

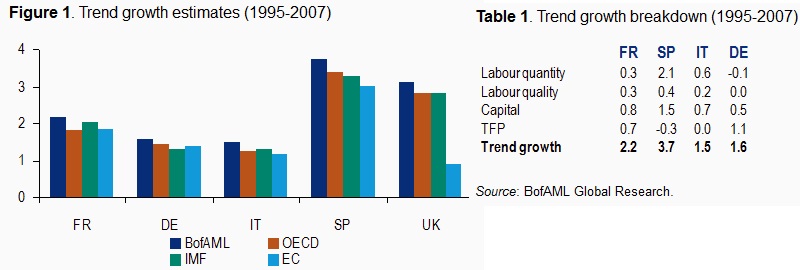

BofAML shows the effects of the transfer union in a Solow model:

Source VoxEU and BofAML

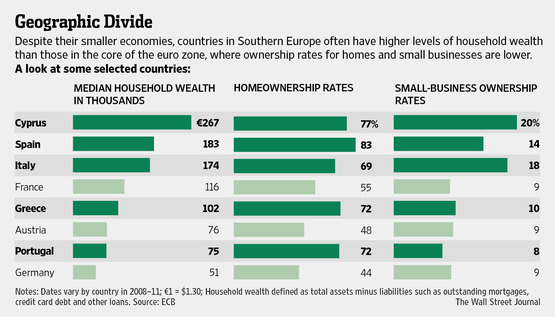

The result of the transfers from Germany into the periphery is visible in the latest household studies by the European national central banks. It shows also that cheap ECB rates helped many Southern Europeans to acquire property and to prop up prices. This tendency was sustained by many rich Germans or Brits who bought houses in sunny places.

Source WSJ and ECB

A large part of the huge difference can be explained by the fact that only 44.2% of Germans live in their own home, compared to 82.7% of Spaniards and 68.4% of Italians. And whereas private pension insurance and life insurance policies have been taken into account, claims on statutory social security systems have not.

The implications:

In crisis countries, there is a lot of wealth that can be taxed as one way to re-balance public sector accounts. A call for self-reliance amidst all the demands for solidarity. … Once the study is out, it will provide more food for this debate that divides Europe so much these days. For the debate in Germany, the Bundesbank’s view is one of the most influential. And there is no indication at all that it will soften its stance.

(Source Nordea)

While many well-informed wealthy and entrepreneurs managed to sell assets early enough, the middle-class in the periphery remained with excessive debt, while most Germans do not live in their own property.

Therefore the first transfer union from North to South was at least partially a transfer from the middle-class and the poor to the rich.

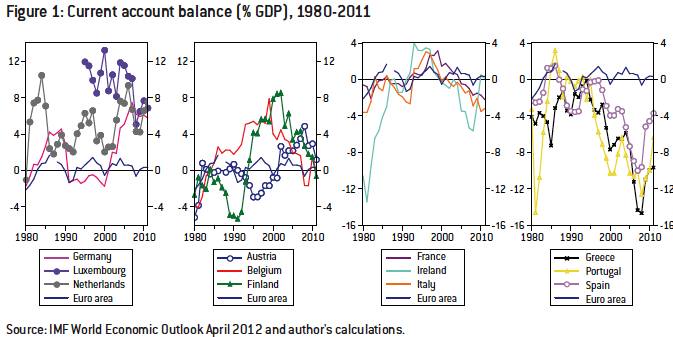

The gold standard might have stopped excessive current account deficits

If we still lived in times of a gold standard, however, running eleven years of current account deficits like Spain and Italy did, would have resulted in large outflows of gold from Italy and Spain towards Germany. The gold standard and the outflow of gold might have stopped the excessive deficits earlier: the euro allowed to borrow cheaply without paying for it in gold.

Source Bruegel Think Tank

The End of Cheap Money Provided by the ECB and Germany

As Nordea stated “In crisis countries, there is a lot of wealth that can be taxed as one way to re-balance public sector accounts”, there are many measures to obtain additional tax income. A (higher) tax on property or even a Cyprus-style “tax” on deposits are thinkable.

In any case it seems to be probable that home prices in the periphery and also in France will fall and German ones will rise, given that Germans have much more regular income left to save. The transfer union from South to North has started in 2008 and will continue. Future German inflation fears fueled by these transfers will limit the potential ECB rate cuts.

The ECB wealth report makes clear that cheap funding based on ECB money printing and implicitly by German tax payers and savers will not happen. (Read why ECB Money Printing are transfers from Germany to the periphery).

Read also:

How “median” Italians became richer than Germans.

2 pings

Southern eurozone countries should follow Germany's trail | The Corner The Corner

2013-04-30 at 03:42 (UTC 2) Link to this comment

[…] cheap labor from Eastern Germany, low or no wage and increased productivity helped so that the German current account surplus exploded. One can understand that the Bundesbank declares ‘war’ on Mario Draghi bond bail-out […]

Italy: The European Transfer Union From North To South and from Poor to | Euro Economy

2014-01-07 at 10:31 (UTC 2) Link to this comment

[…] Read more: Italy: The European Transfer Union From North To South and from Poor to […]