This chapter describes the most controversial episode in the Swiss monetary history: How the Swiss National Bank helped to wreck the Swiss real estate market in the 1990s.

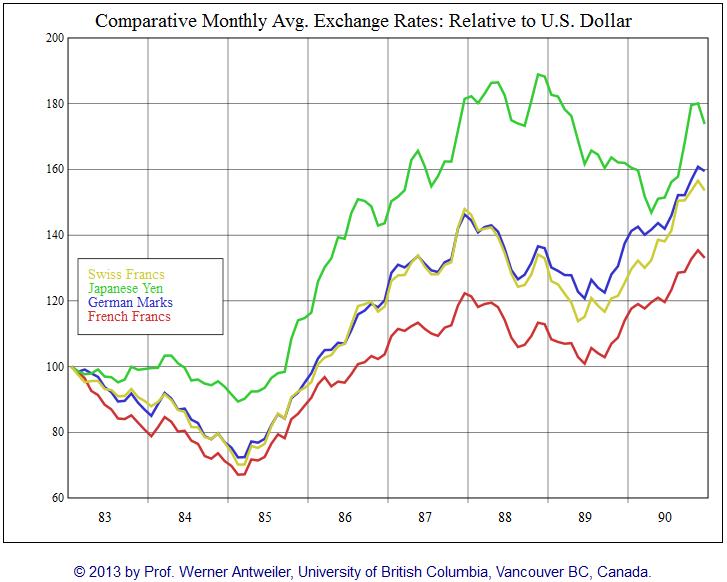

| With the Plaza accord 1985, central banks tried to reduce the strength of the US dollar and the associated disadvantages of U.S. exporters. The result, however, were strong capital inflows into Japan, Germany and Switzerland and a strengthening of their currencies. Due to the rising oil price, the U.S. could not reduce the trade deficit and despite the Louvre Accord of 1987, the dollar continued to depreciate.

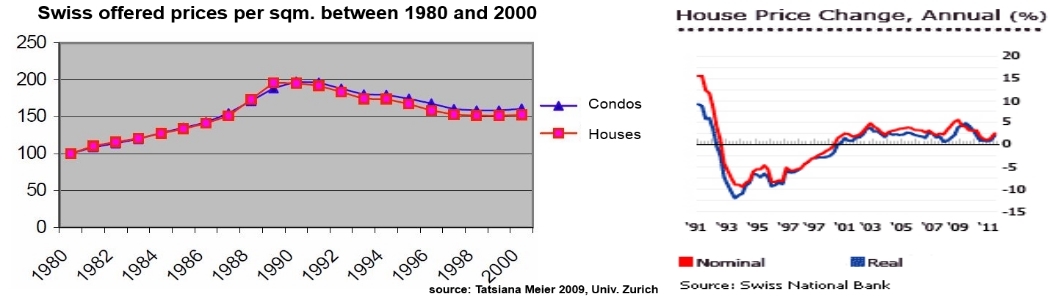

After the short “black Monday” crash in 1987, the SNB reduced interest rates and temporarily allowed higher money supply in order to prevent an excessive franc appreciation. Real estate prices doubled between 1980 and 1990, since 1987 they had a particularly strong increase. Given the high number of immigrants and the physical limitations of Switzerland the bubble was not recognized. After the first electronic interbank payments SIC were introduced in 1988, money velocity edged up and the need for central bank money decreased. But money supply continued rising. High German spending and inflation after the reunification created an additional massive expansion of Swiss money supply; it incited Swiss investments to export to the now bigger Germany. This money supply quickly went into higher wages and prices, inflation peaked at 6.6% in June 1991. Given that a looming VAT increase could further exercise inflationary pressures, the SNB policy change course completely; the central bank hiked rates from 3.5% in 1988 to 7% in 1990 and 9% in 1992. |

CHF DEM JPY vs USD 1980s |

| As opposed to other Europeans today, most Swiss (and also Germans) do not possess their own home. The real estate market is driven by firms that finance their investments mostly by loans. The global recession in 1992 and high interest rates destroyed their business model; the real estate market collapsed. Despite high inflation, home prices fell back to the level of 1988. Other European countries like Sweden or Finland lived through a similar real estate crisis in the 1990’s, but could recover after some years.The weak Swiss growth continued, mostly because of the weakness of Germany, its main trading partner. Until the world financial crisis, Swiss real estate prices appreciated far less than other countries, we recently judged that Swiss price to income ratios are small in historical perspective and prices are still attractive compared to other countries.

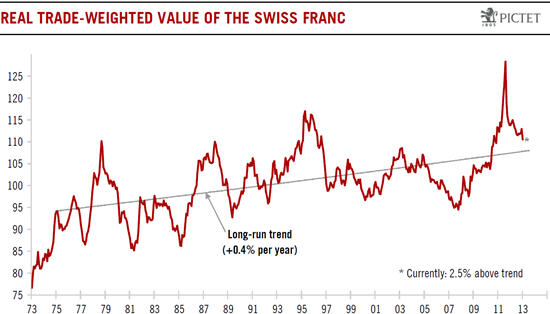

With the SNB rate hikes in 1994/1995, the franc rose to a 15% appreciation against the long-term linear trend of the REER, but it collapsed with the housing bust. |

Pictet Long-term graph EUR/CHF(see more posts on EUR/CHF, ) |

SNB failed to recognize that the German reunification only created a temporary boom with wrong resource allocations. It finally weakened Germany and the closely related Swiss and its export sector. With high interest rates, the SNB destroyed the Swiss real estate market.

As visible in the graph , still in 1991 Swiss real estate rose as response to high inflation, but in 1992/1993 prices collapsed until they reached a bottom in the year 2000.

Source 1, source 2 Global Property Guide