(post originally posted in March 2013, its relevance is more and more increasing, in particular after the end of the peg)

Everyone loves and early inflation. The effects at the beginning of the an inflation are all good. There is steepened money expansion, rising government spending, increased government budget deficits, booming stock markets and spectacular general prosperity, all in the midst of temporarily stable prices. Everyone benefits, and no one pays. That is the early part of the cycle. In the later inflation, on the other hard, the effects are all bad.

Ronald H. Marcks

In a September 2012 paper, we stated that SNB requires three preconditions to reduce currency reserves:

- A substantial decrease of risk differentials between the euro zone and Switzerland, i.e. less global risk aversion, lower debt and current account deficits for the weak countries of the euro zone.

- Far higher interest rates in the euro zone than in Switzerland.

- Stronger GDP growth in the euro zone.

SNB has won the risk aversion game against markets

Global risk aversion is now substantially reduced, current account deficits have been eliminated for Italy and Spain, and government debt or at least yields have become smaller.

Therefore we judge that the SNB has won the first round in the war against markets, that could be called the “risk aversion game”. Sight deposits and FX reserves do not increase any more, interventions have stopped.

The “inflation game” does not start now

In the inflation game, gold will follow rises in wages the same as in the 1970s. We judge that the inflation battle will start at the earliest in 3 to 5 years. By then, U.S. rates will be still relatively low, but inflation will be above 2.5%.

By 2013, however, U.S. CPI inflation has come down far under 2%, due to the slowing in emerging markets and falling commodity prices,.

The main Fed gauche, the Core PCE is currently at 1.20%. There is still plenty of time until it will reach 2.5%.

What will happen between the “risk aversion battle” and the “inflation battle”?

The euro crisis is not solved. Problems will intensify, the Southern member states suffer from the same problems as the U.S., but they do not have the privilege to owning a reserve currency. They cannot fight the crisis with higher spending. The ECB’s , the European aid packages and the fiscal compact, do not allow for it. The ECB will not follow the OMT program when conditionality is not fulfilled.

We suspect that global growth will be driven more by the United States, China and Germany (and with it also Switzerland), but a lot less than previously by other emerging markets (see details).

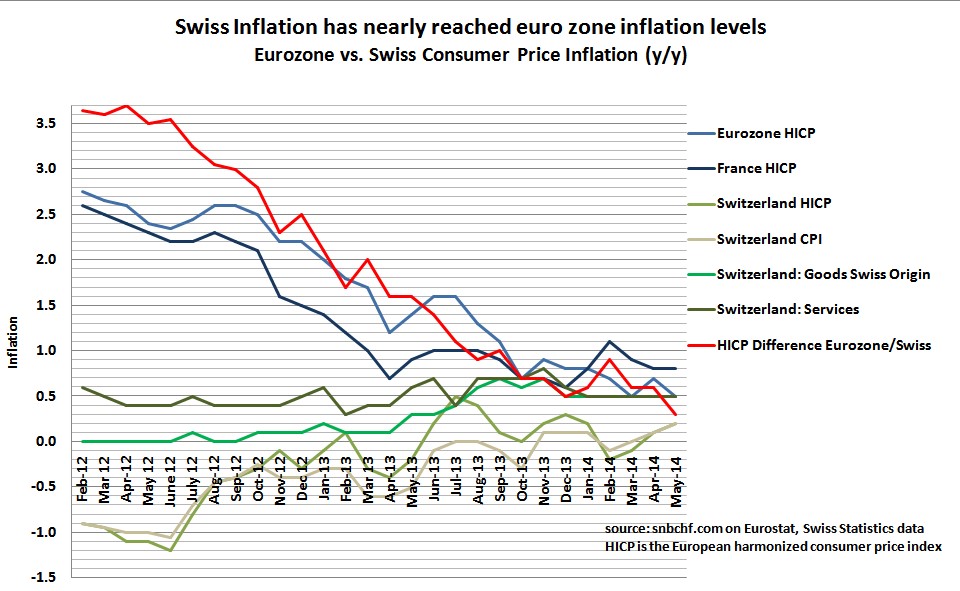

Swiss assets like stocks and real estate will continue to rise, triggering, sooner or later, at least some modest inflation.At the same time, the gap between European inflation figures will become smaller and smaller.

Still in February 2012, the difference was 3.7%. (Update 2014) In 2014, the difference arrived at nearly zero.

The SNB has four tasks in the meantime:

- Reduce money supply to tame inflation risks in Switzerland.

- Reduce risks in the housing sector via the counter-cyclical capital buffer or similar macroprudential measures.

- Accumulate income on investments to be prepared for a stronger franc during the inflation battle. See if this is possible.

- Sell reserves to limit risks in the inflation battle.