The latest Commitment of Traders report covers the week ending February 2 that included the FOMC meeting and the BOJ's surprise cut. There was also speculation of a potential deal between Russia and OPEC to cut output. Speculative position adjustment in the futures market was more limited than one might have expected.

Speculators cut 10.5k gross long yen contracts, leaving 82.5k contracts. The bears added only 2.3k contracts to their gross short position, giving them 44.9k contracts. The result is a modest pullback in the net long position to 37.2k contracts from 50.0k. The strength of the yen since the end of the reporting period may have seen some chase the market.

The euro futures saw the largest position adjustment among the currency futures, seemingly anticipating the upside break that took place since the end of the reporting period. The gross longs rose by 24.6k contracts, tho largest increase since last June. At 96k contracts, it is the biggest long position in more than two-years. The gross short position fell 15.6k contracts to 183.1k. The net short position was reduced by 40k contracts to 87.1k contracts, the smallest since last October.

The Canadian dollar also saw a significant adjustment. We had noted last week that despite the rally in the Canadian dollar, and short-covering in the spot market, the speculative positioning was little changed. The latest reporting period show that 17.1k gross short contracts were covered. Although this is the biggest percentage change since October, the gross short position of 82.5k contracts is simply back to early December levels. There was a little profit taking by the longs. The bulls cut their position by 2.7k contracts.

The other currency futures saw small gross position changes. In fact, there is only one other gross position that changed by more than 5k contracts. That is the gross long Australian dollar position. It grew by 5.1k contracts to 51.4k.

The net long 10-year Treasury futures position was reduced to 5.9k contracts from 44.5k. This primarily reflects bears selling into the rally rather than profit-taking by the bulls. The gross short position rose by almost 32k contracts (to 483.8k). The gross long position was trimmed by 6.7k contracts (to 489.7k).

Both bulls and bears saw the price action in the light sweet crude oil futures to their liking. However, the shorts were bolder and raised their gross position by 30.9k contracts to 348.9k. This is a new record high. The bulls added 22.1k contracts; giving them 545.8k. This is the largest gross long position since mid-2014 peak in oil prices. The gross position adjustments resulted in an 8.8k contract reduction on the net position to 196.9k contracts.

| 2-Feb | Commitment of Traders | |||||

| Net | Prior | Gross Long | Change | Gross Short | Change | |

| Euro | -87.1 | -127.2 | 96.0 | 24.6 | 183.1 | -15.6 |

| Yen | 37.2 | 50.0 | 82.1 | -10.5 | 44.9 | 2.3 |

| Sterling | -45.0 | -47.5 | 32.7 | -2.0 | 77.8 | -4.5 |

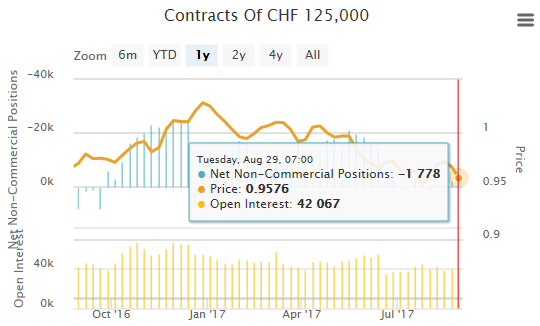

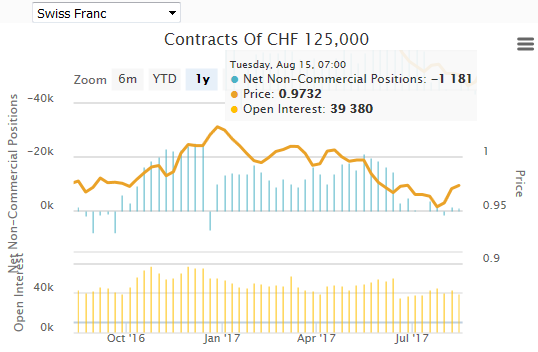

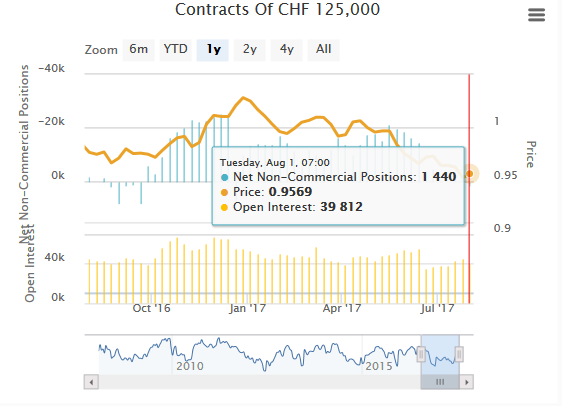

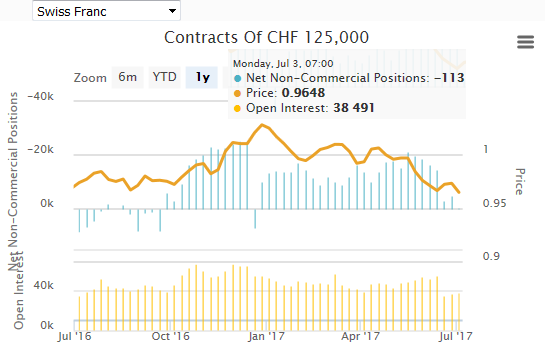

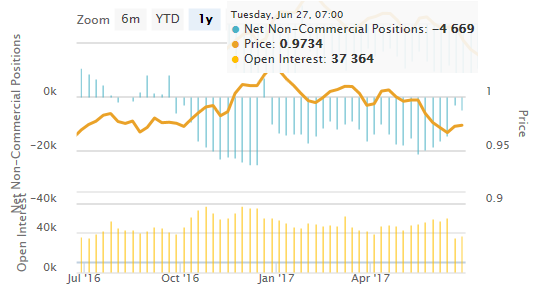

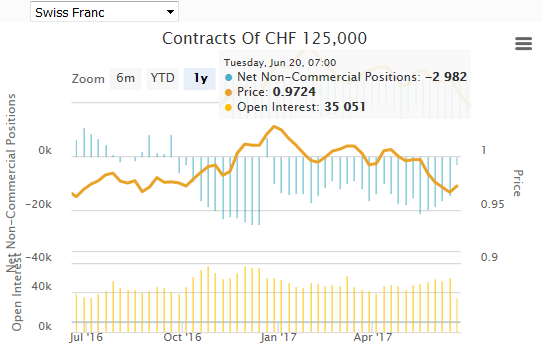

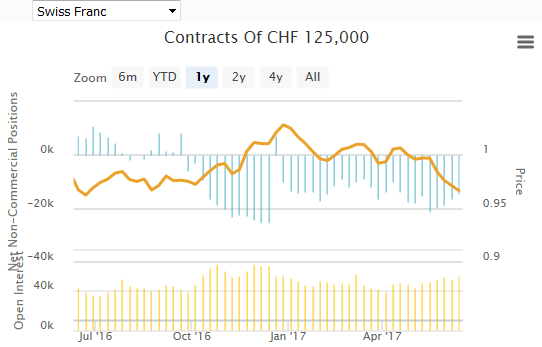

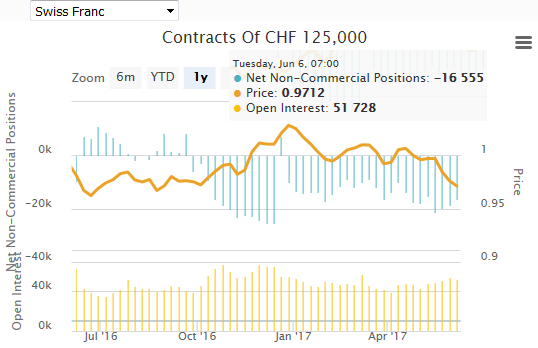

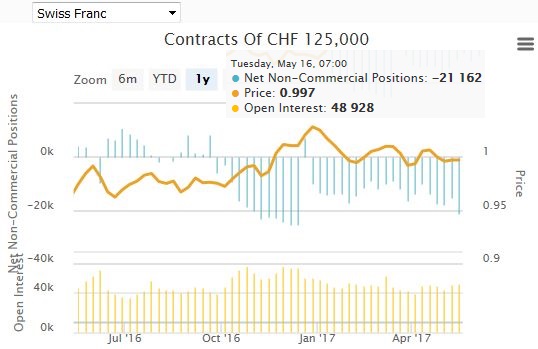

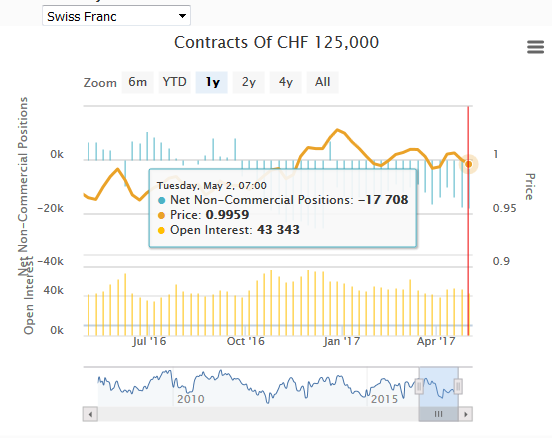

| Swiss Franc | -4.7 | -4.5 | 26.0 | 1.0 | 30.7 | 1.2 |

| C$ | -52.4 | -66.8 | 30.1 | -2.7 | 82.5 | -17.1 |

| A$ | -26.2 | -32.8 | 51.4 | 5.1 | 77.6 | -1.5 |

| NZ$ | -8.4 | -5.4 | 13.5 | -1.7 | 29.9 | 1.4 |

| Mexican Peso | -78.6 | -76.6 | 25.0 | -3.5 | 103.6 | -1.5 |

| (CFTC, Bloomberg) Speculative positions in 000's of contracts | ||||||

Tags: Commitments of Traders,Speculative Positions