The US dollar is sporting a softer profile today as the global capital markets are trying to stabilize. Oil prices have steadied, with WTI back above $30. Bond markets are narrowly mixed though the 10-year US Treasury is steady near 1.85%. Asian and European equities followed US markets lower, but American equities have stabilized, and ahead of the ADP employment estimate and the ISM for non-manufacturing, S&P 500 is set to open slightly higher.

The dollar continued to shed the Kuroda-inspired gains against the yen, falling to JPY119.25 in the European morning. We see near-term risk extending to the JPY118.50-JPY118.80 area. A set of options at JPY119.50 are set to expire today. Tomorrow sees larger options expiration, but with strikes of JPY120 ($3 bln) and JPY121.50 ($1.5 bln), they are not in play.

The yen's 0.5% gain today is not the largest. That honor goes to the New Zealand dollar. It is up nearly 1.3%. The rally was spurred by the RBNZ Governor Wheeler. He dampened expectations for a rate cut, warning against a "mechanical response" to the drop in oil prices. The Kiwi was also boosted by a constructive Q4 employment report. The unemployment rate fell to 5.3% from 6.0%. The consensus anticipated an increase. The drop in the participation rate (68.4% from 68.7%) played a role, but employment rose 0.9% in Q4, recouping in full the 0.5% decline in Q3.

The Australian dollar could not keep pace with the New Zealand dollar. Building approvals jumped twice what the market expected. The 9.2% gain in December follows a revised 12.4% decline in November. It is a volatile series, and the year-over-year rate remained negative. Separately, Australia reported a much larger than expected trade deficit. The A$43.53 bln shortfall is the largest since June. The Aussie fell to around $0.7000 after approaching $0.7130 yesterday. It has recovered. Initial support in North America may be found near $0.7040, and there is potential back toward $0.7080-$0.7100.

News that China’s Caixin services and composite PMI improved did not seem to have much impact on risk appetites. The services reading improved to 52.4 from 50.2. It is the highest since July. The composite reading edged back above 50 (50.1) for only the second time since August. Separately, news wires that did not quote anyone by name suggested that the PBOC is considering easing rules for QFII. This would ostensibly include reducing lock-up periods for withdrawal of QFII funds from China, and institutions could be given more leeways over when they can bring funds into the country. It would essentially align the QFII with the practices of RQFII. Separately, China has imposed soft forms of capital control to limit outflows from domestic accounts and stronger measures to discourage speculation against the yuan onshore and offshore.

The economic focus in Europe was on the service PMIs. There are two key takeaways. First, the eurozone aggregate reading was unchanged from the 53.6 flash reading. It represents a decline from December’s 54.2 reading and is the lowest since August. The composite reading ticked up to 53.6 from flash’s 53.5 and 54.3 in December. The mildly softer start to the year contrasts to the turbulence in the capital markets.

Both the German and French reports came in lower than the flash readings. Italy’s pullback from the 55.3 cyclical high reading in December to 53.6 was a bit more than expected, while Spain surprised to the upside, despite the inability of politicians to cobble together a new government. It was reported at 54.6. The consensus forecast was 54.3 after 55.1 in December Italy and Spain both reported an increase in new orders.

The second takeaway is the UK report. It ticked up instead of down. It rose to 55.6 from 55.5. The consensus expected 55.4. The UK composite reading of 56.1 was also better than expected and follows December’s 55.3. The composite is at its higher level since July. Separately, the BRC price index fell 1.8% year-over-year, apparently led by clothing. The better activity is not boosting prices, and it is not simply energy related.

Sterling is up about 0.5% near midday in London. It is just below $1.45 and at its best level against the dollar since January 12. The five-day moving average has crossed above the 20-day for the first time since mid-December. The initial target is near $1.4525.

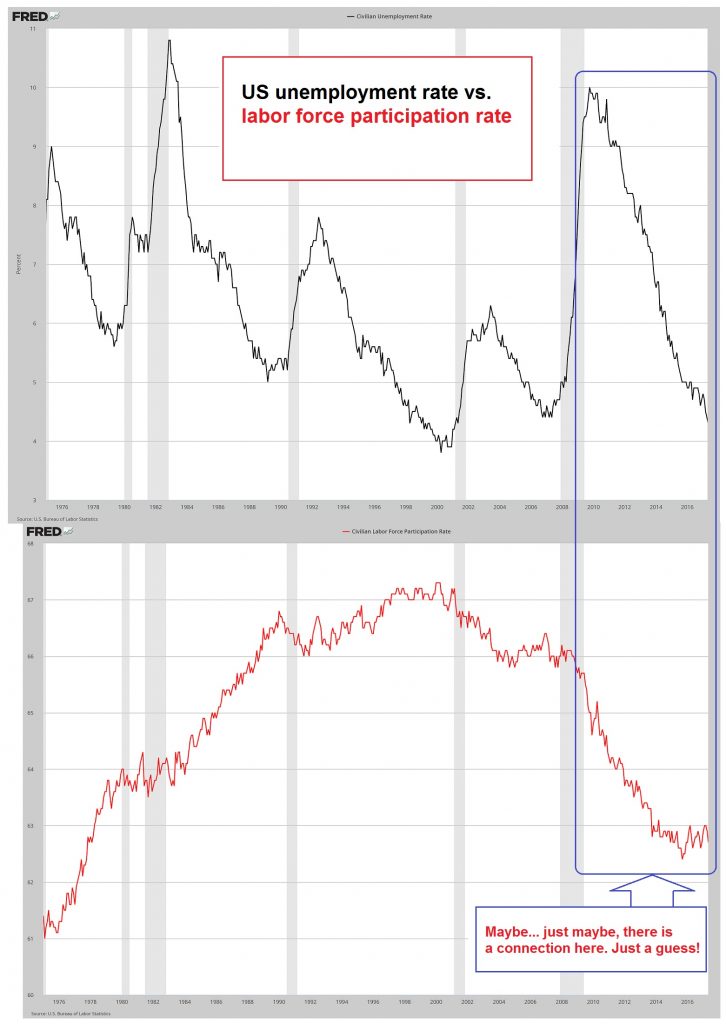

The US session features the ADP employment estimate and the PMI and ISM services. Also, the EIA’s oil inventory data will be watched. The API estimate yesterday showed a 3.8 mln barrel increase. The consensus is for the ADP to be 193k, down from 257k in December. This is in line with the consensus for 190k for Friday’s nonfarm payroll report. While such a report would show that labor market slack continues to be absorbed, it may not be sufficient to boost expectations of a Fed hike in March.

Tags: U.S. ADP Employment Change,U.S. Participation Rate