Week January 17-22

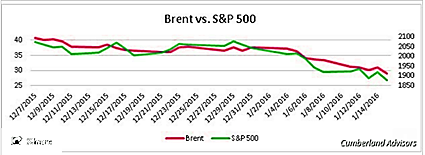

This was the first winning week of 2016 and of some relief to ordinary investors. The question is whether it is sustainable, or just a short-covering bounce, as is frequently the case when the market is undergoing a correction. Currently the S&P 500 has sunk 10.5%, the DJ-30 12.1%, and the NASDAQ 12.0%, since mid-2015. Calling a bottom, or a top, is a challenge even for professional investors. I would cite three short-term factors bearing on the question ‘Where do we go from here?’

Will Crude prices remain so low?

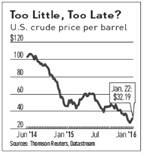

The first is the price behaviour of crude oil and the strong correlation it has with the stock market particularly since mid-December. Thus, the black gold’s 9% rally on Friday to close at $32.19 per barrel triggered Friday’s rally.

|

Whether the crude oil market can within a reasonable time recover part of its losses, or even remain over $30 per barrel is questionable, since Iran will soon pump its oil into the market and Saudi Arabia refuses to cut its production.

Will China become more consumer oriented?

The second factor is whether China is able in its transition to a more consumer-oriented economy to bring some element of stability into its markets in the near-term.

2015 Earnings Season

The final factor is the fourth quarter 2015 earnings season. In the next two weeks, the market will be awash with the majority of reports. If these confirm a profit recession optimism is likely evaporate, and may cause by itself an acceleration towards a bear market, i.e. a decline of 20% from an index’s peak, which could be reached if the S&P 500 falls to 1,704.66 points; a loss of another 202.24 points!

Should none of these factors bear fruit, the probability increases that the global recessionary trend will also backlash on the U.S., fuelled by the dollar’s own strength, which since the beginning of the year has strengthened 0.77%! Already the U.S. manufacturing industry is the first to succumb! The monetary measures already undertaken by the EU, China and Japan may help stem the economic ebb, but already the following countries are suffering a biting recession: Russia, Canada, Australia, Ireland, Belgium, the Czech Republic, Greece, Italy, Portugal, Brazil, and this is not to mention the plight of the majority of dollar-dependent developing countries.

In spite of this highly volatile economic and financial scenario, the growing pessimism may disappear in a trance, once the fog of uncertainty has been lifted, or perhaps gains more momentum to the downside!

As the Greek General and Orator Pericles (c. 495 – 429 BC) said, “The key is not to predict the future, but to be prepared for it.”

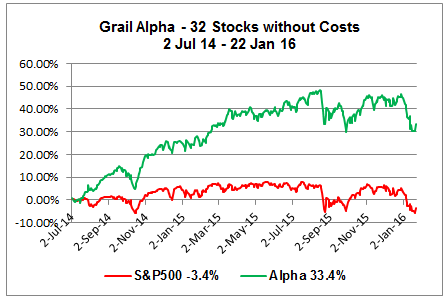

Understand our model again:

http://www.grailsecurities.com/information/the-grail-model/the-model.html

Are you the author? See more for Next post

Tags: