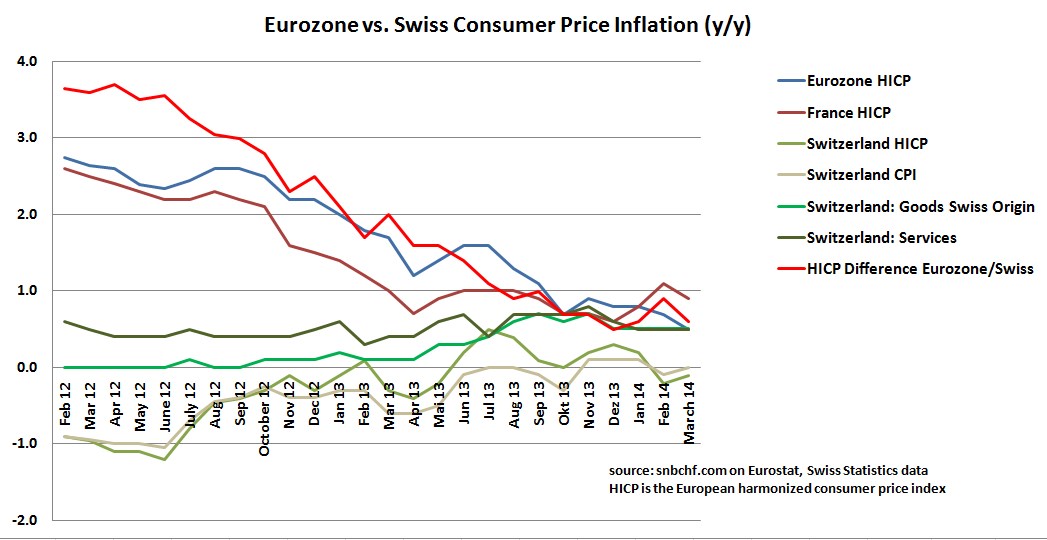

According to Swiss Statistics the yearly inflation rate is at 0.0%, and the monthly rate is +0.4%. The Spanish CPI is already under zero at -0.2%, and the Italian one is at +0.3%, not to speak about severe Cyprus or Greek deflation . Still in February 2012, the difference between the Swiss and Euro zone CPI was 3.7%.

Prices of goods that make up 41% of the Swiss basket have fallen (-0.8% y/y), while services (59% of the basket) are up 0.5%. Swiss goods are rising in price by 0.5%, but foreign goods have fallen (-1.5%). The reason for cheaper imports can be found in long-lasting contracts that incorporate the new currency rate only slowly. Other reasons are cheaper prices of import goods like oil (-3.1%) and clothes (-2.9% y/y).

Still, the increasing trend of local Swiss inflation, visible in prices of services and Swiss goods has stopped. Services are up only 0.5% y/y and goods of Swiss origin only 0.5%. This trend has stabilized at 0.5% y/y inflation.

Real estate prices increased of 6% per year between 2008 and 2012. The pace slowed in H2/2013 to 4.3% (source IMF). This puts an upwards price pressure on the rents component of the CPI. Home rents (a weighting of 18%, included in the services) are up 1.4% on the year, a contribution of 0.252% to the whole CPI. Due to regulatory restrictions on rent hikes, the backlog against real estate market prices will continue to exert upwards pressure on inflation; the 0.252% upwards contribution should be permanent for years and potentially decades.

Wages should increase between 0.6% and 1% in 2014, another factor to indicate further Swiss inflation ahead. The cost problem associated with higher wages, is reduced thanks to ever rising productivity, often visible in a negative producer price index (PPI) and the import of cheap labor. Since many Swiss firms own their properties, real estate price increases do not translate into higher costs. The PPI remains negative, company margins increase and the consumer may pay the bill, visible in a higher “Consumer Price Index” and a rising SMI.

The SNB has perfectly organized a wealth transfer from the average/poor consumer to Swiss firms, stock-holders, home-owners and banks. Unfortunately for the central authority, the people have revolted against stagnating wages and rising rents. The people want to reduce the import of cheap labor as shown in the latest referendum and in the upcoming minimum wage referendum. Swiss investors, however, continue their purchases of Swiss stocks and real estate as a protest against future inflation and against the misleading guidance by their client advisers who have told them for years that the CHF will depreciate. The conflict-of-interest question has never been asked.

With the slowly upcoming/continuing Swiss boom, we see EUR/CHF falling to 1.00 in 10 or maybe 20 years; only then will high wage increases trigger the bust of the Swiss real estate bubble and cause the franc to depreciate again. The bust and CHF depreciation cycle in 10 or 20 years, should be accompanied by heavy FX reserve sales by the SNB to keep inflation under control.

As you know, the SNB has lost control over monetary policy as long as it maintains the EUR/CHF minimum rate. (See the opinion of Prof. Charles Wyplosz’s, International Economics Institute, Geneva; he thinks that the SNB might hike rates earlier than the ECB.)

The recent combination of oil price and dollar depreciation, however, has reduced inflation pressures and the SNB has gained some more time. More time, possibly even some years, before the next big assault by hedge funds, and maybe other central banks, against the Swiss will start. Similar to 2010 at EUR/CHF 1.40, the SNB will also lose the “1.20 battle”. On the other side, the central bank is able to profit on the seigniorage effect every year and earn some income, … hopefully enough….

Read also:

Once again a bank that tries to convince investors that rate differences between ECB and SNB will rise

The FX trade of the Future is EUR/CHF Short, Not EUR/CHF Long

Switzerland’s Slow Way to Inflation

Downwards and Upwards Drivers of Swiss Inflation

Excessive Money Supply: Switzerland Could Follow in Spain’s and Ireland’s Footsteps

Swiss home price to income ratio is small in global comparison, Swiss real estate boom for another decade?

GDP: Switzerland Enters Boom and.. incredibly.. SNB is Still Printing Money

Seigniorage: Will SNB FX Investments Yield Enough Until U.S. Inflation Starts?

Are you the author? Previous post See more for Next postTags: Eurozone Consumer Price Index,inflation,Spain Consumer Price Index,Swiss real estate,Switzerland