UPDATE October 31,

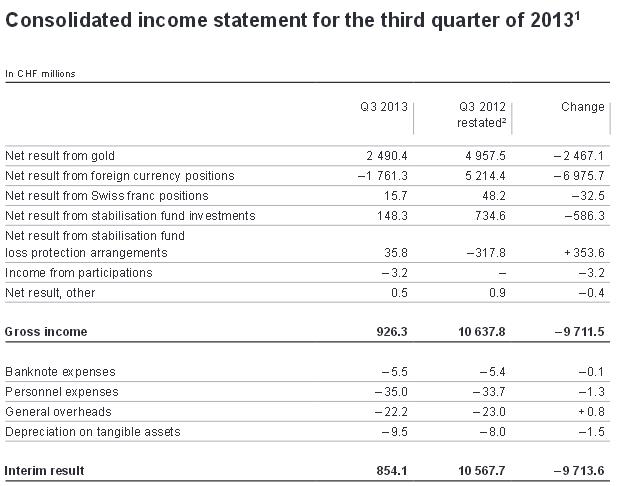

The official press release focused on the results for Q1 to Q3. The loss was 6.4 billion after a 7.3 bln. CHF loss in the first two quarters. Over all three quarters especially gold and the yen weakened the central bank’s positions.

For the third quarter, it means that income was positive by 0.85 bln. CHF, slightly below our estimate of 1.17 bln.

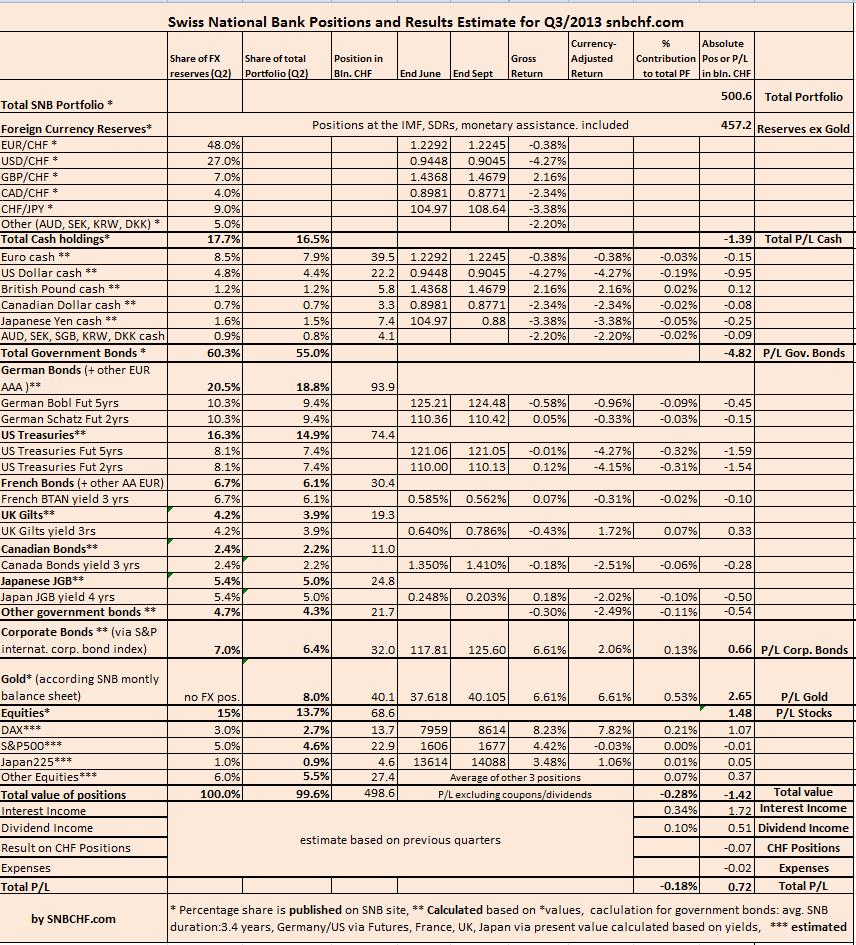

Our estimate gives far more details on which positions the SNB had profit and on which losses in Q3.

Details and estimate on different SNB positions

Tomorrow, on October 31, the Swiss National Bank will publish its Q3/2013 results. Our estimate is 1.17 0.72 billion CHF, mostly driven by a large CHF gain for the gold and equities holdings (update for a slight calculation mistake in gold).

- The bank should lose 1.39 bln. CHF in its cash positions due to the stronger franc – of which nearly 1 bln. can be attributed to USD cash positions. Over the three quarters, losses on JPY are still dominating.

- Valuations of government bonds should lose 4.8 bln. francs, mostly driven by FX rates – of which over 3 bln. due to falling values of U.S. government bonds.

- Our estimate sees a gain of 0.66 bln. for corporate bonds.

- Our estimate was a gain of 2.65 bln. CHF on gold positions; the gold price improved from 1229$ at the end of Q2 to 1329$ in Q3.

- 1.48 bln. profit for equity positions in Q3.

- Based on the previous two quarters data, we obtained an interest income of 1.72 bln. and a dividend income of 0.51 bln.

- The SNB has by far more foreign currency positions, therefore the result on CHF positions do not have an influence.

- Expenses are low compared to the total portfolio.

In March, we were warning of the negative effects on the SNB portfolio when bond yields start to rise again:

Are you the author? Previous post See more for Next post

Tags: equities,Gold,Government Bonds,stocks,Swiss National Bank