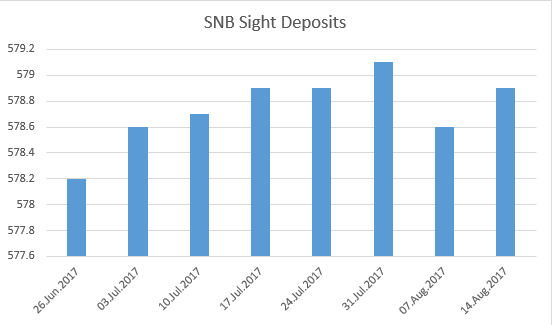

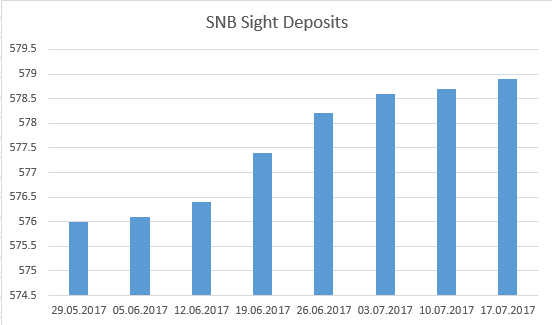

Anybody wondering about the massive M0 Increase in Friday’s SNB IMF data:

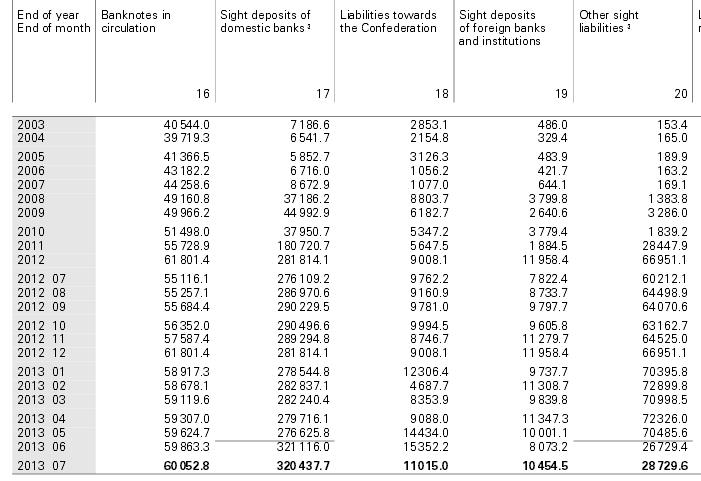

As we know, the monetary base M0 is the main mean of financing currency interventions. It consists of bank notes and sight deposits of domestic banks. However the SNB did not intervene, it was no money printing this time. Deposits of Swiss Post Finance had been reclassified from other sight liabilities to deposits of domestic banks. This increased M0 by around 44 bln. CHF. Other sight liabilities went down from 70.48 to 26.72 bln. CHF, while the ones of domestic banks inched up.

Other insights from the IMF data were that – according to the Real Effective Exchange Rate (REER) – the franc is now only 10.2% overvalued against 1999. In June this number was still 10.9%. 1999 was only some years after the bust of the Swiss real estate bubble; a period when the franc was rather weak and the dollar strong, so a 10% increase in REER was quite easy to achieve. See the full release of IMF data here, the latest SNB balance sheet of end July here. Understand also why we think that CHF is not overvalued, but AUD, NZD or NOK were until end 2012 and are still overvalued today – Purchasing Power Parity.

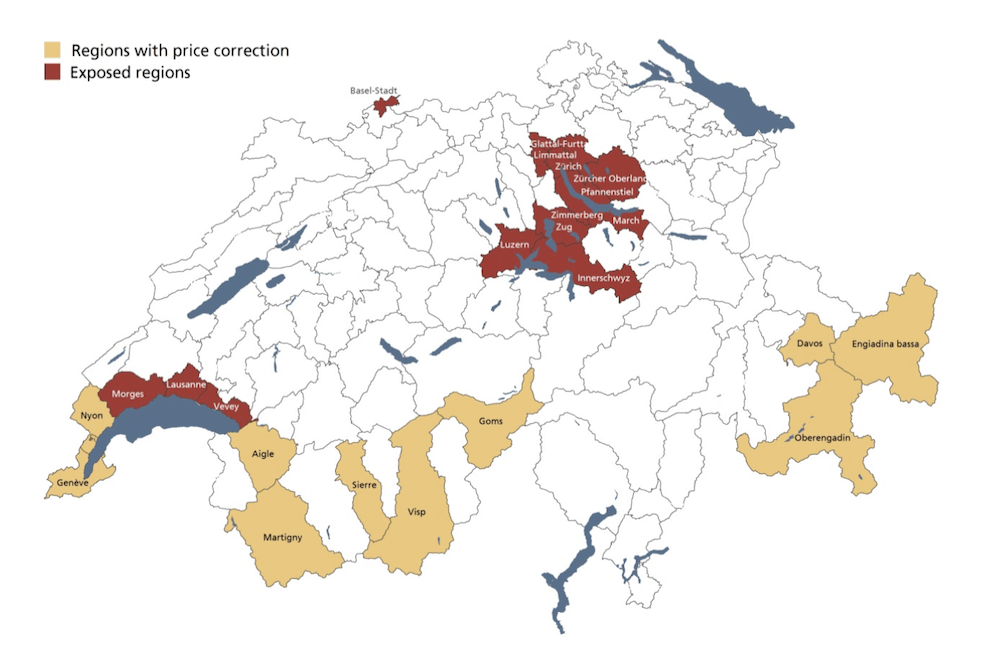

Are you the author? Previous post See more for Next postTags: M0 base money,Monetary Base,SNB sight deposits,Swiss real estate

1 comment

tobymcguire

2015-01-05 at 07:38 (UTC 2) Link to this comment

I have tried debt management services, and unfortunately these services are very helpful, some people don’t understand but they do have to try.

http://www.debtmanagementplan.us