The Swiss National Bank (SNB) delivered a, for her standards, very hawkish monetary assessment with the focus on the risks in the financial sector. This does not come as a surprise for us. Each time, after the United States has recovered from a crisis – just like now – inflation and risks increased in Switzerland. At the same time the EUR/CHF floor is currently not in danger.

The following graph from Hildebrand (2004) shows that a period of inflation has regularly followed monetary expansion in response to the rise of the franc, this with a delay of about 2-3 years.

- The main important criterion is price stability: This “primary goal is to ensure price stability, while taking due account of economic developments. In so doing, it creates an appropriate environment for economic growth”. Price stability means inflation above 0% and below 2%. On this basis the bank implements monetary policy.

- The bank ensures the stability of the financial system and implements a regulatory framework. Moreover, it provides bank notes and payment facilities to the economy and the financial system.

- Asset Management: The SNB manages the country’s currency and gold reserves. It is also the “banker” of the Swiss confederation.

Monetary Assessment: Key phrases from Thomas Jordan

The Swiss National Bank (SNB) is maintaining its minimum exchange rate of CHF 1.20 per euro. The Swiss franc is still high. An appreciation of the Swiss franc would compromise price stability and would have serious consequences for the Swiss economy. We stand ready to enforce the minimum exchange rate, if necessary, by buying foreign currency in unlimited quantities, and to take further measures, as required. The target range for the three-month Libor will be left unchanged at 0.0–0.25%….

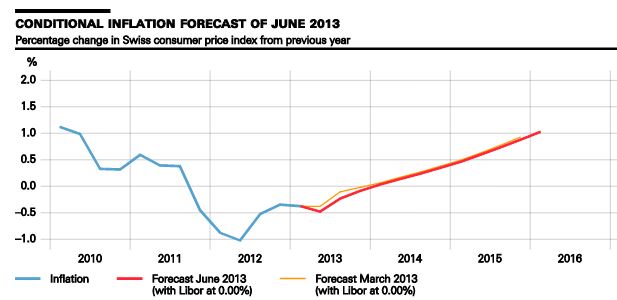

For 2013, we now anticipate slightly lower inflation of –0.3%. For 2014, the inflation forecast is unchanged at 0.2% and for 2015 at 0.7%….

Overall, we still anticipate growth of 1.0–1.5% for 2013…. growth was mainly driven by private consumption and investment in residential construction. These demand components benefited from the relatively robust labour market, a continued strong inflow of immigrants and the favourable financing conditions. In particular, the supply of credit in Switzerland is currently having a much stronger effect on the real economy than in most European countries.

Domestically, there is a risk that the imbalances on the mortgage and real estate markets will grow, given the sustained period of exceptionally low interest rates….

We continue to expect growth of 1.0–1.5% for the year 2013 as a whole.

Monetary and financial conditions

Banks’ sight deposits at the SNB have not increased any further since September 2012. However, growth in the M1, M2 and M3 monetary aggregates, which measure the amount of money held by households and companies, remained strong. This growth in money was accompanied by robust lending on the part of banks. Although the rate of growth of mortgage loans to households has declined since mid-2012, it is still at a high level. Most recently, mortgage lending to companies, in particular in residential construction, has increased significantly….

Overall, lending has been growing faster than nominal GDP for several years. In addition, prices for owner-occupied apartments and single-family homes have risen strongly in the past few years. This development jeopardises financial stability and, in the event of an abrupt correction, can have wide-reaching consequences for the real economy…

SNB monetary policy

… The financial crisis has shown that for balanced economic development more than just price stability is required; financial stability must also be guaranteed. In Switzerland, the fact that the SNB is required to contribute to ensuring financial stability was already laid down in the National Bank Act of 2004. Our annual Financial Stability Report is an important instrument in this respect. It draws attention to emerging imbalances and the existence of risks which, in our view, could jeopardise the stability of the banking industry as a whole in the medium term.

In addition, last year a new instrument was created – the countercyclical capital buffer – based on the lessons drawn from the financial crisis. At the beginning of the year, the SNB proposed that this buffer be activated, and the Federal Council decided in favour of an activation in February. The countercyclical capital buffer will come into effect from the end of September 2013

next page: Key phrases from Jean-Pierre Danthine

Tags: currency reserves,Monetary Policy,Swiss National Bank

1 comment

hr4free.org

2014-01-07 at 17:13 (UTC 2) Link to this comment

Very interesting analysis. Perfectly fits my expectations given the SNB’s current monetary creation drive.