Response to Prof. Nick Rowe, Carleton University, Canada and Lars Christensen, the leading “Market Monetarist“.

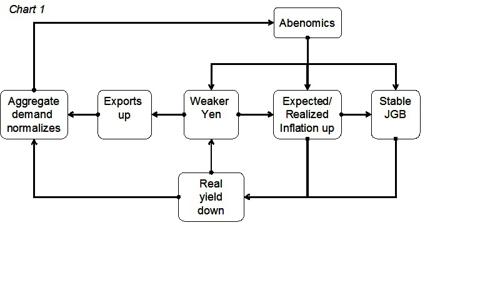

Nick Rowe: Is the Bank of Japan trying to push down bond yields? Well, yes and no. Yes, it is fighting a battle to push down bond yields, but that battle is part of a wider war for economic recovery. And if it wins that war for economic recovery, it will lose that battle to push down bond yields. So it wants to lose that battle to push down bond yields.This is what Ambrose Evans-Pritchard says that Richard Koo says:

“As I reported last night, Mr Koo thinks the Abenomics plan of monetary reflation is madness. “Once inflation concerns start to emerge the BoJ will be unable to restrain a rise in yields no matter how many bonds it buys.” This could lead a “loss of faith in the Japanese government” and the “beginning of the end” for Japan’s economy.”

Yep. When the Japanese economy recovers enough from deflation and recession, the BoJ will be unable to restrain a rise in bond yields. Because the harder it “tries” to restrain them, the more the equilibrium yield will rise. But when the recovery looks strong enough, the BoJ will stop “trying” to restrain bond yields, and start “trying” to increase them, at which point those bond yields will stop rising.

Ambrose also says that Richard Koo is “... Japan’s most famous economist and an arch-Keynesian.” There’s a lot of weight placed on the “arch” bit in “arch-Keynesian. Paul Krugman is a Keynesian, but I don’t think Paul would have a problem recognising that Abenomics, if successful, would drive up bond yields. I think he would cheer the rise in bond yields, and say it means that the BoJ has escaped the liquidity trap, so that monetary policy once again has “traction”. Is Richard Koo really a Keynesian? Or is he just a finance guy, who doesn’t really get macro/money?

George Dorgan:

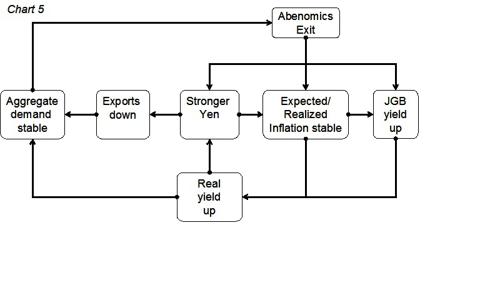

Yes, as Kyle Bass said, the BoJ is facing the “rational investor paradox”. If investors believe in Abenomics to generate inflation, then a rational investor is going to sell his bonds, even if Abeconics wants to stabilize yields.

Abenomics (a must read on Seeking Alpha)

Richard Koo is, like Paul Krugman, a fiscalist that allows for fiscal stimulus under certain situations, e.g. in a balance sheet recession, when people and firms do not want to spend and they prefer to reduce debt. But Koo insists that monetary stimulus is helpless in a balance sheet recession.

Nick Rowe: This is not the “beginning of the end” of the Japanese economy. But it might be, and I hope it is, the beginning of the end of Japan’s long recession.

And if this is indeed the beginning of the end of Japan’s long recession, it will also be the beginning of the end of Richard Koo’s thesis that monetary policy is powerless in a balance sheet recession, and that only fiscal policy can offset private sector deleveraging. And we can only regret that Japan did not do this many years earlier, instead of wasting all those years and letting Japan’s government debt/GDP ratio climb. Because that high debt/GDP ratio is the only reason why someone might want Japan’s economic recovery but not want the higher interest rates that will accompany that recovery. Which is no reason to try to stop the recovery. Though it is one additional reason to regret not having done something like Abenomics a lot earlier.

George Dorgan:

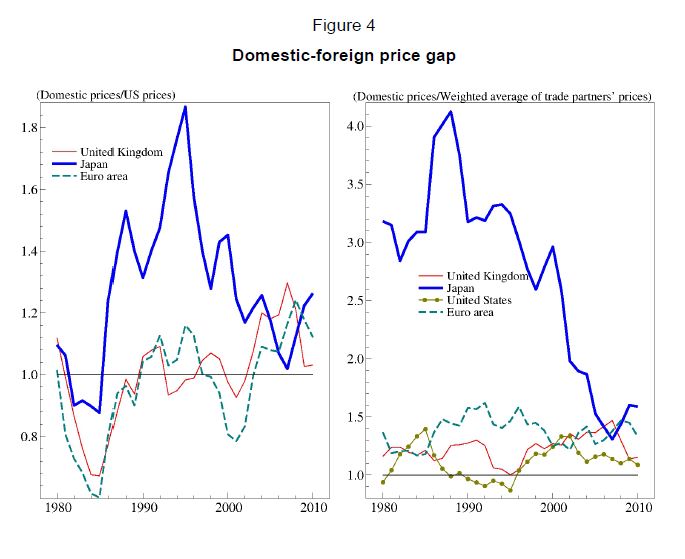

Until the mid 2000s Japanese prices were too high, when compared to other countries. It was possibly perceived that “Japan’s prices were in general too high in comparison with those of other countries”. The following shows:

Relative prices against the US and major trading partners based on the PPP exchange rate. This indicates that Japan’s prices were more than 1.8 times higher than those of the United States around the middle of the 1990s. Since then, the price gaps have narrowed as Japan’s prices have remained weaker than those of other countries. (source).

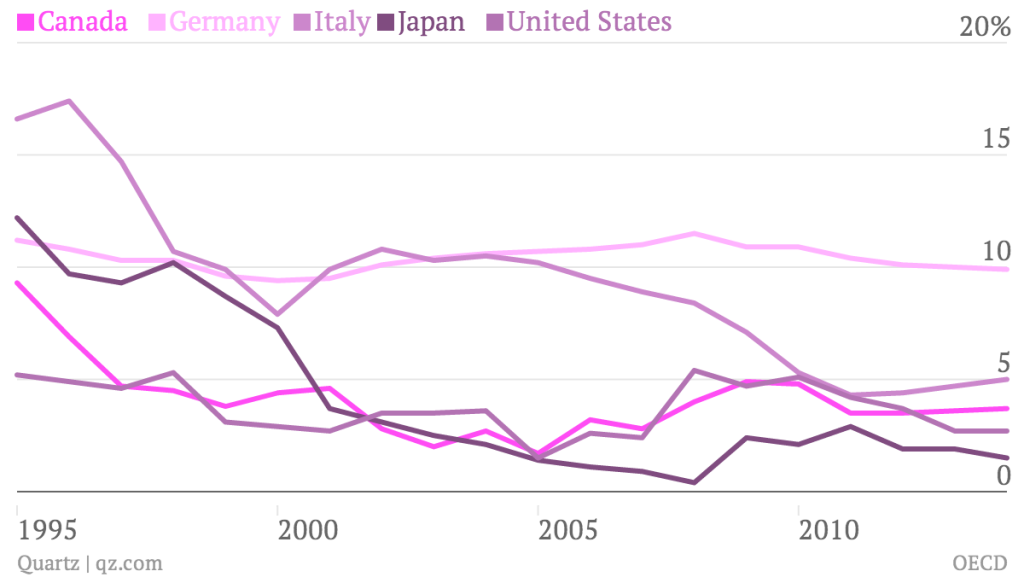

Household Saving Rate Canada Germany Italy Japan United States (source)

Until 2008, it was not possible to stop the Japanese property price bust, despite the already falling saving rate, even if the BoJ tried all monetary tools. The bust had a big deflationary effect.

During the housing booms in the US and Europe, foreigners did not want to invest in Japan, while the Japanese investors preferred to move their money abroad and did not borrow.

Source Paul Krugman

The strengthening of the Japanese economy in 2009/2010 despite the global recession showed that the Japanese balance sheet recession ended at the latest in 2010. Some, like Prof. Noah Smith, even suspect that deflation and the liquidity trap was no real issue since the year 2000.

From the financial crisis on, Japanese investors repatriated their foreign investments and started to move into Japanese assets, initially in JGBs.

Similarly in 2013, many Japanese investors realized gains on their foreign bond holdings . The extreme devaluation of the yen has pushed the Nikkei upwards and fueled potential inflation pressures in an economy that was hardly concerned by the euro crisis or the long-term US weakness.

With the end of the US weakness and the end of risk averseness, however, the yen would have depreciated with or without Abenomics.

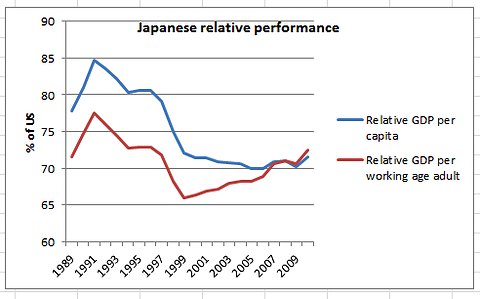

Japan – GDP, good performance despite falling population and strong yen

Apart from demographic issues and low inflation expectations, recent Japanese deflation was caused by global slowing and the strong yen, the hedonic effect of the Japanese technology nation, by lower fees (like lower scholarship fees) and good Japanese infrastructure and productivity. (For NGDP fans read also technology downwards adjustment for NGDP)

But which Japanese would renounce the newest technology because they think it will be cheaper next year??

So why avoid deflation that is mostly caused by technological improvements, but not by falling property prices like during the balance sheet recession?

The balance sheet recession had already finished in 2010, deflation is no real issue. In Q1/2013 Japan was the fast-growing G7 economy (in real terms). When GDP is calculated per working age adult (see Krugman’s graph above), then Japan is growing even more.

The following is the real issue of Abenomics:

Addressing problems that do not exist any more. And putting Japanese banks into risk and even the Japanese state ….

There was no need for Abenomics, the economy would have strengthened anyway when the yen had depreciated thanks to a US recovery.

But, as opposed to Kyle Bass and others, we are quite confident that the Japanese will be able to avoid high inflation, and therewith, bankruptcy.

Abenomics exit scenario (a must-read on Seeking Alpha)

Once the upcoming sales tax and yen devaluation are priced in, inflation should come down to zero again and then JGBs will rise again. Over the long-term I do not believe in the 2% inflation target of Abenomics, but three years after the end of the balance sheet recession, also deflation will end.

Tags: Abenomics,Bank of Japan,Japan