Yesterday’s German CPI has given a first insights of what is coming these years: German inflation. For years excessive risk averseness put pressure on German yields. Most recently, energy prices helped to push down inflation and on German yields possibly for a last time. But many ignore that the main reason for inflation are rising wages:

For rising German wages there won’t be a back-stop in the future, close to full employment, ageing population and still insufficient immigration.

Latest German CPI: China-like Food Price Inflation

Food prices have risen by 5.3% against 2012. After the short-term trough in April 2013 – yearly prices compared to expensive oil in April 2012 – energy prices have recovered.

| Weight in Promille |

Feb2013 | March 2013 | April 2013 | May 2013 | |

|---|---|---|---|---|---|

| Total | 1000 | 1,5 | 1,4 | 1,2 | 1,5 |

| Goods | 479,77 | 2,0 | 1,4 | 1,5 | 1,9 |

| of which: | |||||

| Energy | 106,56 | 3,6 | 0,5 | 0,4 | 1,5 |

| Food | 90,52 | 3,1 | 3,7 | 4,1 | 5,3 |

| Services | 520,23 | 1,1 | 1,5 | 0,8 | 1,5 |

| of which: | |||||

| Shelter | 209,93 | 1,2 | 1,3 | 1,3 | 1,3 |

In 2012, we spoke about the big short against German Bunds; at the time only based on the German responsibility/risk to finance the periphery. But now the more important criterion for bond yields, rising wages and inflation, will slowly tick in. Even if European leaders and the ECB emphasize falling labor costs in the periphery, there seems to be little substance.

Italian wages are rising by 1.4% , French ones were up 1.8% in Q4/2012, only Spanish and Greek wages came down (see Eurostat data). With reduced European austerity, demand for German products should rise again. The day that French, Italian or Spanish products can beat German ones in price, is very remote. The only product group that is often imported, food, gives a first hint.

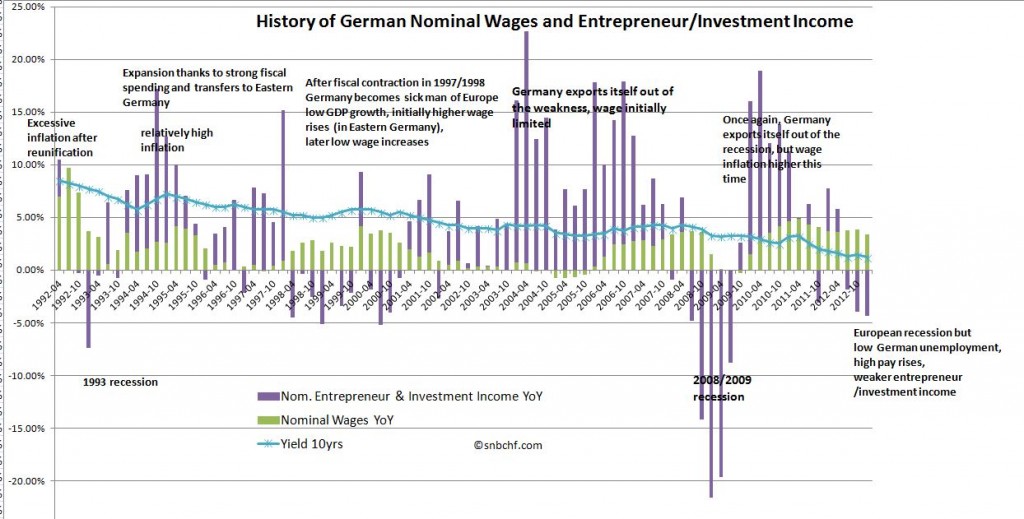

History of German Nominal Wages and Entrepreneur/Investment Income

With the GDP release, the German statistics bureau, destatis, offers also a history of “employee income”, i.e. nominal wages and the “entrepreneur and investment income” (click on graph to expand)

data source Destatis

It shows several phase since 1991:

1990-1993: Extreme fiscal expenditures with the German reunification caused high German wage increases and led to the implosion of the European Monetary System and a short-lived recession in 1993.

1994-1995: Continuing fiscal expansion let both wages and entrepreneur income rise until 1996

1997-2003: Austerity for the euro introduction reverses the expansionary policy. Germany becomes the “sick man of Europe”. Apart from an increase during the dotcom bubble around 1999/2000, German nominal wages stagnate until 2006.

2003-2008: Germany exports itself out of the weakness. Initially wages are mostly limited while they rise at the end of the period with increasing oil prices and inflation.

2008-2009: Recession

2010 -2011: Once again Germany exports itself out of the recession, but this time wage inflation is higher.

Since 2012: Wages continue to increase, but due to the weakening in Asia company profits decline.

With record-low German unemployment , the recovery in the United States, less austerity in Europe, it is obvious that German salaries and inflation will see mostly one direction: upwards.

Short German Bunds

The idea is to short German Bunds with maturities of ten years and more. This is a long-term trade over many years. Traders should use upcoming risk averseness to short 10 year Bunds at levels between 1.45% and 1.5%.

Read also:

Tags: Bund,Bunds,German,Germany Consumer Price Index,Germany Exports,Germany Unemployment Rate,inflation