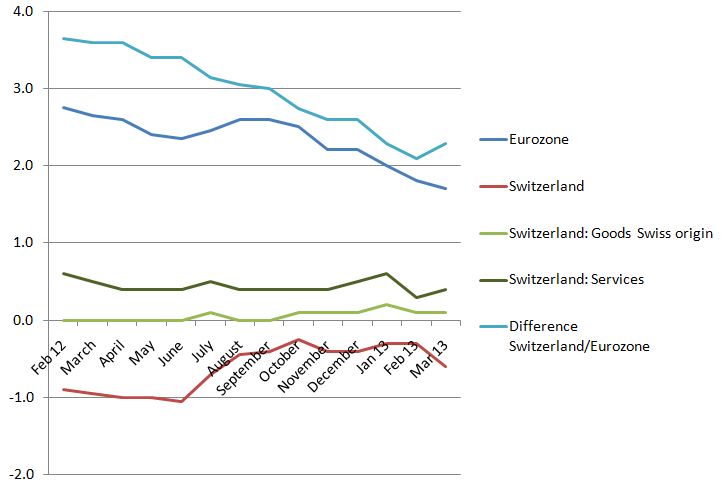

Swiss inflation edged up 0.2% MoM in March when seasonal effects on clothes and footware were corrected.

According to Swiss Statistics, on a year basis, the CPI fell by 0.6%. Major reasons were the falling energy prices, reflected in -1.2% YoY in transportation and -0.7% in the category “housing and housing energy”. The difference between the Eurozone CPI and the Swiss one increased for the first time since the floor introduction. One reason is that Swiss energy prices are taxed less, therefore changes in prime materials cause higher volatility. Both inflation for services and goods of Swiss origin are over 0%. Deflationary pressures are still exercised by imported goods, but with time these will be worn out when the FX rate in longer-term import contracts are modified.

Read more on the drivers of Swiss inflation.

Are you the author? Previous post See more for Next post

Tags: Eurozone Consumer Price Index,inflation,Swiss economy,Switzerland,Switzerland Consumer Price Index,Switzerland inflation

1 comment

George Dorgan

2014-07-03 at 19:31 (UTC 2) Link to this comment

No issue, just provide credit.