Hedge Funds have lost their power. This year has shown that their only remaining possibility to gain easy money is a concerted action with some of their friends manipulating currency markets, calling it “currency wars” and creating an unholy alliance with the dovish prime minister Abe.

Some of the biggest U.S. hedge-fund investors have made billions betting against the yen, exploiting Japan’s determination to weaken its currency and boost its economy.

Wagering against the yen has emerged as the hottest trade on Wall Street over the past three months. George Soros, who made a fortune shorting the British pound in the 1990s, has scored gains of almost $1 billion on the trade since November, according to people with knowledge of the firm’s positions. Others reaping big trading profits by riding the yen down include David Einhorn’s Greenlight Capital, Daniel Loeb’s Third Point LLC and Kyle Bass’s Hayman Capital Management LP, investors say. (source)

In reality, the “currency wars” reflected:

- The rows between China and Japan.

- Slower growth of China, India and other emerging markets due to higher wages and tightening measures of their central banks after inflationary pressure in 2011.

- Weak European demand for Japanese cars due to the European debt crisis.

- The strengthening of the U.S. housing market thanks to the Fed’s intervention in the U.S. housing market and money outflows from Europe for the U.S. Some of these funds in times of cheap money found its way in the perhaps undervalued U.S. homes.

- Limited global growth led to an end of rising gas prices – and this despite money printing. This dampened risk aversion and volatility. Low U.S. salary increases helped companies to achieve high profit margins. Margin Debt additionally helped to reach record levels at stock markets.

- The yen is the currency associated with high risk aversion. Point 4 and 5 led to additional depreciation of the yen.

- And certainly verbal intervention by Japanese leaders.

Real “currency wars” existed in 2010 when hot QE2 money flooded into emerging markets or in the 1970s when American funds came into Germany and Switzerland to escape American inflation. Also during the carry trade era, between 2003 and 2007, Japanese funds were invested in U.S. housing or U.S. treasuries, somehow also a currency war.

As opposed to 2010, Japanese FDIs or portfolio investments do flood into the US, but in Japanese equities; therefore today’s “currency wars” are not real but just a speculation with derivatives and margin trades in equities based on JPY borrowing. As soon as strong Japanese economic growth data comes out – what we expect – the weakness will end.

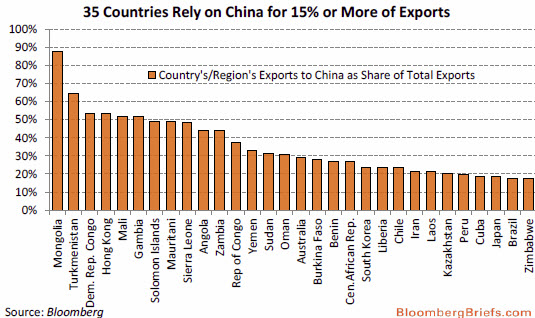

Some other countries are far more concerned by lower Chinese growth than Japan:

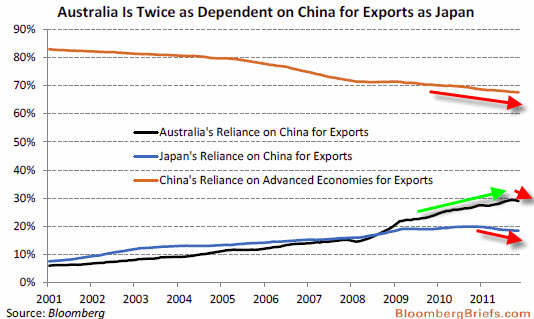

Australia’s dependency on China

While China depends on only one nation for 15% or more of its exports (US 17.3%), Bloomberg’s Michael McDonough notes that an incredible 35 nations depend of China for at least 15% of the exports; up from just 4 in 2001. Most are emerging markets or major commodity producers with the shift being driven by China’s demand for raw materials, fueled by its investment-led growth model and the stimulus package following the global financial crisis. This gross dependence leaves the world’s economy increasingly susceptible to shifts in the Chinese business cycle – most notably Australia which relies on China for a massive 30% of its export demand. This is almost double the next largest developed nation of Japan (which relies on China for 18.5% of its exports) though tensions between the two nations has led to an almost 10% decline in Chinese imports of Japanese goods since September. As we have noted, China has become a key source of FDI in Africa in recent years and 12 of the 20 most-China-dependent economies are from that continent; but as China attempts to transition from investment toward consumption, demand for commodities may slow and downside risk grows for these dependent commodity-producing nations. (source Zerohedge)

The news that the Chinese will increase their public deficit to 2%, while they try to cool the property market, is clearly bearish for Australia, which will be able to sell less commodities for construction, but bullish for Japan, which may export more electronics and cars thanks to a reduction of Chinese unemployment and higher Chinese consumer spending.

The key targets for this year included 7.5 per cent GDP, 3.5 per cent inflation and creation more than nine million new urban jobs to keep urban unemployment under 4.6 per cent, the report said.

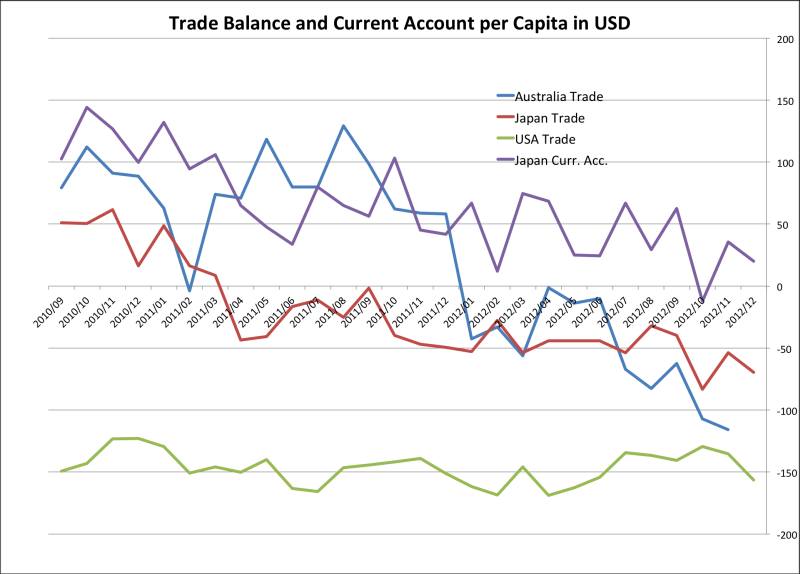

Effectively, the Australian trade balance is getting weaker and weaker, while the Japanese still have a positive adjusted current account. Similarly, the Kiwi trade balance is negative, as well. New Zealand is mostly dependent on Australia and therefore indirectly concerned by a slowing in China, while its diary products are exported to many other countries.

Japanese, Australian and US from investing.com

The Japanese economy is always strong in spring

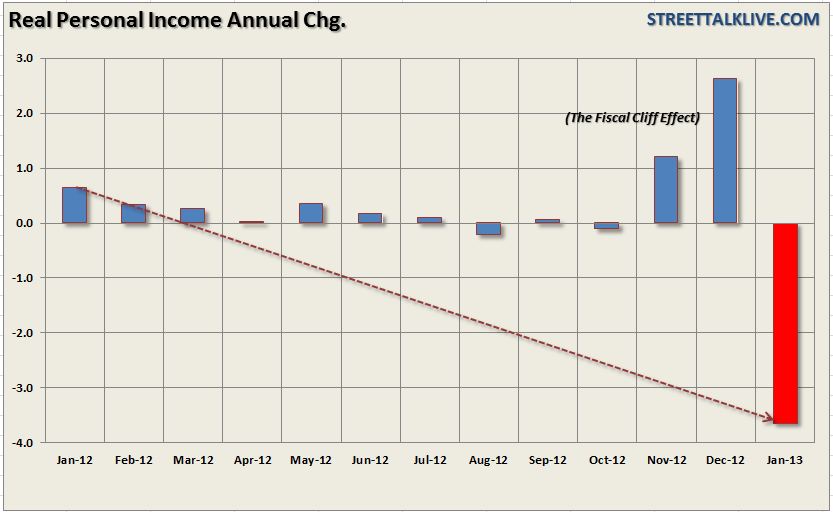

Average Japanese cash earnings are up 0.7% YoY despite deflation, while American personal income is down with the fiscal cliff effect.

The Japanese current account typically shows better values in the spring and summer than in the winter. The trade surplus with the U.S. is rising every month.

And the wonder: Tokyo asset prices and rents are rising after 21 years of descent.

Japan will not intervene in FX markets: Is the yen too weak?

March 04.2013

In the meantime, for the Ministry of Finance, the yen is too weak to do FX interventions. They still manage to find an excuse:

(Reuters) – Haruhiko Kuroda, the government’s nominee for next Bank of Japan governor, said on Monday it would be difficult for the central bank to buy foreign bonds in huge amounts under current international rules on currencies.

“As for currency intervention, the Group of Seven nations have a rule and the Group of 20 nations have a joint statement. There’s a set rule in place. As such, it would be difficult for the BOJ to buy foreign bonds in huge amounts,” Kuroda said in a confirmation hearing at the lower house of parliament. (source Reuters)

Nothing is left from the previous news:

JANUARY 15th, 2013

According to Bloomberg, at least prime minister Abe is taking the nuclear option and is following the SNB in buying foreign assets. This is a huge change in global monetary policy, when not only a small central bank like the Swiss, but one of the biggest ones goes for large-scale purchases of foreign assets.

Abe’s Liberal Democratic Party pledged to consider a fund to buy foreign securities that may amount to 50 trillion yen ($558 billion) according to Nomura Securities Co. and Kazumasa Iwata, a former Bank of Japan deputy governor. JPMorgan Securities Japan Co. says the total may be double that. source Bloomberg

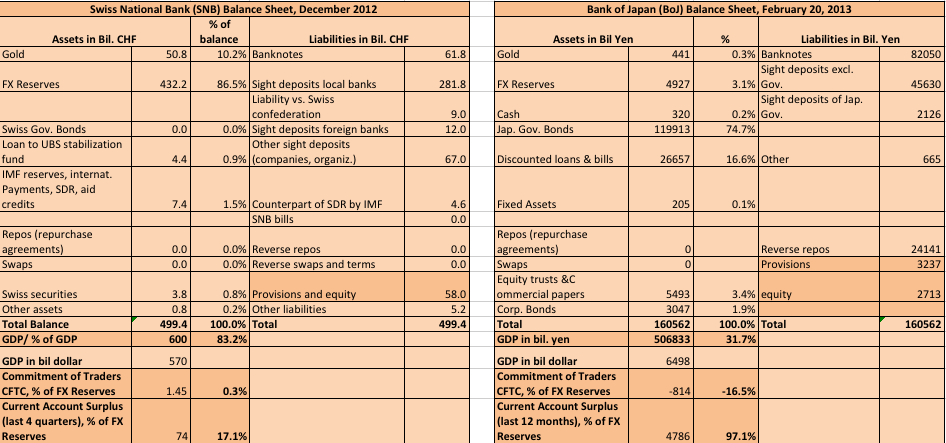

These are the balance sheets of the SNB and the BoJ compared: as can be seen the Bank of Japan (BoJ) has hardly any foreign assets in its portfolio, but masses of JGBs and Discounted Japanese T bills, for 30% of the Japanese GDP. The Swiss, however, posses nearly only foreign assets and some gold.

(click to expand), sources SNB monthly bulletins and Bank of Japan weekly accounts)

The question remains: When Will Hedge Funds and FX Traders Close their Short Yen Positions?

We think with the arrival of stronger Japanese data, they will. We judge that Japan might be the G7 country with the strongest growth in 2013.On the other side inflation will be clearly lower than 2%.

Therefore it is time to short USD/JPY, AUD/JPY and NZD/JPY.

We suggest reading “SNB Remains the Only Central Bank Currency Warrior: The Japanese do not Fight, they Talk”

“Currency Wars: How to Push and Talk Down Your Currency?”

“Guest Commentary: The Trade of the Year: Short USD/JPY”

“Why the Currency War is not the Main Driver of the Weak Yen”

Are you the author? Previous post See more for Next postTags: Abenomics,Bank of Japan,Helicopter Money,Japan,Ministry of Finance,monetary stimulus,SNB balance sheet,Swiss National Bank,U.S. Treasuries,USD/JPY