UPDATE March 4, 2013:

For the Ministry of Finance the yen is too weak to do FX interventions. Still they find an excuse:

(Reuters) – Haruhiko Kuroda, the government’s nominee for next Bank of Japan governor, said on Monday it would be difficult for the central bank to buy foreign bonds in huge amounts under current international rules on currencies.

“As for currency intervention, the Group of Seven nations have a rule and the Group of 20 nations have a joint statement. There’s a set rule in place. As such, it would be difficult for the BOJ to buy foreign bonds in huge amounts,” Kuroda said in a confirmation hearing at the lower house of parliament. (source Reuters)

JANUARY 15th, 2013

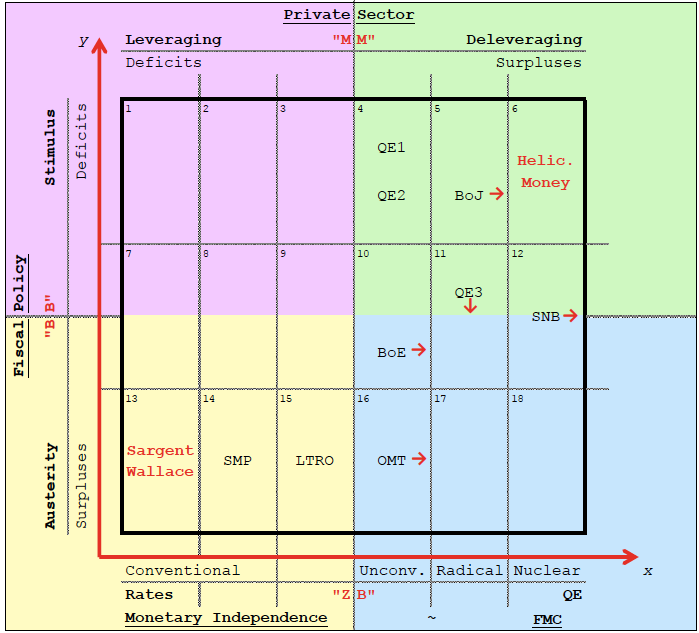

According to Bloomberg, at least prime minister Abe is taking the nuclear option and is following the SNB in buying foreign assets. This is a huge change in global monetary policy, when not only a small central bank like the Swiss one, but one of the biggest ones goes for large-scale purchases of foreign assets.

Abe’s Liberal Democratic Party pledged to consider a fund to buy foreign securities that may amount to 50 trillion yen ($558 billion) according to Nomura Securities Co. and Kazumasa Iwata, a former Bank of Japan deputy governor. JPMorgan Securities Japan Co. says the total may be double that. source Bloomberg

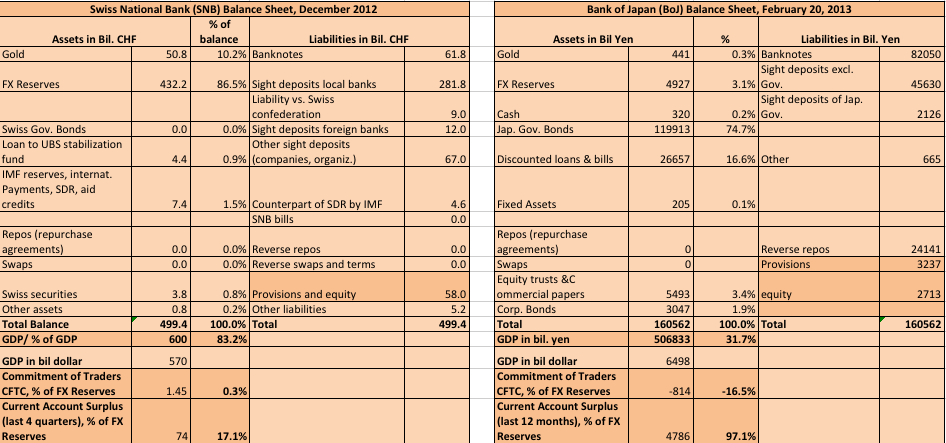

These are the balance sheets of the SNB and the BoJ compared: As visible the Bank of Japan (BoJ) has nearly any foreign assets in its portfolio, but masses of JGBs and Discounted Japanese T bills, for 30% of the Japanese GDP.

(click to expand), sources SNB monthly bulletins and Bank of Japan weekly accounts)

The Bank of Japan would go even above nuclear with this step, because the risks considerably increase; similarly as the SNB that is indicated to the very right side. As opposed to helicopter money, that is essentially buying government securities with printed money, the SNB and possibly soon the BoJ go beyond.

We suggest reading “SNB Remains the Only Central Bank Currency Warrior: The Japanese do not Fight, they Talk”

and “Currency Wars: How to Push and Talk Down Your Currency?”

and “Guest Commentary: The Trade of the Year: Short USD/JPY”

Are you the author? Previous post See more for Next postTags: Abenomics,Animal Spirits,Bank of Japan,Helicopter Money,Japan,Ministry of Finance,monetary stimulus,SNB balance sheet,Swiss National Bank,USD/JPY