When the Swiss National Bank introduced the 1.20 lower limit, it wanted to eliminate the deflationary risks for Switzerland. For a certain period, namely when a global recession was looming in Autumn 2011, and the Swiss franc was hovering around 1.10, this risk was really present. In this post we would like to know if these risks still exist today. This gives a hint when the SNB must remove the peg.

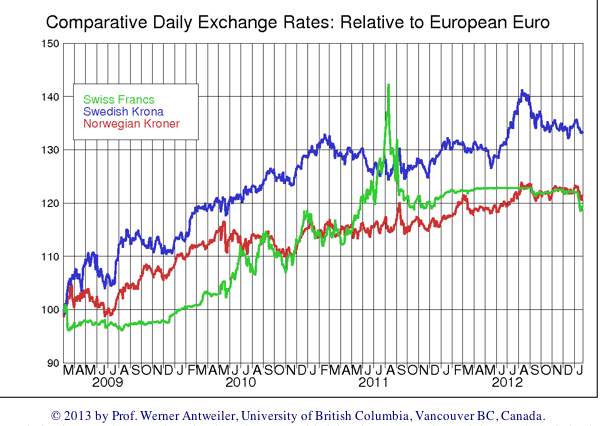

For this sake, we compare three countries, Switzerland, Sweden and Norway against the euro zone. The following is the relative exchange rate for these countries against the euro since stock markets started to improve in March 2009.

After the EUR/CHF overshot in August/September 2011, the exchange rate improvement of the Swissie was limited by the SNB at 24% against the euro (compared to March 2009).

The EUR/SEK and the EUR/NOK were allowed to continuously appreciate. It is visible that investors replaced the Swissie with NOK and SEK in September 2011, after the SNB floor introduction. But when the world economy seemed to go into recession and oil and stock markets fell, both Scandinavian currencies fell again.

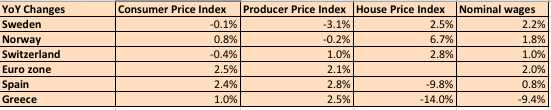

Our second look is on different inflation figures, on consumer, producer and house prices and on wages.

We used local CPIs for Sweden and Norway that include owner-occupied rent. For Switzerland and the euro zone (the “HPCI”) these items are excluded. It is visible that none of these three countries show deflationary risks. Especially house prices and wages, that have a longer-term effect on consumer price levels, are still strongly rising.

In the European periphery things are different: Spanish house prices are falling by nearly 10% per year and salaries must go down according to the policy makers. Thanks to rising oil and food prices and imports from Germany and other Northern euro members, the whole Spanish and Greek CPI is not (yet) in deflation.

Out of our three countries, only Sweden has one indicator in deflation: after the strong appreciation of the Krona, producer prices are still falling.

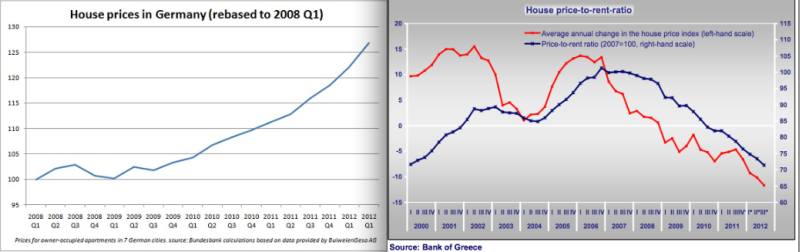

House prices in the euro zone have two different tendencies:

The recent increase of the EUR/CHF exchange by 3% from 1.20 to 1.24 will further push Swiss inflation upwards, given that imports take nearly 30%. This may neutralize the tendency that exchange rate changes arrive at the consumer only very slowly, visible above in the difference between consumer and producer prices. Hence this might push Swiss total inflation by 1% upwards and cause that inflationary tendencies clearly outweigh deflationary ones (see drivers of Swiss inflation).

While the SNB sees CPI inflation falling by 0.4% in 2013, UBS thinks it will increase by 0.6%, the BAK Basel speaks of 0.2%.

Are you the author? Previous post See more for Next post

Tags: Deflation,House Prices,Norwegian Krone,PPI,Producer Price,producer prices,Swedish Krona,Swiss National Bank,Switzerland,Switzerland Consumer Price Index,wages

1 comment

Llewyth

2013-01-25 at 00:24 (UTC 2) Link to this comment

Yep, but the rate will reslette at 1.20 IMHO. The SNB has to sell a lot of EUR and try to deleverage.

And importers can still transmit a part of the 1.60-1.20 FX change gains with the public.

So I predict 0.00 inflation this year.