To us, the big theatre surrounding Greece was just a preview of a much bigger crisis that will happen in the coming years in Spain, the upcoming Spanish lost decade(s). Greece was an absolutely desperate case; therefore, everything was quick. It took just two years till we arrived at the official sector participation and yearly German transfer payments to Greece.

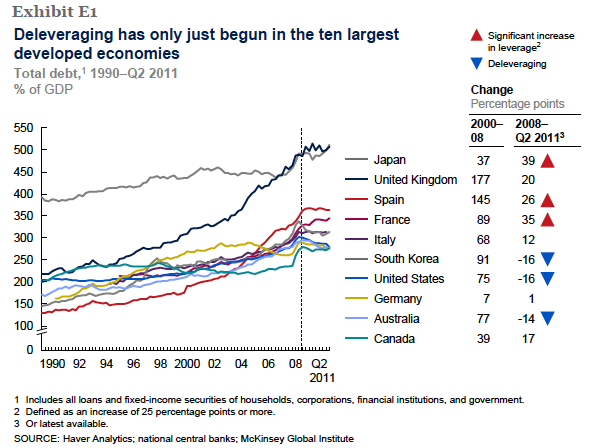

The Spanish lost decade(s) have just started in 2010/2011 in its full-fleshed version, as the first measures the Spanish government implemented between 2008 and 2010 were counter-cyclical government spending, with an increase in leverage by 26%. These measures kept the Spanish economy alive for a certain period, but since 2011 households and banks will need to de-leverage, bad loans are ever increasing.

Mexico and Brazil could kick-start their economies after their lost decade in the 1980s and 1990s, thanks to commodities, relatively low salaries and a weak currency. Spain has none of these three factors with the euro. One main source of income, tourism, has a big disadvantage against competitors like Turkey or Egypt.

The must-watch video: The Spanish Crash

Are you the author? Previous post See more for Next post

Tags: lost decade,Mexico,Spain