John Cassidy’s remarkable interview with the Nobel Prize winner Paul Samuelson maybe best describes the rise and fall of Keynesian economics.

John Cassidy’s remarkable interview with the Nobel Prize winner Paul Samuelson maybe best describes the rise and fall of Keynesian economics.

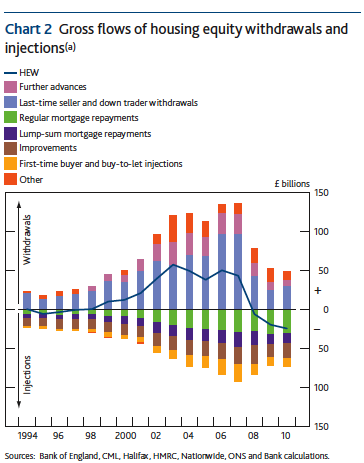

Since households need to deleverage, the idea of fiscal spending during periods of weak growth makes sense for non-mainstream economists like Prof. Steve Keen (see why) and for Nomura’s Richard Koo (see why).

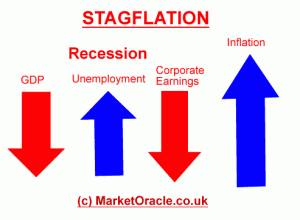

Still, Keynesians led the world to two of its most unfortunate experiences, the 1970s stagflation and to the sub-prime bubble.

One remark: Samuelson calls himself a “post-Keynesian”, which is entirely different from the “Post Keynesians”, a movement that, as opposed to the neoclassical mainstream, wants to use Keynesian monetary theory not only for the short-run, but also for the long-run.

Are you the author? Previous post See more for Next post

Tags: Keynesian,Post-Keynesian,stagflation