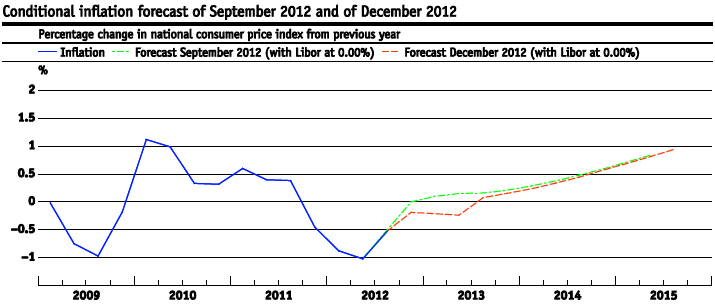

The SNB decided to maintain the floor at 1.20 and the Libor target between 0% and 0.25%. As we expected in our outlook on the assessment, there were still important downwards drivers of inflation after the strong appreciation of the franc. Therefore, the SNB has moved its inflation expectations downwards for 2013 to minus 0.1% and for 2014 to 0.4%, despite the expected weakening of the franc.

The short form of the SNB monetary policy assessment is available at the SNB site.

In the following we give details from the press conference.

Thomas Jordan, chairman of the Governing Board

The full video on the SNB site (video on bottom part). In the following the summary:

Growth expectations

The world economy is growing slower than expected. The only country that has started to recover a bit are China and the United States thanks to the help of the Fed. In Switzerland exports recovered in the third quarter. However, in the fourth quarter, growth is probably going to be a lot weaker. In 2012, real GDP growth should be 1%. For 2013 they expect growth of 1% to 1.5%. The strong franc hampers export activity and investments of the companies. The internal demand will be limited and the unemployment rate higher.

Downwards risks

The downwards risk for Switzerland remains high. The SNB thinks that the euro zone will be leaving the recessionary phase in the middle of 2013. Thanks to the Outright Monetary Transactions (OMT) of the ECB, the downwards risks will be reduced. However, the fiscal cliff constitutes another potential risk.

Monetary data

On the franc interventions

Between May to August, the SNB had to purchase large quantities of foreign currency in order to enforce the minimum exchange rate. Consequently, the SNB’s foreign currency investments have significantly increased. It cannot exclude the possibility that it will have to intervene substantially again. Through diversification the SNB is trying to reduce the risks in its balance sheet. For monetary reasons, however, the SNB must accept the FX risks. The SNB works as a buffer between the markets and the Swiss economy in order to limit the risks of a shock. Thanks to long-term orientations, it is able to fulfill its mandate: price stability under the consideration of economic trends.

Jean-Pierre Danthine, vice chairman of the Governing Board

Situation of the big banks [UBS and Credit Suisse]

The situation of the big banks has improved since the last news conference, as both institutions have further increased their equity and other measures to reduce risks. This increase in equity was particularly pronounced at Credit Suisse. The level of debt of the big banks remains high and is a high risk, especially if the European debt crisis intensifies again.

Risks in the housing sector and repercussions on the banks

Due to the still exceptionally low interest rates considerable risks exist. In the search for higher returns, investors target real estate. Real estate prices are rising at a higher rate than expected in the second quarter. Credit in form of mortgages is rising far more quickly than GDP. Therefore imbalances have intensified. The banks are ready to take risks,. We see this in the following points:

- For new mortgages, the ratio between the credit and the home value and the ratio between credit and revenue of the mortgage taker remains high.

- The interest rate risk remains high.

- The already weak margin on the interest rate has fallen further.

The capitalization of banks remains high when compared to historical levels, but this data may disguise the capacity for resistance of these banks. The risk of an abrupt correction of these tendencies over the medium term keeps increasing.

Under these circumstances, the SNB is carefully monitoring the developments in the mortgage and real estate markets. It periodically assesses the necessity to activate the countercyclical capital buffer.

Tags: Jordan,Monetary Policy,negative interest,Swiss National Bank,Switzerland,Thomas Jordan

2 comments

1 ping

netmex

2012-12-15 at 01:29 (UTC 2) Link to this comment

No question about GOLD??? The Germans are asking for inspection, the Austrians know now that most of their Gold is abroad, the Chinese buy like crazy… and no question about Gold? Gimme a break!!

DorganG

2012-12-15 at 05:41 (UTC 2) Link to this comment

The Swiss press is trained not to ask questions that could put the SNB too much under pressure.The gold question has two aspects. As you say, where is it? However, this is probably too long for this meeting.

The second one, however, is more interesting: For years the SNB did not increase its gold reserves as much as fiat money, in the last quarter it switched to USD. Given that gold is strongly correlated to the franc https://snbchf.com/2012/12/arbitrage-trading-after-negative-cs-ubs-interest-rates/, why do they not buy so less gold, but rather dying currencies like the USD ?

Gold would be exactly the hedge against FX losses they are looking for.

SNB Losses 1.85 Billion Francs in Just One Day, 231 Francs per Inhabitant - SNBCHF.COM

2012-12-19 at 06:25 (UTC 2) Link to this comment

[…] be some more days when the whole country will need to work for its central bank, especially if SNB’s weak inflation expectations were beaten by reality: the producer price index has risen by more than […]