The Swiss National Bank (SNB) had valuation losses of around 6 billion francs in October due to the weaker EUR/CHF exchange rate and a weaker gold price.

The FT reports:

“Overseas currencies held by the Swiss National Bank dipped in October to SFr424 bn, after hitting a fresh record high of SFr429 bn the previous month. Analysts said the fall was likely to be due to changes in the value of the franc, rather than any shift to sell assets by the SNB.”

According to the FT, Rudolf Minsch, chief economist for the Swiss business federation, says that

“[Swiss] industry would prefer a weaker exchange rate, but that is “unrealistic, taking into account the difficulties in the eurozone”. The chance of the SNB taking losses, he says, is an “occupational hazard”.

The German professor Peter Bofinger, however, recommended that you should not care about the risk of potential losses and to raise the EUR/CHF minimum rate to 1.35.

The SNB data on money supply, the counter position to SNB currency purchases, fell by 0.9 billion francs between September 28 and November 5, a period we use to approximate the month of October.

“Week ending on November 2: 372’538 million francs

Week ending on September 28: 373’416 million francs”

These money supply figures include only sight deposits by banks and firms at the SNB, but exclude bank notes and coins. The M1 figures which also include bank notes and coins are not available yet.

According to IMF data, SNB gold holdings have lost a value of around 2 bn. CHF after the gold price depreciated from 1768 to 1720 US$ in October.

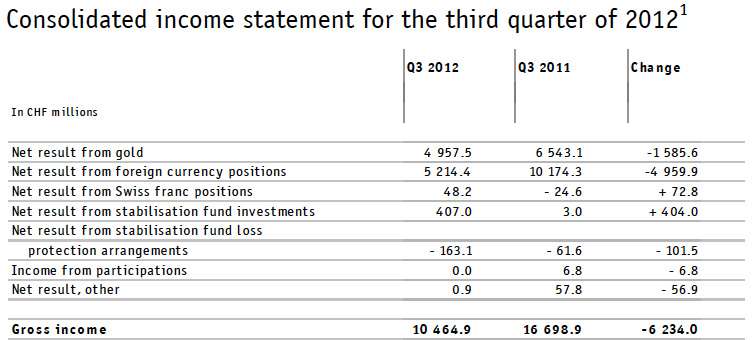

In the third quarter until September, however, the central bank was able to achieve the strong result of 10.5 bn. francs, thanks to the easing measures of the major central banks that pushed the gold price up by nearly 200 US$ and also helped to strengthen the euro. Both gold and foreign currency positions saw gains of around 5 bn. francs in the third quarter.

In October, however, the picture changed, when the temporary effect of the central banks’ easing vanished (see “The Shrinking Half-Life Time of Central Banks’ Actions”):

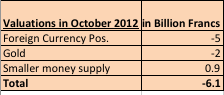

The value of foreign currency reserves fell by 5 bn. and gold holdings by 2 bn. francs, but the counter position of money supply only decreased by 0.9 bn. francs.

This means that the central bank experienced valuation losses of about 6.1 bn. francs in the month of October. The large volatility of the holdings reflects the risk the SNB takes with its huge amount of foreign currency reserves. Additionally, extremely low yields from its major government bond holdings reduce the income of the central bank and increase risks.

Tags: Deposits,Reserves,SNB Gold Holdings,SNB profit,Swiss National Bank,Switzerland Money Supply,yields