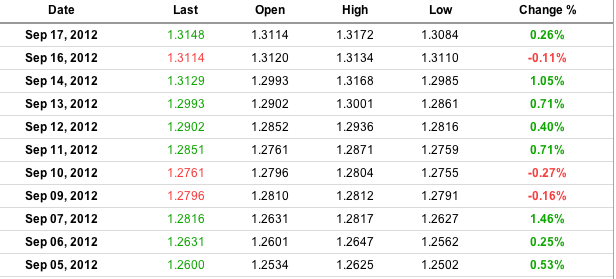

Recently we have observed the upward movement of all euro pairs. They have marked more or less continuously higher highs and higher lows thanks to massive support from the central banks ECB, Fed and SNB (ignore Sunday 16th)

The first euro pair to finish this upwards trend is traditionally the EUR/CHF. Friday’s weak industrial production and Monday’s bad NY manufacturing data, let investors doubt that the US recovery thanks to “QE ∞ “ will really take place. Apart from gold, the Swiss franc is the safe-haven that is closely associated with rising oil prices and inflation fears caused by quantitative easing.

The CHF saw today a lower low, but also a higher high. This lower low breaks the rising EUR/CHF channel. Traditionally a fall of EUR/CHF comes some time before EUR/USD or EUR/JPY go south.

This year’s situation

Since the beginning of September the speculators (like Forex traders or investment bank traders) were long EUR/CHF. At the same time sight deposits at the SNB rose by 5 billion in the first week of September and by 2.6 billion CHF in the second week (see more on sight deposits). Rising sight deposits can often be translated that long-term investors are piling into Swiss francs and the SNB needs to buy euros or other currencies to counter this move.

For simplicity we assume that the SNB also buys euros in order to counter the inflows into CHF and not other currencies. In this situation both speculators and SNB are long EUR, but long-term investors are long CHF. In the first two weeks of September speculators and SNB outweighed the long-term investors and the pair appreciated.

| Long EUR | Long CHF | EUR/CHF | Period (2012) |

Total pos. >> + 5 bln. |

Sight deposits +5 bln | 1.2010 ->1.2102 | Sept 3- Sept 7, 2012 |

Total pos. >> +2.6 bln. |

Sight deposits+2.6 bln | 1.2102 ->1.2168 | Sept 10- Sept 14, 2012 |

| Weak US data à Sight deposits up | 1.2168 ->1.2161 | Monday Sept 17: trend break with lower low at 1.2144 |

Same trade, one year ago

One year ago the situation was completely different. The SNB had just introduced the floor, Switzerland was heading for a Q3 contraction of 0.2%, the CHF-correlated gold followed the following CHF shortly after, when recession fears finally triggered a sharp drop in commodity prices.

Gold was going for one of the biggest fall ever from 1824 on September 12 to 1590 on September 28, 2011. Investors were moving frenetically out of gold and out of the correlated franc. Let’s look on the 2011 positioning as for francs:

Most importantly, sight deposits were on the other side: they were long EUR together with the speculators; the SNB was buying francs and reducing FX reserves.

| Long EUR | Long CHF | EUR/CHF | Period (2011) |

Total pos. >> 6 bln. |

SNB > +6 bln. CHF | 1.2043 ->1.2086 | Sept 12-16, 2011 |

Total pos. >> 5 bln. |

SNB > +5 bln. CHF | 1.2062 ->1.2227 | Sept 19-23, 2011 |

Will EUR/CHF fall like a stone or does the SNB help?

With the broken upwards channel, many technical traders, who are a big part of the speculators, will take profit. This means that positions of possibly 5 billion francs will go long CHF.

| Long EUR | Long CHF | EUR/CHF | Period (2012) |

Total pos. >> + 5 bln. |

Sight deposits +5 bln | 1.2010 ->1.2102 | Sept 3- Sept 7, 2012 |

Total pos. >> +2.6 bln. |

Sight deposits+2.6 bln | 1.2102 ->1.2168 | Sept 10- Sept 14, 2012 |

-Total 9 bln. (?) |

Weak US data à Sight deposits up +4 bln.(?)Speculators take profit +5 bln. (?) | 1.2168 ->1.2161 | Monday Sept 17: trend break with low at 1.2144 |

This implies that the SNB is left alone as EUR buyer with volumes of 9 billion CHF or more. The question is now if

1) The SNB will allow the pair to fall to 1.2010 in order to get the euro cheaper.

2) The central bank decides to sustain the upward channel despite the break. This means that the bank pays too much for the euros.

3) She decides for a slow downwards movement at the cost to buy the euro too expensively.

In the first case the pair could fall like a stone to 1.2010 or some support levels under 1.21. This could especially happen, when, as often, bad news from Spain arrive. A perfect scalp ?

Are you the author? See more for

Tags: Switzerland