Swiss Gross National Income (GNI) rises by 1.8% in Q2, after Q1 +0.5%

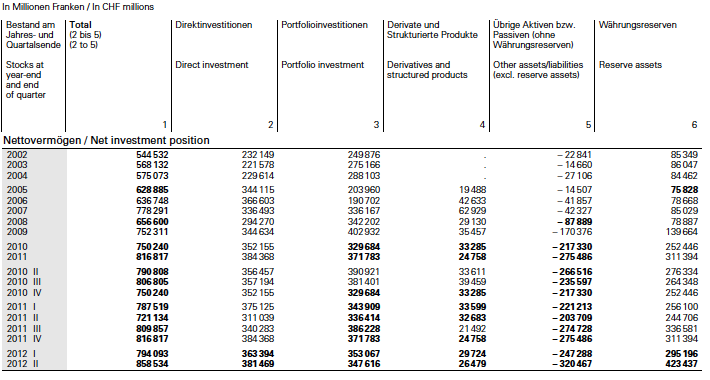

According to the latest SNB Monthly Bulletin, the Swiss net international investment position (NIIP) has improved by 64.5 billion francs. The Gross National Income (GNI) rises by 1.8% in Q2.

The SNB contributed with its 6.5 Bln. half-year profit to the 64.5 billion CHF NIIP improvement.

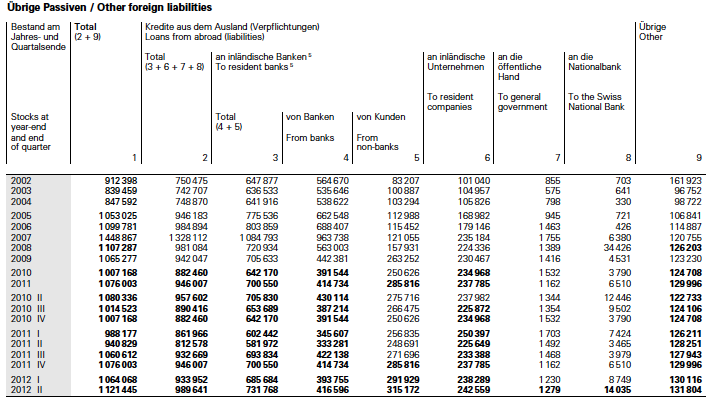

Swiss commercial banks reduced loans to foreign debtors by 14 Bln. CHF (see more in the monthly bulletin, page 137).

In the table below we can observe that banks increased their debt to foreign creditors by 47 Bln. CHF, of which 23 Bln to banks and 24 Bln. to private clients. The money, the banks borrowed from foreigners, was then lend to the SNB. The central bank increased its direct debt to foreigners by only 6 Bln. CHF, because its operations were mostly unsterilized, i.e. via deposits to local bank and not via SNB bills directly to local or foreign investors.

Certainly, local clients provided additional funds to bank in order to finance the SNB FX purchases, but they are not contained in the table.

Swiss Gross National Income (GNI) rises by 1.8% in Q2, may push Franc higher

The change in the international investment position is reflected in the strong increase of 1.8% of the Swiss Gross National Income (GNI) in Q2/2012, much stronger than the 0.5% appreciation in Q1/2012 (source SECO).

Financial markets and Forex traders usually judge that the Gross Domestic Product (GDP) is more important. Swiss GDP contracted by 0.1% in Q2/2012 after a rise of 0.5% in the first quarter.

During risk-off periods, however, the net international investment position and the GNI become far more important, because foreign assets represent a collateral for creditors (more details here). Moreover, foreign profits are in risk-off periods repatriated into local currency, which then pushes the franc higher.

SNB’s Thomas Moser gave yesterday a detailed explanation, why this profit repatriation was one of the main reasons for the strong franc and the capital inflows (details NZZ) and probably also for the strong inflows in Q2.

Are you the author? Previous post See more for Next post

Tags: international investment position,Monthly Bulletin,NIIP,Swiss National Bank

4 pings

Guest Commentary: Standard and Poors Critique of the Swiss National Bank | Forex Trader Markets | The future of Forex is here…

2012-09-26 at 20:14 (UTC 2) Link to this comment

[…] Position (NIIP) by 65 billion francs in the second quarter, a whopping 9% of Swiss GDP. We reported here or on Daily FX. Between May and July the SNB currency reserves rose by more than 50 billion francs […]

Guest Commentary: Standard and Poors Critique of the Swiss National Bank | Top Binary Options Brokers Reviews

2012-09-26 at 22:17 (UTC 2) Link to this comment

[…] Position (NIIP) by 65 billion francs in the second quarter, a whopping 9% of Swiss GDP. We reported here or on Daily FX. Between May and July the SNB currency reserves rose by more than 50 billion francs […]

Guest Commentary: Standard and Poors Critique of the Swiss National Bank | Currency Trader News

2012-09-27 at 13:32 (UTC 2) Link to this comment

[…] Position (NIIP) by 65 billion francs in the second quarter, a whopping 9% of Swiss GDP. We reported here or on Daily FX. Between May and July the SNB currency reserves rose by more than 50 billion francs […]

Guest Commentary: Standard and Poors Critique of the Swiss National Bank | Forex Protocol News

2012-10-07 at 02:00 (UTC 2) Link to this comment

[…] Position (NIIP) by 65 billion francs in the second quarter, a whopping 9% of Swiss GDP. We reported here or on Daily FX. Between May and July the SNB currency reserves rose by more than 50 billion francs […]