Germany’s stance in the euro crisis: More than ESM will not be possible for many years

updated on August 31, 2012

German politicians and the German Bundesbank believe that the Euro crisis can be only solved by supply side reforms as formulated in the Euro Plus Pact, reforms that were already successfully introduced during the Thatcher/Reagan era in the UK und the US or in Germany between 2000 and 2007.

Merkel’s CDU does not want Eurobonds; her party thinks that commonly issued bonds would be an incentive for the PIIGS not to implement austerity and supply-side reforms. The Fiscal Compact formalizes the austerity plan: It requires the strong reduction of government debt and a balanced budget rule. This new pact includes automatic penalties. The Fiscal Compact is additionally enforced by strong controls in the form of the “European Semester”, through which the European Commission controls national budgets. Currently there are plans that the Fiscal Compact is extended so that the Commission is able to control the national budgets for the following year before October 15.

The ratification of the Fiscal Compact including the balanced budget rule is the precondition that countries may get access to the permanent European Stability Mechanism (ESM), which was originally designed to replace the temporary EFSF.

The ESM and the Fiscal Compact are currently under examination of the German Constitutional Court. The court will decide on September 12. We think that it will pass the treaties but with many modifications and with limits on German liability. These modifications will need several months up to one year, the laws need to be rewritten and all parliaments must pass them. In the extreme case the court will rule that German need to adopt in a referendum.

Hans Werner Sinn gives his comment on the upcoming court decision here.

In December 2011 Germany and France advocated steps towards a fiscal union. According to Merkel a fiscal union would require that Brussels have a veto on national budgets, a measure still rejected by France. Some commentators even suggest that the logical step of a fiscal union would be a centralized finance ministry under EU or German lead.

After France’s new president Francois Holland had revealed his plans to cut the pension age to 60 years, Merkel has promptly introduced the step of a political union including common economic policy and a loss of sovereignty towards Brussels (which would never have permitted the pension age reduction). Only after that a fiscal union would be possible.

Both a fiscal or a political union requires a referendum over a new German and other countries constitutions. This process takes 2 to 4 years.

The final step Eurobonds, i.e. unlimited common responsibility, implies directly unlimited transfers among member states. The same applies to a banking union, because a bank that takes aids from a common banking fund, might easily never return the money and go bankrupt, without any responsibility of the concerned member state.

In summary:

English-speaking press and many hedge funds are sure that Germany will pay

The French president and economists especially in the english-speaking countries and very influential papers like “The Financial Times” or “The Economist” want Germany to take anti-crisis measures and finally to shortcut the route to Eurobonds and a banking union, which implies German transfer payments and not only loans. At the same time their domestic countries, the UK and the US do not want a strong increase of their contributions to the IMF, whereas BRICs countries agreed to raise their payments to the IMF by 95 bln. US$.

Financial markets and hedge funds are of the strong believe that Germany will finally give in and allow for Eurobonds to avoid a global financial crisis.

As German native speakers we strongly suggest investors not to buy in what these papers are writing and what these hedge funds are betting on. We believe in what the German press and what German politicians and courts say.

Merkel’s stance against Eurobonds has hardened

Merkel assumes that Greece and even contagion to Italy and Spain is rather like the 1998 Asia crisis, but not a global downturn in the center of the financial system in the United States like the sub-prime crisis was. In the strong trust that no global crisis is imminent, Merkel has hardened her stance as compared to last autumn’s endless attempts to solve the crisis when many were fearing a US recession. And even if the global crisis comes: The world should not overestimate Germany‘s abilities. Last but not least, Finland, Austria and the Netherlands also oppose common bonds. Mrs Merkel entered the final limit and said “No Eurobonds as long as I live”.

Even German opposition now against Eurobonds

Together with increasing popular German protests against the ESM, even the German opposition (socialist SPD and greens) has recently rejected Hollande’s demands of a quick introduction of Eurobonds even if some months ago they were still in favor of them. Merkel’s coalition partner FDP compared Eurobonds to giving a box of whisky to an alcoholic. The German people’s opinion is 79% against Eurobonds and 14% in favor of them.

Instead the German opposition is in favor of a common “debt repayment fund” (or again a biased FT article), which would assume all euro zone debt beyond the threshold of 60% debt, financed by common bonds. All debt under 60% will still belong to the single countries. The debtors, i.e. all nations in the euro zone would be required to repay all debt in 25 years and accept the conditions of even stronger supply-side reforms than the Stability and Growth Pact. The Bundesbank swiftly rejected this idea, because the equivalent of 90% of German GDP would go to the fund every year.

Anything beyond ESM is against the German constitution

Already the ESM, on which Germany could theoretically earn money, borrowing at 1% or less and lending at 4% or more, has difficulties to pass the constitutional court. The German president Gauck will only sign the law, after the constitutional court has examined it. Last year, the court let the EFSF, the temporary bailout fund, pass. The German Wolfgang Münchau of the FT, an advocate of Eurobonds, explained that it will be a lot more difficult for a permanent bailout fund like the ESM to pass. Still it has a chance, it is a just lending some money to the other nations not a transfer, however a permanent lending. For Münchau a borderline case.

Anything beyond the ESM including a political, fiscal or banking union, Eurobonds or the debt repayment fund would require that the German people abolishes its Grundgesetz by a referendum and adopts a new constitution, a process that can take many years.

Bailout of the Eurozone would be Germany’s second bailout, already the first one was far too expensive

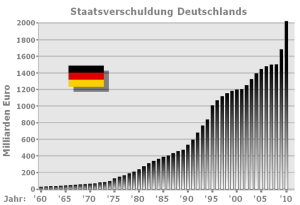

The first German full-blown “bailout”, namely the integration of the Eastern German part (only 17 million people) caused the Germany debt (see right) to triple from 430 bln. euro in 1989 to 1200 bln in 1999, a decade during which even the US managed to reduce debt for a couple of years. Germany greatly underestimated the integration costs. It let the country see a long phase of slow growth till 2006, and still now the west pays transfers to the east. Spain, Italy, Portugal, Ireland, Cyprus and Greece might be better developed now than the former communist GDR, but they count over 100 million people and might need more time than the 20 years the former Eastern Germans needed to cope up. This first bad experience is may be the main reason why Angela Merkel says that people should not overestimate Germany.

Fiscal Union would cement the German leadership in law

As opposed to Germany, France is more reluctant to a central government or a severe central fiscal authority or a fiscal union. It could destruct France’s dream of “La Grande Nation” and the strong desire of the French people to live in a welfare state. Moreover, I would give Germany a possibility to rule the other countries, as long as the others are not able to find a way back to growth with low deficits.

Eurobonds are light years away

The final step, Eurobonds and permanent transfer payments are “light years away”, as Tim Duy put it in Economonitor. Before these permanent transfer payments happen, the euro zone might have been dissolved and recreated in some different forms several times. Eurobonds are hence pure utopia.

This original entry was cross-posted in the testosterone pit blog on June 22nd.

For anyone who speaks German, here a nice link to a blog on the German constitutional court and its decisions.

Are you the author? Previous post See more for Next postTags: Bailout,Constitutional Court,Draghi,EFSF,ESM,Euro crisis,Eurobonds,Eurozone,Fiscal Compact,Fiscal Union,Hollande,Political Union,Referendum,Supply-Side,Testosteronepit,zone