Many details why the SNB had lost the game in previous interventions and will lose the game against markets again can be found in our regular spreadsheet on the SNB money supply and FX reserves (here also the graph form). In the following spreadsheet we have added the estimations of FX reserves and unrealized losses based on a EUR/CHF rate of 1.10 :

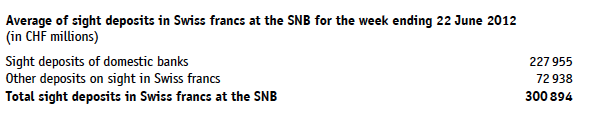

[caption id="attachment_1249" align="alignright" width="730"]

Many details why the SNB had lost the game in previous interventions and will lose the game against markets again can be found in our regular spreadsheet on the SNB money supply and FX reserves (here also the graph form). In the following spreadsheet we have added the estimations of FX reserves and unrealized losses based on a EUR/CHF rate of 1.10 :

[caption id="attachment_1249" align="alignright" width="730"] BalSheet SNB June 22[/caption]

BalSheet SNB June 22[/caption]

SNB interventions are seven times more expensive than during the financial crisis in 2009

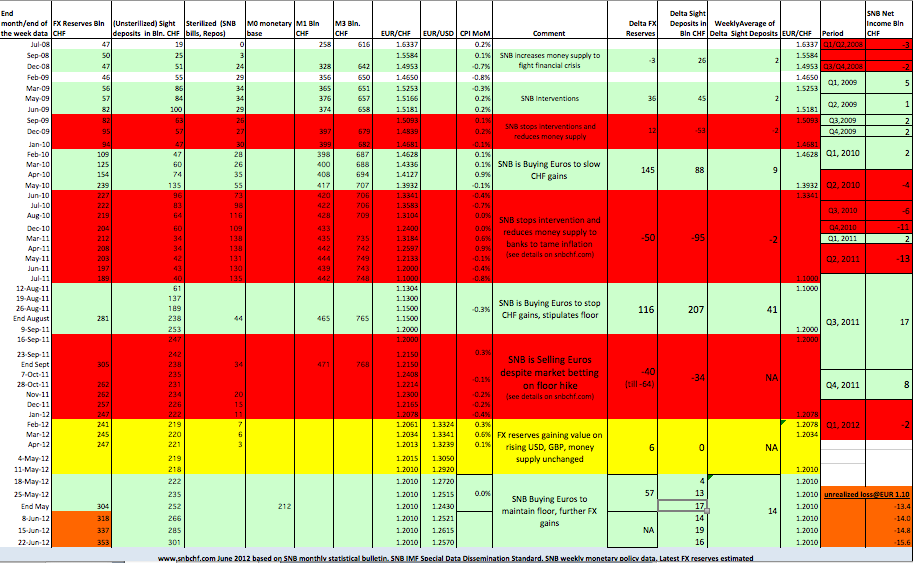

The SNB did Forex interventions during four periods:- Between February 2009 and June 2009 the central bank managed to push the EUR/CHF up from 1.4650 to levels around 1.52. The weekly effort in terms of change of sight deposits (unsterilized money supply) was around 2 billion francs.

- Between February 2010 and June 2010 the SNB could not stop the fall of the EUR/CHF from 1.4628 to 1.3942 even if it spent 9 billion francs per week (in terms of sight deposits). After it spent over 60 bln. only in April, the central bank gave up.

- From End July to Mid September 2011 the central bank was able to introduce the EUR/CHF 1.20 floor and to push the average EUR/CHF rate up from around 1.13. The weekly average costs in terms of sight deposits were 41 billion francs, but the term was relatively short.

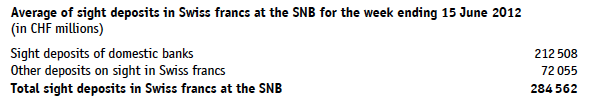

- Since May, 11th, 2012 the SNB had to spend an average of 14 billion francs per week only to maintain the floor at 1.20.

Government spending, monetary and fiscal policy support Swiss growth

The worldwide accepted IS-LM model proves that the increased money supply, the government spending multiplier (+2.0% QoQ in Q1/2012) and low taxes and tax incentives will continue to sustain the Swiss output. The austerity and tax hiking policy in the PIIGS does the complete opposite and suppresses growth. SNB's money printing, the strong money inflows into Switzerland and the new money for Swiss banks might soon end up in the Swiss housing market, despite the SNB's desperate attempts to stop it. And most importantly it will lead sooner or later to inflation.Strong Swiss trade balance but SNB unrealized losses are higher

Weekly inflows of 14 bln. CHF and a break of the floor from 1.2040 in Q1/2012 to 1.10 based on 51% Euro reserves, imply that the weekly unrealized losses for the central bank on the euro positions are about 700 million CHF, a number that strongly outweighs the SNB weekly income in form of interest on FX positions of 4 million CHF (own calculation forthcoming). The monthly unrealized losses will be around 3 billion CHF, higher than the strong trade balance of 2.5 bln. CHF. It might be a lot cheaper to give the SNB money directly to the "poor" exporters instead to the financial markets. The solution of the euro crisis in form of euro bonds or similar will only send more money out of German Bunds into Switzerland. To our views, the SNB has only one chance to get away with the 1.20 floor, namely when the US economy strongly rises, which will then open the door for US rate hikes. Unfortunately, Swiss "monetary policy is not almighty", as SNB's Jean-Pierre Danthine said in a different context. Yes, it can further fuel the Swiss real estate bubble and ease rich Germans panic-buying of Swiss properties but it cannot heal the American economy. This post appeared in testosteronepit and was referenced in Seeking Alpha on June 25th. Full story here Are you the author? Previous post See more for Next postTags: austerity,Bailout,Credit Suisse,Deposits,Euro crisis,floor,franc,German Bund,intervention,M1,monetary data,money printing,PIIGS,QE3,Reserves,Seeking Alpha,SNB sight deposits,Swiss National Bank,Swiss real estate,Switzerland,Switzerland Money Supply,Testosteronepit,UBS