Some economists have claimed that the Swiss National Bank (SNB) will be always able to maintain the floor. As opposed to George Soros’ defeat of the Bank of England, the SNB is able to print money ad infinitum, whereas the BoE had limited currency reserves to support sterling. The question, however, is where this “infinitum” is, and what happens, if caused by strong inflation or a strong Euro depreciation, the inflows into the Swiss franc get bigger and bigger.

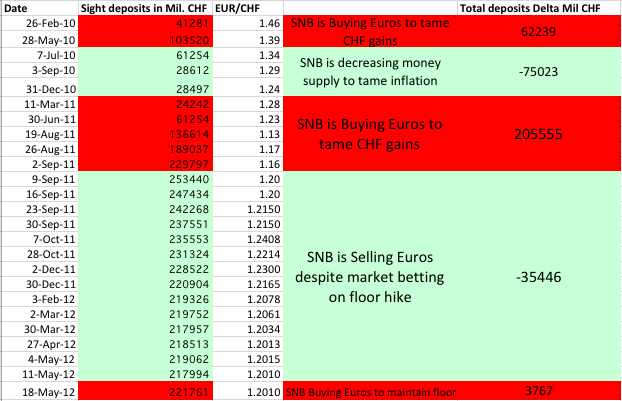

Between March 2011 and September 2011 the Swiss National Bank (SNB) was buying FX reserves more or less for the equivalent of 205’555 million CHF deposits (which is on the other side of the central bank balance sheet). That was five times (!) their previous deposits.

The SNB strategy to sell euros even if the market was betting on a hike of the floor, helped the central bank to reduce deposits by 35446 mil CHF, as measured in deposits by local banks and other sight deposits, i.e. real money supply; bank notes and the recently increasing in deposits by the Swiss confederation are excluded), what is about 17% of what they bought before.

Since one week the SNB is on the buy again. In one week they had to borrow 10% of the 35’446 mil. CHF they could pay back before. The effect of the seven months money supply reduction seem to vane quickly. This is even more dangerous for the SNB since the YoY inflation might top at about +1% to +1.5% in August 2012 before it falls again later. Markets might think that the SNB is afraid of inflation and put up even more pressure on the SNB.

Our question is now: How high will the deposits rise this time, will they double or triple their Forex reserves ?

Chairman Jordan was confident one year ago, saying that the central bank can go into negative equity.

Will they double or triple their FX reserves and wait till inflation really shows up or will they give up earlier ?

Implementation of the peg

We reckon that the central bank has introduced an automatic peg mechanism which obliges them to buy euros at exactly 1.2010 and sell euros above this level. If they sold more euros than they bought, they are happy to have offloaded some items of the overloaded balance sheet. If they bought more euros than they sold, however, there are some “superfluous” euros. They might sell these superfluous euros against a basket of USD, GBP and JPY, which pushes the euro down against this currency basket – something that Swiss and German exporters will appreciate. More details about this “slow move towards a CHF peg against USD, JPY and GBP via currency reserves” can be found here.

This strategy works perfectly as long as nobody wants to sell dollars against francs, but this exactly happened last week and now flows seem to reverse: Money is flowing from the dollar (and the other basket currencies) back into the franc.

Are you the author? Previous post See more for Next postTags: Deposits,floor,franc,intervention,Jordan,negative equity,peg,SNB sight deposits,Swiss National Bank,Switzerland Money Supply